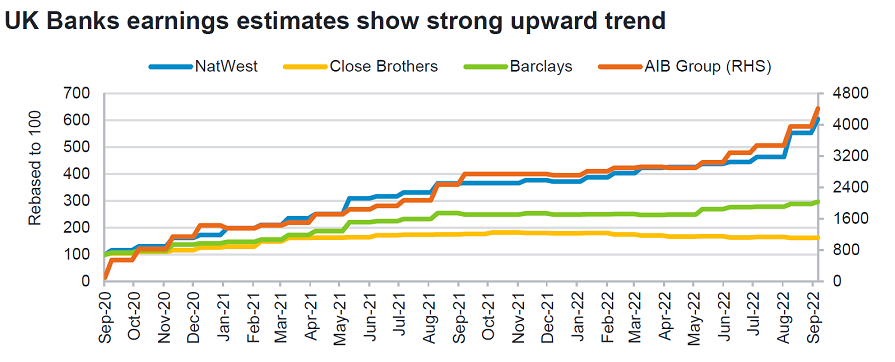

Banks are currently the most exciting sector in the UK, according to Alex Wright of the Fidelity Special Situations fund, who pointed out that in an environment when most companies have downgraded earnings, they have almost doubled theirs.

Banks make up about 10% of the FTSE All Share index, yet Wright pointed out none of the three largest funds in the IA UK All Companies sector – Liontrust Special Situations, LF Lindsell Train UK Equity and TB Evenlode Income – have any exposure to them.

The manager said their unpopularity suits him, as he likes to move against the crowd, looking for stories that have yet to be picked up by the rest of the market. He has added to positions in Barclays and NatWest this year.

“A lot of investors have sworn off investing in the banks post-financial crisis, and therefore knowledge of that sector is quite low,” he said.

“But actually the change in the interest rate environment is quite transformational for the earnings of the banking stocks.”

He added that NatWest's earnings estimates for 2023 have more than doubled in the last two years, which he described as a compelling story in an environment where many companies are seeing earnings downgrades.

Source: Fidelity

“And I think there are more earnings upgrades to come – people underestimate just how strong the interest rate changes are in terms of the benefits to the structural hedges in the banks,” he said.

Interest rate rises are not exclusively positive for banks. They increase the risk of recession and make it more difficult for customers to meet loan and mortgage repayments.

In October, Lloyds, the UK’s biggest mortgage lender, announced it had increased default provisions to £668m from £119m the year before.

However, Wright said there was a “dramatic misunderstanding” about how resilient banks are to a recession compared with history.

“Post the financial crisis, the Bank of England subjected the banks to significant stress tests that assumed GDP would fall by 5%, unemployment would rise to 7 or 8%, and house prices would be down 20%,” he continued.

“That’s not an everyday recession: that’s a really bad, financial crisis-type recession.”

Even in this pessimistic scenario, Wright said that NatWest would still be profitable.

“Earnings would halve, so there would be a big hit to profits,” he continued. “But the bank is currently on 5x earnings. In that kind of recession, NatWest would be on about 10x earnings, and that is still only in line with the market as a whole.”

Wright is not the only UK manager backing the banks. Clive Beagles of the JOHCM UK Equity Income fund described the valuation of NatWest as “absurd”.

“There is a whole generation of investors who started work after 2008 who've never had to own a bank,” he explained.

“People say: ‘What would you want to own one of those for, they’re just full of litigation risk and PPI claims. They can't make any money out of the deposit bank.’”

Performance of stock over 20yrs

Source: FE Analytics

Yet he said NatWest is trading on about 0.5x book value, is expected to return 40% of its market cap to investors in the next two years, and should make a return on equity of 17 to 18%.

“There's a whole regime change here. I think it will take time for people to recognise how significant it is,” he added.

AJ Bell’s investment director Russ Mould prefers Lloyds over NatWest. He said that while sentiment towards the stock remained downbeat, loan losses in 2022 are undershooting expectations, meaning “it may not take much to provide upside surprises”.

“Meanwhile, Lloyds’ balance sheet is far stronger than it was back in 2007, if regulatory ratios are anything like a reliable guide, and that, coupled with the lowly valuation, will hopefully provide some downside protection if anything unexpected does go wrong in 2023,” he added.

Yet some investors still refuse to invest in banks, no matter how far their valuations fall. Eric Burns, chief analyst at Sanford DeLand, said there is a simple reason for this: “When you strip out the leverage on their balance sheets, the returns to equity are woeful.

“We believe most people who invest in the banking sector don’t fully understand their balance sheets, a point best illustrated by what happened in 2007.”