Sometimes fund managers go through tough times, but it is how they recover, respond and rebound that is what truly separates the good from the great.

It can take years of suffering if the market moves away from your investment style and for some it has bordered on decades. Indeed, for much of the post-financial crisis period, growth was the way to invest, with large US tech firms dominating returns.

During this time, investors with other strategies had to do their best, making the highest returns they could while accepting it may not be as much as the top end of the market. But with the market rotation of 2022, managers that bided their time for the big win were rewarded.

The rotation last year benefited a number of managers. Below, Trustnet looks at those who have previously held – and been rewarded in the latest rebalance with – the FE fundinfo Alpha Manager title, having been without it for at least the past five years.

The rating is based on a fund manager’s performance over their career, including all funds they have managed and firms they have worked for.

First up is Adrian Frost, co-manager of the £4.7bn Artemis Income fund since 2002. Initially launched with Adrian Gosden, he has run the portfolio alongside Nick Shenton since 2012, with Andy Marsh joining in 2018.

The fund invests predominantly in large-cap UK dividend-paying stocks – one of the poorest-performing areas of the market for more than a decade.

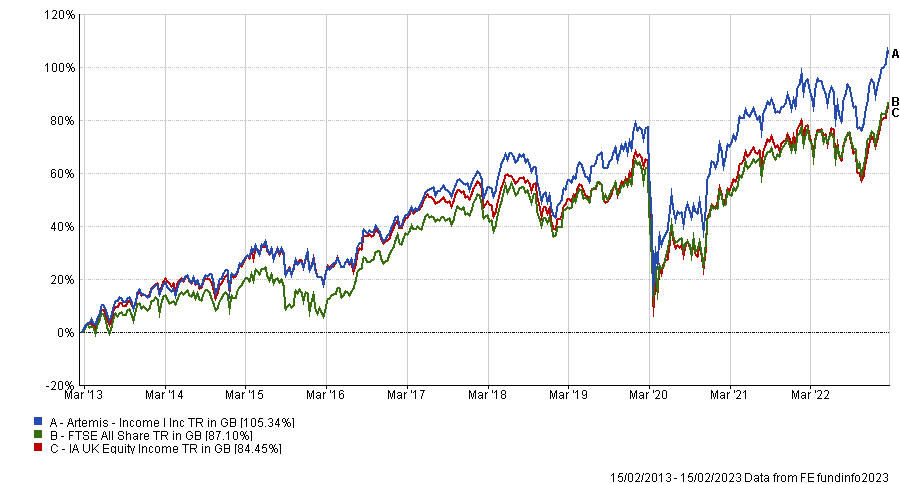

Despite this, it has remained a top-quartile performer in the IA UK Equity Income sector over 10 years, beating the FTSE All Share index and the average peer by around 20 percentage points.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Frost has become an Alpha Manager again for the first time since 2015. Since then, the portfolio has beaten its average peer in every year apart from 2021. He also co-runs Artemis Income (Exclusions) and SJP UK Equity Income.

Another UK manager to regain his Alpha Manager title is James Henderson, best known as the co-manager of the £1bn Law Debenture trust, as well as the £343m Lowland and £94m Henderson Opportunities trusts. He also manages the open-ended £191m Henderson UK Equity Income & Growth fund.

The manager has had contrasting fortunes in his portfolios, with Law Debenture and Henderson Opportunities Trust the second-best portfolios in their respective IT UK Equity Income and IT UK All Companies sectors over the past decade, but his Lowland and Janus Henderson UK Equity Income & Growth have been in the bottom quartile.

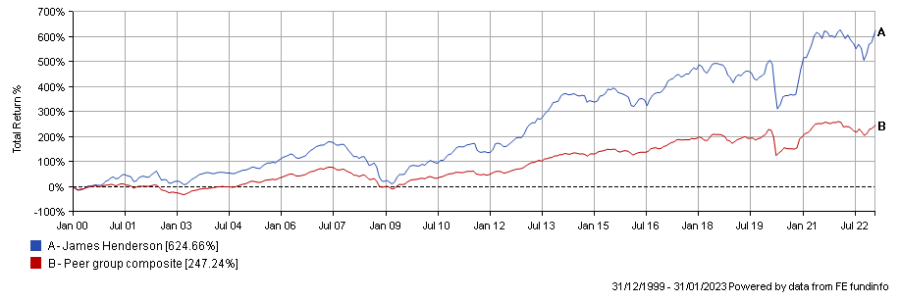

Combined, however, the manager has proven a strong long-term track record, making more than double the returns of his peer group since 2000, as the below chart shows.

Total return of manager vs peer group since 2000

Source: FE Analytics

He regains his title having last been recognised as an FE fundinfo Alpha Manager in 2016.

Staying with income as a theme, Robert Hay also has reclaimed his title for the first time since 2017. The manager took charge of the £3.6bn BNY Mellon Global Income fund alongside Jon Bell in 2020, during which time it has made 40.5%, slightly ahead of the FTSE World and IA Global Equity Income sector.

However, much of this track record came from the BNY Mellon Global Opportunities portfolio, which he ran from 2009 to 2020. The fund was in line with the MSCI AC World benchmark and 30 percentage points ahead of the average fund in the IA Global sector during his tenure.

Lastly, Baillie Gifford’s John MacDougall is the fourth name to regain the Alpha Manager rating for the first time in more than half a decade, last boasting the accolade in 2015.

While many Baillie Gifford managers lost their ratings in the latest rebalance, MacDougall was readded, although it should be noted that he had an extended break between 2017 and 2022 when he did not run money.

He is now a co-manager of the £2.3bn Baillie Gifford Long Term Global Growth Investment fund alongside four others, including fellow Alpha Manager Mark Urquhart.

While some managers had been out in the cold for years, others took just 12 months to get their rating back. Michael Lindsell, John Bennett and Pieter Fourie were among nine fund managers to get the rating back at the first time of asking.

Some have never lost the rating in the 15 years that the FE fundinfo Alpha Manager accolade has been running, as we discussed earlier this week.