Baillie Gifford has made a reputation as an all-out-growth investment house, investing in opportunities that its managers expect a large amount of development from over time.

A growth-oriented market boosted returns sky high over the past decade, but some investors may be questioning their ability to continue outperforming now that market conditions have changed.

Indeed, the low interest rate environment that helped the firm thrive in the past have been replaced with monetary tightening and rampant inflation, creating a hostile environment for its growth mantra.

None of Baillie Gifford’s 49 funds and trusts made a positive return in 2022, leading some long-term holders to sell out.

Chris Metcalfe, chief investment officer at IBOSS, said that he removed several Baillie Gifford funds from his core portfolios after it became apparent that they would not sway from their growth strategies.

He added: “As many of their stocks had benefited from the global 'lower for longer' interest regime, which we saw coming to an end, we decided to remove them.

“We continue to avoid funds that have benefited from market conditions that no longer apply and won't be returning anytime soon.”

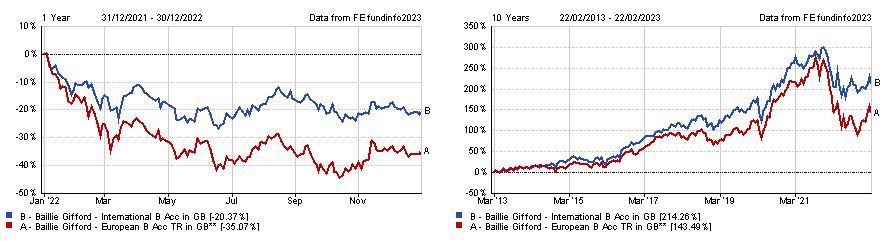

Names that he removed included the Baillie Gifford International and Baillie Gifford European funds, both of which fell 20.4% and 35.1%.

They both outperformed over the long term but fell behind their peers last year and Metcalfe did not envisage them delivering the same level of high returns in a tougher market environment.

Total return of funds in 2022 and over the past decade

Source: FE Analytics

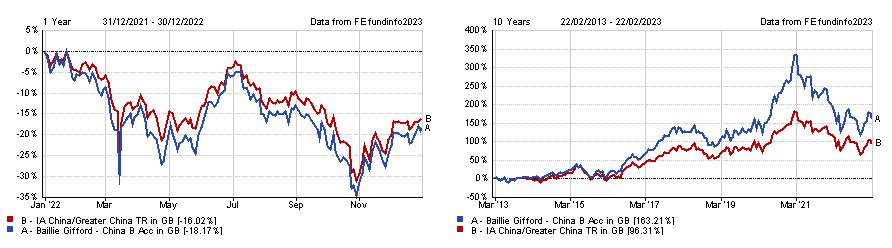

He did, however, maintain exposure to the Baillie Gifford China fund, which he expects a decent return from despite its 18.2% decline in 2022.

Metcalfe said: “Being a Baillie Gifford fund, it is tech and growth-heavy, but there are still tremendous opportunities in this space.”

The £436.6m portfolio run by FE fundinfo Alpha manager, Sophie Earnshaw, along with Mike Gush and Roderick Snell, was a top quartile performer over the past decade, climbing 163.2% over the period and outpacing its peers in the IA China/Greater China sector by 66.9 percentage points.

Total return of fund vs sector in 2022 and over the past decade

Source: FE Analytics

Tom Sparke, investment director at GDIM, acknowledged concerns around the firm’s ability to navigate these very different conditions, but maintained positions in their funds.

He said that if held for the recommended three-to-five-year period, their ability to pick out good stocks and deliver a decent total return “has rarely gone awry”.

One of his favoured names is the Baillie Gifford Positive Change fund, which has delivered a 209.5% return since launching in 2017, outperforming the rest of the IA Global sector by more than three-fold.

Total return of fund vs sector since launch

Source: FE Analytics

The £2.5bn fund sunk 21.9% in 2022, but it was one of the seven Baillie Gifford funds to benefit from a small rebound at the start of this year, climbing 4.6% in 2023.

Sparke said: “It has provided our portfolios with considerable returns, albeit with a generous dose of volatility too.”

He also recommended the Baillie Gifford Global Discovery fund, which invests in earlier-stage companies and holds them to maturity, although this has been a bottom-quartile performer over the past one, three and five years.

Over the past decade, the £932m portfolio run by FE fundinfo Alpha manager Douglas Brodie, Luke Ward and Svetlana Viteva, was up 190%, climbing 42.8 percentage points above its peers.

Total return of fund vs sector over the past decade

Source: FE Analytics

These two funds are Sparke’s preferred Baillie Gifford names, but investors who want to see a positive return in the near-term might not find that here.

He said: “Over shorter periods this investment style may not be appropriate, but as long as the time horizon is appropriate, I would say that most Baillie Gifford funds would be long-term holds.”

Baillie Gifford funds may have submerged into red territory last year, but Kelly Prior, manager on the multi-manager team at Columbia Threadneedle, said that this exactly what investors should expect from high-growth strategies.

Investing in growth funds like Baillie Gifford’s often come with an added notch of volatility, so investors need to decide whether it is worth the added risk for potentially high returns.

Prior said: “Their foundation is built on thorough fundamental analysis, resulting in long holding periods and low turnover as they wait for their thesis to play out.

“The fortunes of growth companies will vary over time, but as history has shown, when this style of investing comes into favour, they are well placed to perform.”

Although the group is still facing significant headwinds, Prior said it was commendable that it has not changed its strategy under the pressure of a unfriendly market environment.

“Baillie Gifford as a house make no apologies for short-term performance, given its long-term approach to investment, which is an increasing rarity these days,” she added.

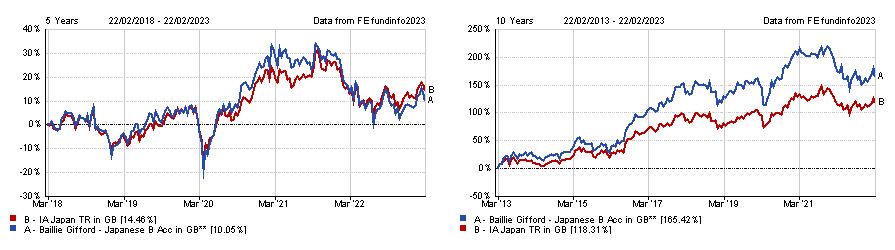

Her favourite fund from the group is Baillie Gifford Japanese, which takes a slightly different approach to the firm’s growth approach.

Manager Matthew Brett has divided the opportunity sets between secular growth, growth stalwarts and special situations and cyclical growth, which gives the fund more mobility, according to Prior.

She said: “This affords him a more flexible take than might be assumed on this style of investing, though it’s still with a focus on the fundamentals of the individual companies, sustainable earnings and cash flow growth.”

It sold out of some fast-growing names to buy some equities undergoing short-term challenges at the end of last year, exemplifying the benefits of its more flexible approach.

Total return of fund vs sector over past five and 10 years

Source: FE Analytics

The £2.8bn fund was the second-best performing portfolios in the IA Japan sector over the past decade, climbing 165.4% over the period, but returns dropped to the bottom quartile over the past one, three and five years.