FundCalibre has included five new funds in its Elite list after this winter’s investment committee, while four have lost the recognition.

The badge is awarded to funds that pass quantitative and qualitative screenings as well as a peer group review within the team and typically no more than 10% of funds in any sector achieve an Elite Rating.

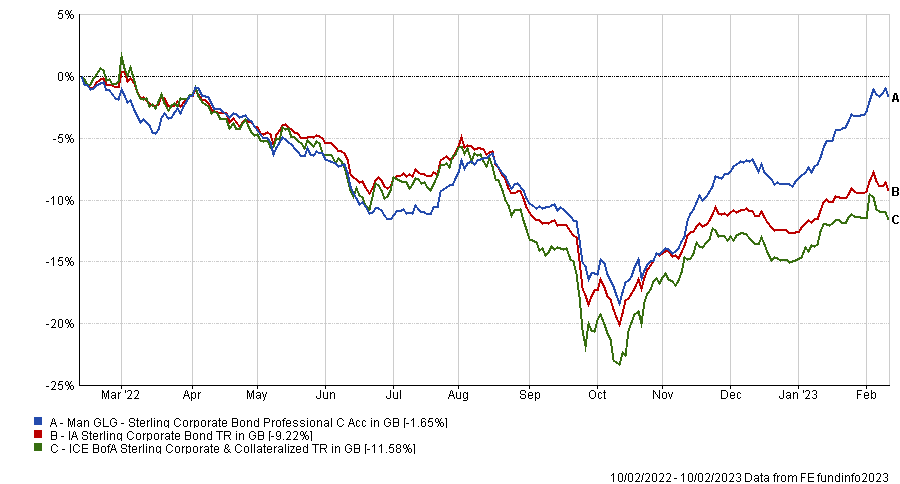

First up is Man GLG Sterling Corporate Bond, which distanced its average peer by eight percentage points over the past year and received the praise of Juliet Schooling Latter, research director at FundCalibre, who was convinced by its manager and interest in small- and mid-cap debt.

Performance of fund over 1yr against sector and index

Source: FE Analytics

“Manager Jonathan Golan is one of the most exciting young bond fund managers around today,” she said. “He often finds many of his best ideas off the beaten path and is not afraid to invest in small and medium-sized issuers.”

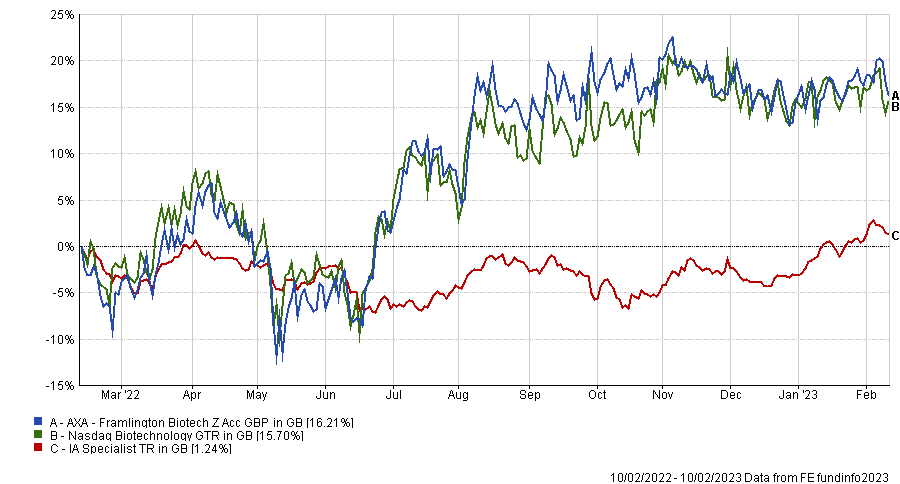

The next fund is AXA Framlington Biotech, which invests in biotechnology, one of the few sectors positively impacted by the Covid pandemic.

Performance of fund over 1yr against sector and index

Source: FE Analytics

“The case for investing in biotechnology is a strong one. These companies are helping us live longer by bringing new drugs to market to tackle the likes of cancer, heart disease and obesity,” said Schooling Latter.

“The sector is evolving at a rate of knots and requires a specialist, focused team with skills, experience, and a network to keep up with these changes. That is exactly what manager Linden Thomson and her team offer with this fund.”

For fans of value investing, FundCalibre highlighted LF Lightman European, which was praised as “one of only a few funds left with a genuine value style”.

Performance of fund since launch against sector and index

Source: FE Analytics

“Performance has been excellent since its launch four years ago, but it is the sort of fund that is likely to either be at the top or the bottom of the performance charts in any one year, depending on whether or not its style is in or out of favour,” the research director explained.

“For investors who can stomach the potential volatility, this could be a great option, especially if they are looking to balance out their style exposure elsewhere within their portfolio.”

