An “uncontested” investment classic provides “strong supporting evidence” for the power of equities to withstand high inflation and two best sellers that make an argument for the slow and steady growth of larger companies are among the well-worn books in the Lindsell Train office.

For this instalment of the Investors’ bookshelf series, James Bullock, portfolio manager of the Lindsell Train Global Equity and North American Equity funds, highlights four books that have helped shape Lindsell Train’s long-term investment approach.

Bullock is co-manager of the £5.6bn Global Equity fund, together with Nick Train and Michael Lindsell, and principal manager of the £30m North American Equity fund alongside deputy manager Madeline Wright.

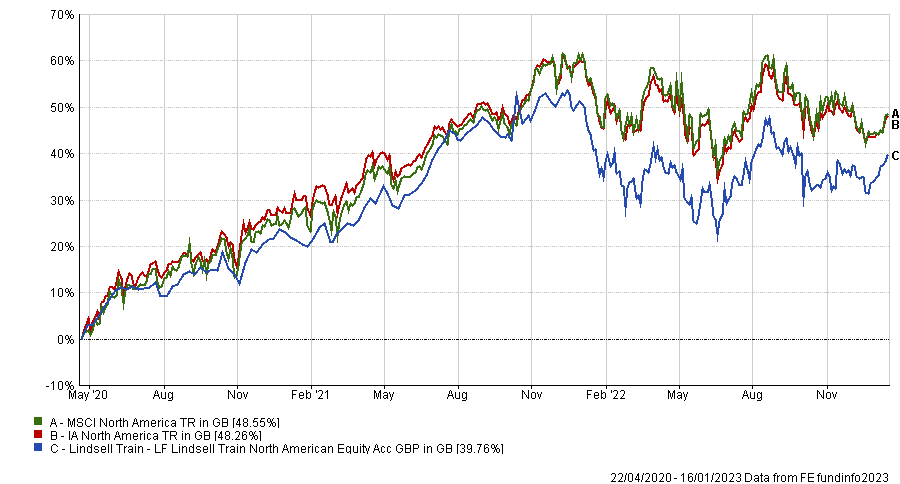

The latter fund, launched in April 2020, has scored second-quartile returns within its IA North America sector, and achieved first-quartile performance in the very short term (three months), as shown in the graph below.

Performance of fund since launch against sector and index

Source: FE Analytics

The list opens with Jeremy Siegel’s Stocks for the Long Run, a book that contains “enough market insight to bow even the sturdiest bookshelf”.

“An uncontested investment classic, the book was instrumental in popularising equities as the ultimate buy-and-hold asset class and is required reading for all new arrivals to our team,” said Bullock.

Armed with 200 years of data, Siegel spotted that even post-inflation the US market has never had a 20-year losing period, delivering higher long-term returns with less risk than fixed income alternatives. Post-gold standard, inflation ravaged the second half of the 20th century, and it threatens to do so again today.

“Seigel’s trademark finding, the eerily steady 6-7% real return observed since 1801, provides strong supporting evidence for the power of equities as a claim on real earnings to weather these storms,” said the manager.

“Six editions later, the book remains a standard reference text and Siegel a revered market pundit.”

Less well-known is the 2005 book The Future for Investors by Jeremy Siegel, but this too convinced Bullock for its “pressing case for the long view”.

Siegel, also known as the Wizard of Wharton, backs investment inactivity ahead of not just activity, but passivity too, noting that the original 1957 constituents of the S&P 500 have outperformed the index itself.

“The difference wasn’t vast (11.4% per annum vs. 10.8% over 46 years) but runs counter to the conventional narrative, popularised by Joseph Schumpeter, that survival demands change. Not every company did well – at least a third didn’t make it – but the long-term compounders that did, left untouched, bailed them out,” explained Bullock.

When Siegel ranked the original S&P500 survivors by performance, he found that 17 of the top 20 were brand-owning consumer staples or healthcare companies, “slow and steady” sectors that were the index’s best performers by a wide margin, in contrast to the “flashier but less durable growth traps” found in areas such as telecoms or IT.

Bullock also reclaimed Siegel’s observation that ‘The persistence of good earnings growth is better than transience of superb growth’ as Lindsell Train’s company motto.

“Unlike Siegel’s S&P 500 thought experiment, however, we are in the fortunate position of being able to learn from the past, weighting ourselves to the winners from his and other lists, allowing us to benefit at outset from their time-tested ability to compound,” the manager said.

“Just as importantly we are set up to embrace inactivity as a virtue and ultimately trust that, if given long enough, both quality and patience should continue to win out.”

In addition to the above, Geoffrey West’s Scale provides insight on the scaling and survival of complex organisations. His work stimulated much internal debate as to the permanence of corporations and the durability of their competitive advantages.

For readers who find the options above too “mainstream”, Bullock recommended David Warsh’s 2006 Knowledge and the Wealth of Nations.

“Written with impressive economic fluency, this book traces the discipline’s decades-long battle to reconcile the increasing returns brought by scale with the diminishing returns imposed by competition,” he said.