Getting your head around the world of investing can be tricky. It is for this reason that fund platforms have created ‘best-buy’ lists of recommended funds that aim to whittle the universe of investible funds down to the best of the best.

Despite thousands of options to choose from, some funds appear on multiple lists. While crossover is common, there is only one fund in the Investment Association universe that appears on four of the five lists managed by the UK’s largest fund platforms – Hargreaves Lansdown, AJ Bell, interactive investor, Fidelity and Barclays.

BlackRock Continental European Income is the standout pick for investors wanting to gain exposure to dividends from across the channel, according to analysts at Hargreaves Lansdown, AJ Bell, interactive investor and Barclays. Fidelity’s best-buy list does not have a specialist European income recommendation.

The swathe of recommendations for the fund may be as a result of its strong long-term track record. Over the past decade it has made 164.4%, more than 30 percentage points ahead of the average IA Europe Excluding UK peer and around 40 percentage points above the FTSE Developed Europe ex UK benchmark index.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

This performance is good enough to place it in the top quartile of the sector, although returns have been more volatile in recent years. BlackRock Continental European Income was among the best in the sector in 2020 but languished in the bottom quartile of 2021. Last year it made a 7% loss, which was above average in the peer group and 2 percentage points ahead of the benchmark.

The £1.4bn fund aims to deliver an income to investors by buying shares in European companies (excluding the UK) that pay a high dividend, but also looks for long-term growth, according to analysts at Barclays.

“It does this by applying a more flexible approach to investing than many equity income funds,” according to the firm’s website.

“This is a dynamic approach to income investing in European shares managed by one of the most experienced and talented European teams. The flexibility of the strategy means that the managers go beyond the obvious income sectors and are very reactive when trading around positions.

“Rather than investing in large companies, which often pay good dividends, the fund manager tends to look at mid-sized businesses which pay dividends and have strong growth prospects,” they added, although currently the fund has 83.8% invested in large-caps, with 13% in mid-sized businesses and 1% in smaller companies.

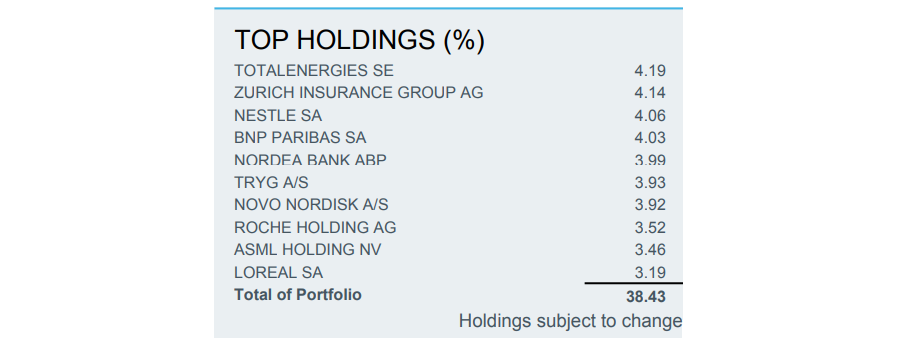

Top 10 holdings

Source: BlackRock

Analysts in charge of interactive investor’s (ii) Super 60 list added that the portfolio is constructed with a “degree of pragmatism”, noting that the managers look for ‘quality’ companies – those with strong corporate governance, financial discipline and earnings stability – which has given it “a steadier return profile” than its more value-focused peers.

Analysts at Hargreaves Lansdown (HL) agreed, saying that the BlackRock Continental European Income “aims to provide some resilience during turbulent times for markets”, making it an ideal selection to provide “balance” alongside more aggressive European equity funds in an income-focused portfolio.

“We think the fund could work well in an investment portfolio focused on income or provide diversification to European or other global funds focused on growth,” they said.

A key for all of the fund platforms however is the management team, with Andreas Zoellinger at the helm since 2011. Brian Hall joined him in 2021.

On the website, analysts at HL said Zoellinger is the longest standing member on the BlackRock European team, while ii analysts noted that the pair are supported by a strong European equity team.

“While BlackRock’s European equity team has experienced a period of above-average turnover over the past five years, we have seen evidence of increasing collaboration and synergy in their buy and sell decisions, illustrating that knowledge is more effectively shared across the team. We also have a positive view of Zoellinger and Hall and continue to believe that they can manage the fund to good effect,” the analysts said.

AJ Bell fund pickers added that the firm’s “wide resources and scale” provide “helpful support” for the fund managers, particularly in respect to the macroeconomic picture.

The four FE fundinfo Crown-rated fund is not the cheapest on the market, charging investors 0.91%, but has an above-average yield of 3.5% and fits the bill for ethically minded investors, scoring five stars on the ISS environmental, social and governance (ESG) rating system.