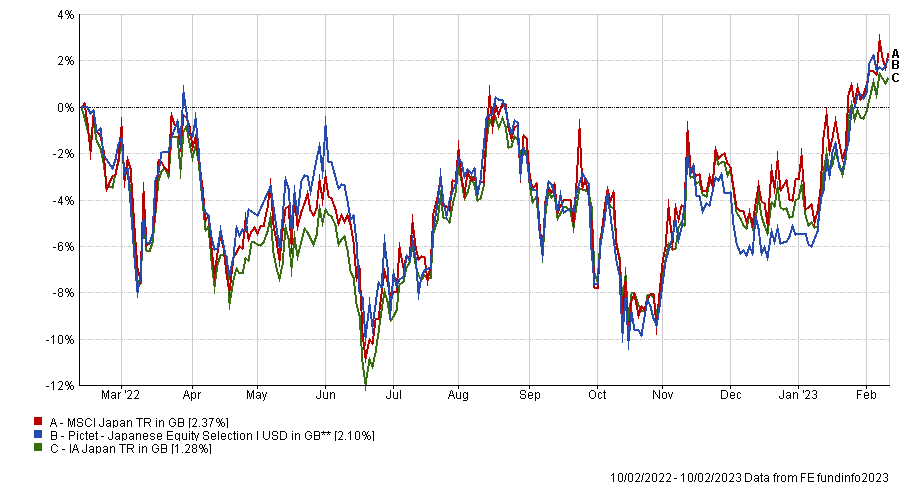

In Japan, Pictet Japanese Equity Selection offers “growth prospects at a reasonable price”, according to Schooling Latter.

Performance of fund over 1yr against sector and index

Source: FE Analytics

“This is a high-conviction strategy that invests in large and medium-sized businesses for the long term. The manager uses a combination of market and company analysis to select Japanese firms that promote good environmental and governance practices.”

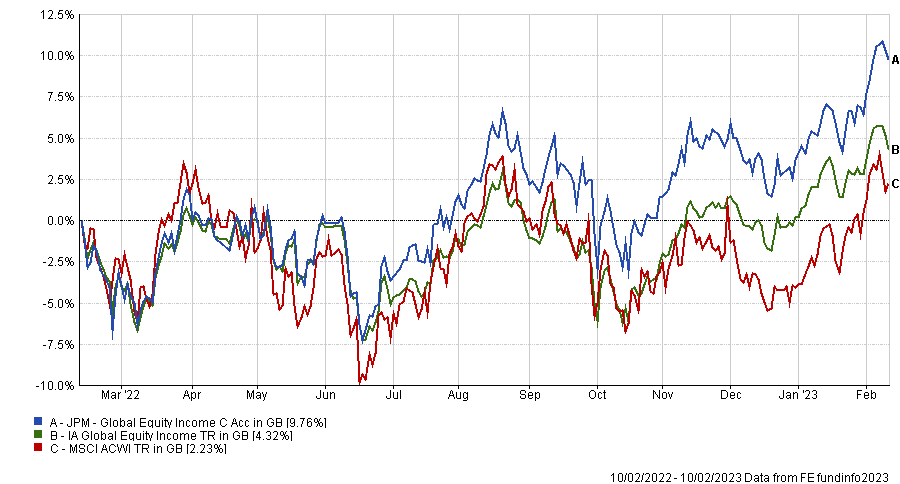

The final fund to make it to Elite status is JPM Global Equity Income, a core global equity income portfolio that invests all around the world, including in emerging markets.

Performance of fund over 1yr against sector and index

Source: FE Analytics

“The managers aim to achieve a superior yield on the fund without sacrificing growth,” said Schooling Latter.

“With the aid of a huge global team of analysts, they filter down the whole global market to a portfolio of 40-90 predominantly large and mega-cap companies, balancing ‘compounders’ with higher yielders and higher growth stocks.”

TB Amati Strategic Metals and Artemis Global High Yield Bond didn’t make it to the list but were highlighted as on the investment committee’s radar.

The former was described as “a great portfolio diversifier that taps into unique investment opportunities, including the transition to a lower-carbon world”, while the latter was mentioned for its “unique approach”, with the managers focusing on the smaller and medium players on the index, which has allowed them to “consistently find hidden gems with a strong upside, helping them to outperform”.

On the way out were , TM CRUX European Special Situations, Schroder Global Recovery and SVS Church House Tenax Absolute Return Strategies, who lost their ratings due to an insufficient quantitative score.

CT UK Equity Income also lost its score after the retirement of veteran investor Richard Colwell, despite new manager Jeremy Smith claiming to be the “continuity ticket”.

“With the manager retiring, the decision has been made to remove the Elite Rating from CT UK Equity Income pending a meeting with the new manager,” explained Schooling Latter.