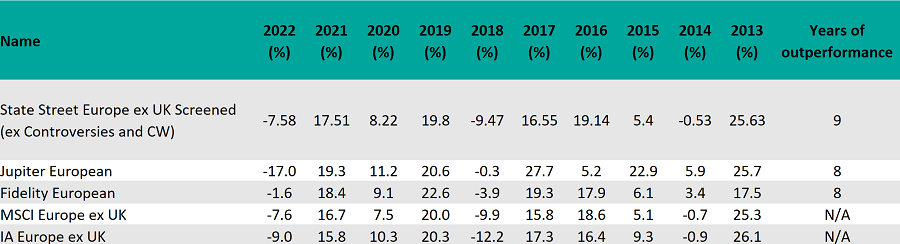

State Street Europe ex UK Screened (ex Controversies and CW) is the most consistent IA Europe Excluding UK fund of the past decade, beating the most common benchmark in the sector – the MSCI Europe ex UK index – in nine of the past 10 calendar years.

Of the 96 funds with a track record long enough to be included in the study, another four beat the index in eight of the past 10 calendar years. Of these, Jupiter European and Fidelity European did the best against their sector average, beating it in seven of the past 10 calendar years.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

State Street Europe ex UK Screened (ex Controversies and CW) is a passive fund that aims to replicate the performance of the FTSE Developed Europe ex UK ex Controversies ex CW index.

The index includes a negative screen that excludes securities based on two criteria: controversial weapons (including chemical and biological weapons, cluster munitions and anti-personnel landmines), and controversies as defined by the 10 principles of the UN Global Compact.

Many studies have indicated that companies that place an emphasis on environmental, social and governance (ESG) factors tend to outperform those that don’t.

However, while State Street Europe ex UK Screened (ex Controversies and CW) consistently beat the MSCI Europe ex UK index over the period in question, the outperformance was relatively slight – 8 percentage points over the decade.

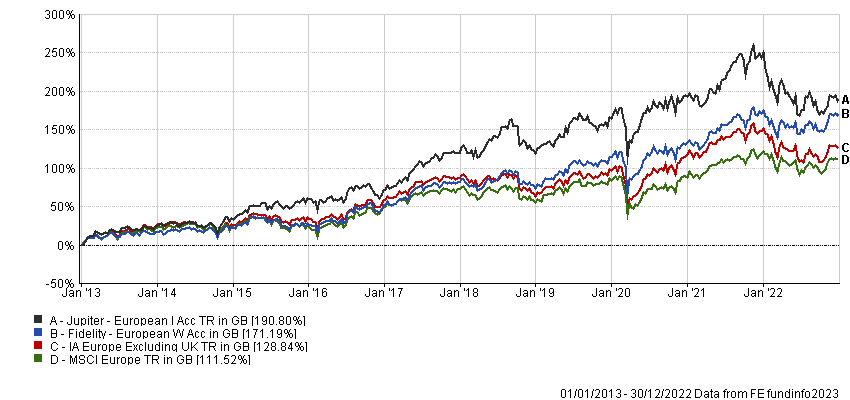

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

It only beat the sector average in half of the 10 periods.

The £4bn fund has ongoing charges of 0.12%.

Jupiter European is a regular feature of this series. Managers Mark Heslop and Mark Nichols invest in companies that have strong business models exposed to the drivers of secular growth, deliver sustainable returns on capital and are run by first-class management teams. The returns will be driven by the companies themselves, not by shorter-term price-to-earnings (P/E) re-ratings and/or cyclical calls.

The managers are keen to stress the global nature of Europe’s best companies, meaning the continent could be a major beneficiary of China’s reopening.

For example, they pointed out that China was the third largest partner for EU exports of goods (10%) in 2021, and the largest partner for EU imports of goods (22%), noting that the luxury goods sector is particularly interesting in this regard.

“Chinese consumers made up a third of all global personal luxury goods sales in pre-Covid 2019, falling to around 18% in 2022, according to Bain & Company research,” said Heslop and Nichols.

“Europe has by far the highest proportion of the largest luxury goods brands and companies. French-listed LVMH, which is a diversified luxury goods group, is the largest with €64bn of sales worldwide in 2021.

“While China lost market share in luxury goods spending in 2022, it is expected that greater mobility and higher savings rates for Chinese consumers should be a tailwind for luxury names. Bain forecasts that demand will begin to recover this year, and by 2030 Chinese consumers will make up 38 to 40% of all luxury sales, the most of any nationality.”

Much of Jupiter European’s outperformance came under former manager Alexander Darwall, who left to set up Devon Equity Management in 2019. However, the new managers quickly proved their worth by selling out of Wirecard, one of the largest holdings in the fund.

In 2020, the payments processor announced €1.9bn was missing from its accounts, and it was declared insolvent. That year, Darwall’s European Opportunities Trust – which had 17% in the stock at one point – lost 9.2%, while Jupiter European made 11.2%.

The analysts at RSMR said Heslop and Nichols joined Jupiter because it offered them the ability to back their own convictions and make their own investment decisions within the remit of the fund’s objectives.

“This means they are not constrained by investment committees or house views,” they added.

Jupiter European made 190.8% over the 10-year period in question, compared with gains of 128.8% from the sector and 111.5% from the MSCI Europe ex UK index. The £3.5bn fund has ongoing charges of 0.99%.

Fidelity European made the list after outperforming the MSCI Europe ex UK index and its sector average in each of the past two very different calendar years.

Its manager Samuel Morse and co-manager Marcel Stotzel look for companies that are expected to raise their dividend over three to five years. They target companies that have sustainable margins and a strong balance sheet and fund their dividends through organic growth rather than by taking on high levels of debt.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

“Each company in the investable universe will have a score based on the analysts’ view, the liquidity of the stock and the risk associated with the name,” explained the analysts at FE Investments, which include the fund on their Approved List.

“The managers use this score to isolate potential investment ideas. Each holding has an investment case with three reasons as to why it’s being held. Two of these reasons will be based on fundamentals and the third on valuation. These reasons are revisited regularly to ensure the thesis has not been violated.”

The fund is also highly rated by Square Mile Investment Consulting & Research, whose analysts said Morse has “a history of acting as a safe pair of hands”.

“We believe this fund provides long-term investors with an attractive exposure to the region, though the strategy may underperform during periods of strong equity market returns when riskier stocks are in favour,” they explained.

“However, we think the fund is likely to outperform in weaker, more volatile environments, and so this should improve the fund's risk/reward characteristics over time.”

Fidelity European made 171.2% over the 10-year period in question. The £4bn fund has ongoing charges of 0.92%.