Evenlode co-founder Ben Peters has warned value strategies that have outperformed the wider market since inflation first began to rise won’t necessarily protect investors if the trend of higher prices becomes embedded over the long term.

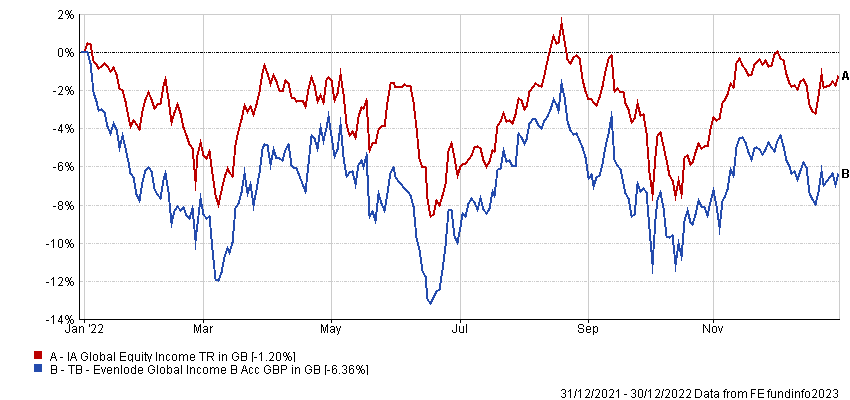

Peters is manager of the TB Evenlode Global Income fund, which underperformed its IA Global Equity Income sector last year, the first time this has happened.

Performance of fund vs sector in 2022

Source: FE Analytics

However, while the manager's focus on quality, asset-light businesses fell short in 2022, he is confident his strategy will continue to outperform over the long term, even if inflation remains high.

“One of the nice things about these asset-light businesses is that they're quite good in deflationary times, but also quite good in inflationary ones as well,” he said.

“And the reason is because they don't have assets they need to replace at an ever-increasing rate. Warren Buffett wrote about stuff ‘rusting in the yard’ back in 1982 or so: if you've got high inflation, it costs more and more for asset-intensive businesses to replace their assets. In inflationary times, it is helpful if companies don't have to invest too much back into the business.”

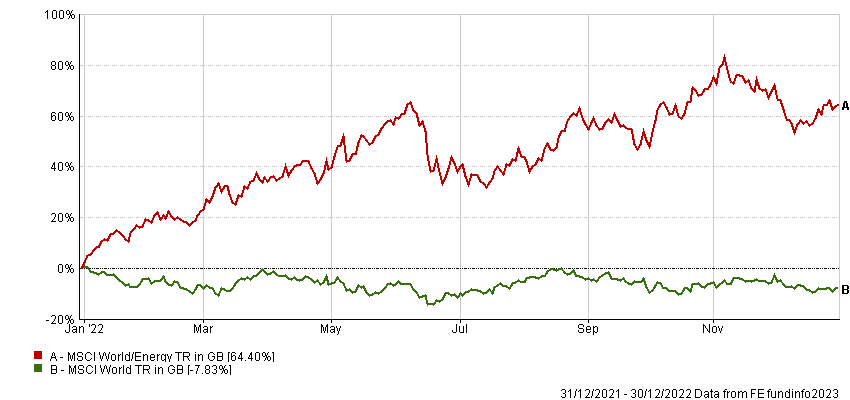

One of the main reasons for TB Evenlode Global Income’s underperformance last year was its zero weighting to energy – the MSCI World Energy index made a 64.4% return last year, while the broader index lost 7.8%.

Performance of indices in 2022

Source: FE Analytics

However, while energy surged last year, Peters said the sector is a good example of why he avoids asset-intensive businesses – especially those involved with commodities.

“Yes, oil & gas stocks have raised their revenues in the short term, but you only have to go back to March 2020 for a time when the oil price was negative,” he explained.

“Sometimes the oil price is high, and that’s great for these businesses. But if you look at their history of free cash conversion over a decade or more, there's only a handful of years where they have actually generated excess cashflows. The rest of the time, they have had to invest that capital back into the business to drill more oil out of the ground.

“They have performed well recently, but I don't think that negates our long-term strategy.”

Many asset-light businesses have been hit hard in the recent correction and some value managers claim they may follow the path of the Nifty Fifty blue-chip group of businesses – including Coca-Cola, Disney, IBM, Philip Morris, McDonald’s and Procter & Gamble – at the start of the 1970s.

While these were all solid businesses, their valuations fell as inflation began to rise and investors in most of these companies had to wait for about a decade before they broke even.

This is a risk that Peters said he is well aware of.

“We look for quality businesses and a lot of our time is spent thinking about competitive positions and why they are going to persist into the future,” he said.

“But we also value the businesses we invest in, using a discounted cashflow model. We understand that there's no right answer for the valuation of a business. But we move away from companies in our universe that have become more expensive relative to other opportunities. Everything has a price.”

He used Microsoft as an example, cutting exposure to the tech giant in his TB Evenlode Global Income fund in 2021 as it looked expensive, then increasing exposure after it fell last year.

Overall though, he said he has been impressed with the way the underlying businesses in his portfolios have coped with the inflationary environment, successfully passing price increases on to customers in most cases.

“But now all that is starting to moderate, so the price of commodities, packaging and transportation is coming down,” he added.

“This time last year when we spoke to technology companies, they said it was very difficult to hire skilled developers. But you have just had a significant round of job cuts from some of the big tech players, so I suspect that that will lead to that issue ameliorating, too. It’s the reverse of last year, and there’s good value to be had.”