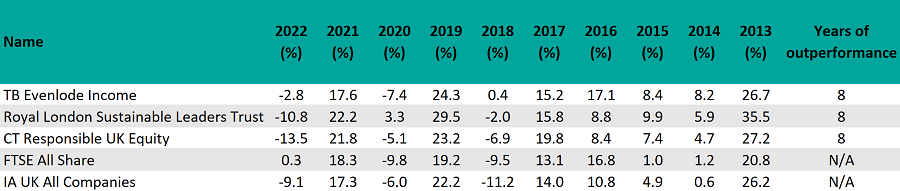

TB Evenlode Income is the most consistent IA UK All Companies fund of the past decade, beating the most common benchmark in the sector – the FTSE All Share – in eight of the past 10 calendar years and its peer group composite in nine.

Of the 203 funds with a track record long enough to be included in the study, another two funds – Royal London Sustainable Leaders Trust and CT Responsible UK Equity – beat both measures in eight of the past 10 calendar years.

Performance of funds vs sector and index

Source: FE Analytics

TB Evenlode Income aims to deliver a growing dividend and attractive annualised capital returns over rolling periods of five years.

To do this, managers Hugh Yarrow and Ben Peters invest in businesses with a market-leading position or competitive edge that allows them to consistently generate high levels of recurring profits that can be returned to shareholders.

They look for profitable, asset-light and cash-generative companies with repeatable sales, low debt and intangible assets that are difficult to replicate.

The analysts at FE Investments said the managers take an “uncompromising approach” in their search for these businesses.

“The monitoring of a smaller universe of companies allows them to delve deeper into modelling and understanding companies, which makes for strong stock selection,” they commented.

“Their processes and systems have become robust and efficient over the years, which sets Evenlode apart from other smaller management houses.”

The analysts added that the fund’s anti-cyclical stance means it will underperform when more economically sensitive areas such as energy rally. This was the case in 2021 and 2022, the only two calendar years in the past 10 when the fund fell behind the FTSE All Share. However, it still beat its sector average in both periods.

“On the other hand, the preference for global consumer products firms and tech companies means the fund will outperform when the market is led by these sectors and when sterling weakens,” the analysts added.

TB Evenlode Income made 164.8% over the period in question, a top-decile figure in the sector, which was up 83.1%. The FTSE All Share index made 88.2%.

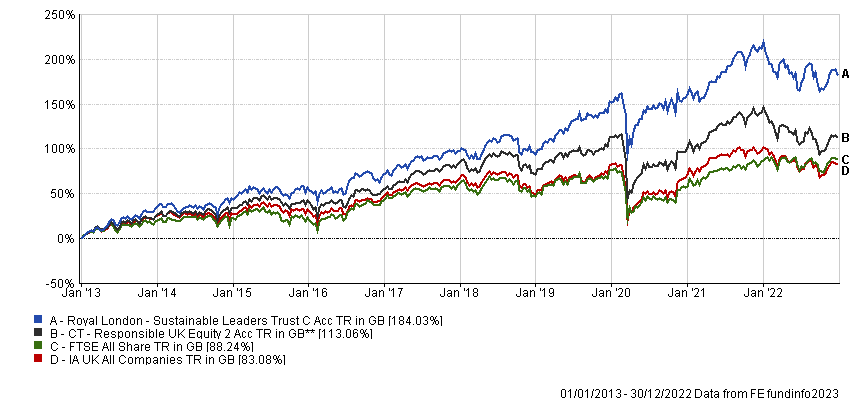

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

The £3.5bn fund has ongoing charges of 0.87%. It is now soft-closed and charges a 5% entry fee to new clients, but this is waived if you buy the fund through certain platforms.

Royal London Sustainable Leaders Trust and CT Responsible UK Equity also both underperformed the FTSE All Share last year, and again this can be partly attributed to their low exposure to the energy sector.

However, the Royal London fund made even more than TB Evenlode Income over the decade in question, with gains of 184%.

Its managers Mike Fox, George Crowdy and Sebastien Beguelin screen for companies with strong ESG qualities, while excluding those that are exposed to controversial activities.

To merit inclusion in their portfolio, these companies also need to offer growth potential and trade at attractive valuations. The team then scores them on financial and sustainability factors.

The analysts at FE Investments said that what separates the fund from its ethical peers is that as well as using a negative screen, it also uses a positive screen to identify companies that aid the transition to a sustainable world.

“As such, it is a good candidate for investors who specifically want exposure to companies that are making a positive impact for society or operating in a sustainable manner,” they added.

“Fox is an experienced manager and his track record highlights the benefits of his style – despite several periods of underperformance of cyclical sectors, the fund continues to beat its peers and the wider market over the long term.”

The £3.2bn fund has ongoing charges of 0.76%.

Performance of funds vs sector and index over 10yrs

Source: FE Analytics

CT Responsible UK Equity is managed by Catherine Stanley, who invests in attractively priced, high-quality businesses with proven management teams, strong financials and competitive advantages, while screening out companies with damaging or unsustainable practices.

This screening is carried out by Columbia Threadneedle’s responsible investment team, which the analysts at FE Investments said gives Stanley more time to focus on stock analysis through fundamental analysis of balance sheets, competitive advantages and management quality.

“This separation creates a good structure and a thorough due diligence process, and helps ensure the fund remains loyal to its responsible mandate,” they added.

CT Responsible UK Equity made 113.1% over the 10-year period in question. The £573m fund has ongoing charges of 0.79%.