Microsoft founder Bill Gates bought 4.8% of the shares in Heineken last month for almost $1bn, highlighting the appeal of consumer staples companies in volatile markets, according to Nick Train, manager of the Finsbury Growth and Income trust.

The Dutch brewer is the 10th biggest holding in the £1.9bn portfolio, accounting for 5.4% of total assets.

Gates made a name for himself in the technology sector, but Train said that he may have moved to the safety of consumer staples now that tech companies are particularly vulnerable to high inflation and soaring interest rates.

“We assume Bill Gates gets to see and act on any number of new technology investment opportunities,” Train added. “But we also assume it makes sense for him and his foundation to ensure some of his wealth is committed to a business as enduring as Heineken.”

The Finsbury Growth and Income trust is situated in the IT UK Equity Income sector but has the flexibility to hold up to 20% of the trust’s assets outside of the UK.

Train, who also manages LF Lindsell Train UK Equity noted that his position in the Dutch brewing company provided a healthy tailwind to the trust in February after the release of its 2022 results last month.

In its latest annual report, Heineken announced a 30.9% increase in net revenue to £28.7bn, but this was slightly offset by a 19.3% decline in net profit to £2.7bn.

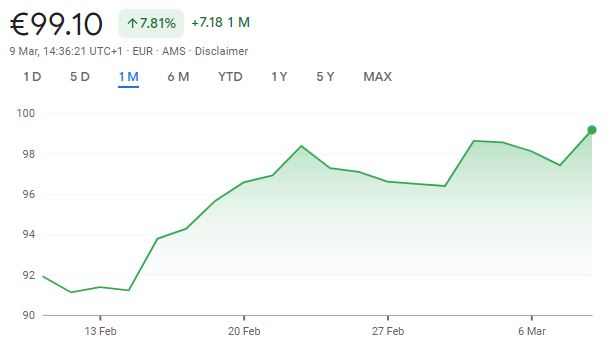

Markets reacted positively to the financial statement, with the share price climbing 7.8% over the past month.

Share price of Heineken over the past month

Source: Google Finance

Indeed, Heineken’s share price was resilient over the past year, climbing 17.4% despite wider market volatility creating a challenging environment for equities.

It was this durability amongst a mass of share price downgrades that likely caught Gates’ eye and motivated him to buy a chunk in the company, according to Train.

He said: “The increase in sales of premium products is so critical for the long-term investment case for Heineken and, indeed, many consumer brand owners. Premium brands tend to be more profitable than ‘value’ ones and offer surer inflation protection”.

Two more foreign companies in the UK portfolio also provided a tailwind for the company in February. One of which was American confectionary company, Mondelez, which makes up 6.9% of the trust’s holdings.

Train said that he was pleased by the company’s financial statement released last month, which showed a 9.7% increase in net revenues to £31.5bn in 2022.

The only other non-UK holdings – French spirits producer, Rémy Cointreau – also received a positive boost following its latest financial statement.

Its report at the end of January revealed a 6% drop in organic sales in the third quarter, but this was up 10.1% over the nine months to December 2022.

Shares in Mondelez and Rémy Cointreau were up 1.2% and 0.8% over the past month, creating a positive boost for Finsbury Growth and Income.

Share price of Mondelez and Rémy Cointreau over the past month

Source: Google Finance

Train may have been pleased by the performance of his three non-UK holdings last month, but British analytics business RELX was the biggest contributor to performance in February.

It is the largest position in the portfolio, accounting for 12.2% of all assets, and shares in the company went up 6.6% over the past month.

Train said: “We continue to regard RELX as one of the most attractive growth companies in the world, let alone the UK – which is the reason why it is the biggest holding in the portfolio.”

Returns of the trust are up a modest 0.1% in 2023 following a 6% drop last year.