Investors are often warned that the funds, trusts, sectors and stocks that led the bull run in one market cycle are unlikely to lead it in the next one and the abrdn Asia Focus Trust serves as the perfect example.

The small-cap focused trust made more than 1,000% in the 10 years to May 2013 as it rode the emerging markets boom. Yet someone who bought the abrdn Asia Focus Trust at the peak of that month almost 10 years ago would have made just 35.1% since then, barely above inflation at 28.6%.

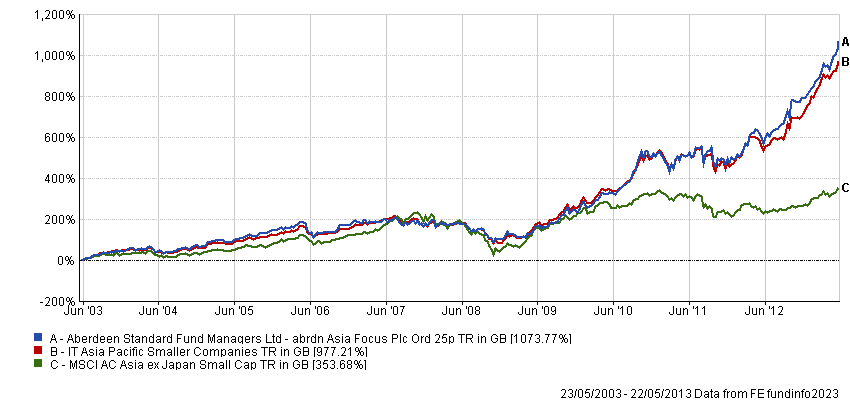

Performance of trust vs sector and index in 10yrs to May 2013

Source: FE Analytics

Other funds and trusts run by the same team saw a similar, if slightly less extreme, return profile.

So what went wrong?

“Our performance wasn't very good for a five- or six-year patch – I think we peaked roughly when Ben Bernanke started speaking,” said the trust’s manager Hugh Young.

He was referring to what became known as the Taper Tantrum, when then chairman of the Federal Reserve Ben Bernanke announced the central bank would eventually reduce the volume of its bond purchases. This caused the dollar to strengthen, leading to problems for emerging markets that borrowed money in this currency and a wide-scale sell-off in the sector.

Performance of trust vs sector and indices since May 2013

Source: FE Analytics

Co-manager Gabriel Sacks said the trust’s focus on bottom-up fundamentals at the expense of taking macroeconomic views meant it was hit disproportionately by currency depreciation.

He also said it was harmed by an under allocation to north Asian countries, such as Taiwan, South Korea and China, while Young admitted the broader emerging markets team missed out on the early stages of the tech boom.

“We were certainly quite sceptical over the structure of some of these companies, particularly Alibaba, given that it fleeced some of its shareholders,” he said. “With the VIE [variable interest entity] structure, the legal ownership of companies wasn't that clear.”

However, Young claimed that, after a decade in which growth drove markets and his value style fell out of favour, the focus appears to be returning to fundamentals once more.

“It's starting to benefit the stockpickers more than the people who shove stuff in big index stocks and follow macro trends,” he said.

“Ultimately, that's what drives share prices. The portfolio is cheap relative to large caps at 12x or 13x earnings, while growth is coming through quite nicely. So I’m generally quite bullish. But I guess you'd expect us to say this.”

But he is not the only one with this view. Analysts at Kepler said: “In the short term, the quality approach of Young, Sacks and Flavia Cheong seems well suited to the current market environment, and we find it reassuring to hear the portfolio is performing well operationally.

“While we acknowledge the near-term environment is likely to remain challenging, we note that not only is the portfolio cheap, but the shares trade on a discount to NAV [net asset value]. As such, this could prove to be a good long-term entry point.”

Young said investors in this market will only be rewarded with patience, though, adding that businesses can perform well for many years without being rewarded by an improvement in the share price. This can leave you “wondering whether you've got it right or not”.

“You can go for quite a few years without it happening at all,” he added. “But in a funny sense, we worry more about the fact that the businesses are doing well and rely on common sense for the share prices eventually to follow. But it can be a fair old wait in certain markets.”

In terms of where he is seeing opportunities, he said that “some of the quality in India is first rate”, adding that the region has become cheaper recently on the back of the Adani scandal.

He also said that it is difficult to ignore China considering how cheap it has become.

“It's funny how fickle investors are,” the manager continued. “It had been flavour of the month maybe two years ago, then everyone fell out of love with it and it performed really badly.”

Overall though, Sacks is positive on the Asian small-cap market as a whole.

“There's growth coming through and it's still one of the biggest untapped opportunities in markets,” he said.

“There are still companies that no one’s really covering that could be leaders in their field, and hopefully we can catch these early. Broadly speaking, I think it's quite exciting.”