Only one out of the 15 IA North America funds run by Alpha Managers charges below-average fees, data from FE Analytics has showed.

With an average ongoing charge figure (OCF) of 0.63%, the IA North America sector is cheaper than the average Investment Association fund, where the average charge is 0.72%.

However, North American funds do not look as cheap if you are looking for seniority, as experienced managing teams will prove expensive.

Yet they might be worth the price, according to AJ Bell head of investment analysis Laith Khalaf, who said that “40% of US active managers outperformed a passive alternative in 2022”.

“Although 40% may not have the ring of resounding triumph, it compares favourably to 2021 when only 19% of active US funds managed to outperform the passive machines and to the long-term picture, which shows that only 17% of active funds have outperformed over a 10-year period,” he said.

This was partly due to the techlash damaging the share prices of big US technology stocks and consequently the passive funds that track it.

“Against this backdrop, it’s been a positive year for active managers investing in the US stock market.”

Still, for investors who don’t want to pay an arm and a leg for their US alpha, Trustnet gathered up the cheapest IA North America funds run by FE fundinfo Alpha Managers below.

It has to be noted, however, that 92 funds out of the total 245 in the sector are passive vehicles with much cheaper OCFs than their active counterparts – which does bring the average fee down. Disregarding passive funds, the average OCF goes up to 1%.

Source: FE Analytics

With an OCF of 0.51%, the only fund that charges below the sector average is Baillie Gifford American.

Baillie Gifford American has shrunk considerably since the beginning of the year, losing an eyewatering 47.6% in 2022 so far and reaching £2.7bn of assets under management, down from its £7.9bn peak in February 2021.

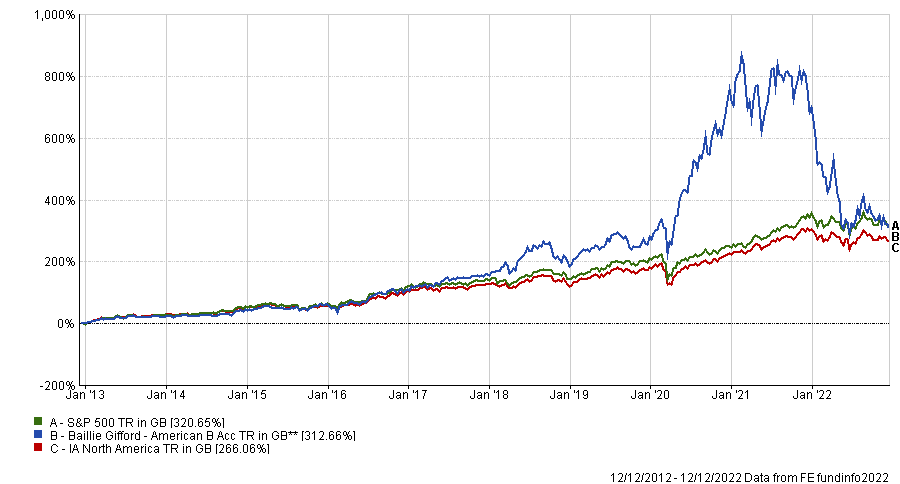

In fact, it has been the second worst-performing fund in the IA North America sector in 2022, making a loss of 48.3%. It was also the second worst in 2021, when it lost 2.8%. It means it has now failed to beat the S&P 500 over 10 years, although it remains ahead of its peers over this time.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

This bottom-up, high-volatility strategy is heavily invested in US-based telecom, media and technology companies (38.7% of the portfolio), consumer products (24.2%) and health care (22.9%), with Tesla, Amazon and Netflix among its top 10 holdings.

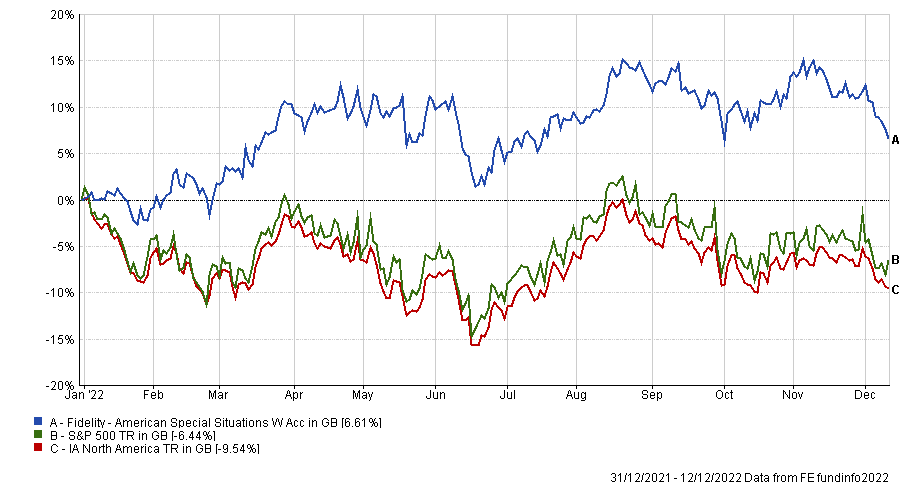

Fidelity American Special Situations charges 0.86% annually and is the only fund that has made gains in the year-to-date (7.6%). Manager Rosanna Burcheri explained that the fund has achieved this by investing in companies that “are mispriced, either because they are out of favour or their intrinsic asset value is misunderstood, or their journey to sustainability is misunderstood”.

Stock picking is at the core of the fund’s investment approach and is the main driver of risk and return, alongside its value-biased investment style.

Performance of fund vs sector and benchmark over YTD

Source: FE Analytics

Another strategy by the same investment house on the list is Fidelity Sustainable US Equity, which has an OCF of 1.08%.

For the best long-term track record, AB SICAV I Sustainable US Thematic Portfolio made 88.3% over five years, the best result within this list.

This $1bn fund has achieved a FE fundinfo Crown rating of four and also scores four out of five in Climetrics and ISS environmental, social and governance (ESG) ratings.

It focuses on US-domiciled companies that are positively exposed to environmentally or socially oriented sustainable investment themes, using top-down investment processes to uncover companies fitting into these themes as well as bottom-up research to assess a company’s exposure to ESG and its prospective earnings growth, valuation and quality of management.

Lastly, the most expensive on the list are the Nordea 1 North American Stars Equity and Allspring Worldwide US Large Cap Growth funds, which are both managed by a team of two Alpha Managers but charge double the two cheapest funds.