Uncertainty is abound in markets and investors who are unsure about where to allocate in 2023 should consider outsourcing such decisions to mixed assets funds – especially those that pay close attention to protecting money, Hargreaves Lansdown analysts suggest.

In the past year both stocks and bonds have made significant losses, which could cause some investors to wonder about what role each should play in their portfolios. While many are hoping that 2023 will herald some improvement in markets, many headwinds remain in play and the outlook for both asset classes is uncertain.

Joseph Hill, senior investment analyst at Hargreaves Lansdown, said: “In difficult and volatile times with so much going on and uncertainty lingering, it’s difficult for investors to keep track of emerging risks and opportunities.

“That’s why we think there’s value in leaving it to the experts. Investing in a mixed asset fund offers access to a carefully crafted, ready-made investment portfolio run by experts in their field. We think there are some talented managers who’ve demonstrated an ability to navigate this environment well.”

Below, Hill picks out three mixed asset funds that Hargreaves Lansdown thinks can help investors deal with uncertainty.

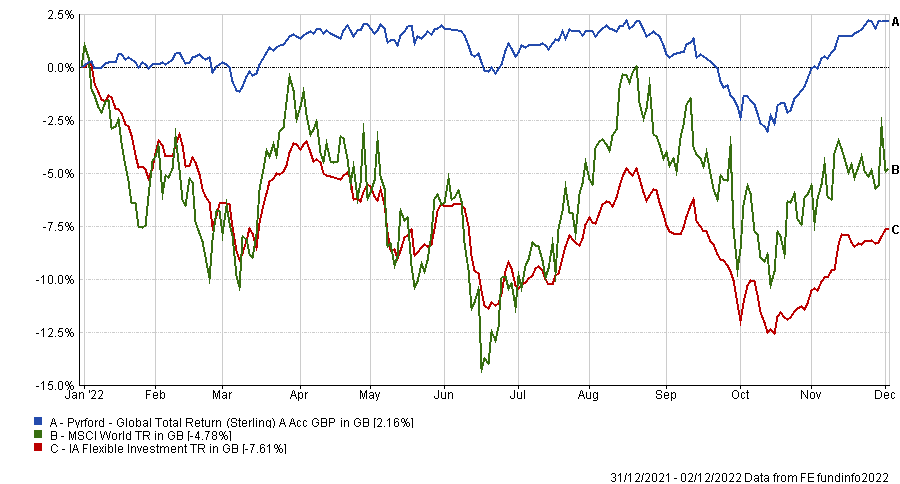

Pyrford Global Total Return

Hill’s first pick is the £1.7bn Pyrford Global Total Return fund. It has three aims: its priority is to preserve capital over rolling 12-month periods, generate a real level of capital growth over the long term and maintain a low level of volatility.

Hill said: “Led by manager Tony Cousins, the team tries to grow investors' wealth modestly over the long run, without all the significant ups and downs of investing fully in the stock market.

Performance of fund vs sector and index over 2022

Source: FE Analytics

“While it won't shoot the lights out, we like the long-term, disciplined investment philosophy, which has been in place for many years. The team has a good record of sheltering capital in market falls but don’t expect it to keep up with rising markets.”

Reflecting this, Pyrford Global Total Return has made a 2.2% total return this year, which ranks it eighth out of the 150 funds in the IA Flexible Investment sector. It has been bottom-quartile in years when markets have been rising, although it jumps to the first quartile in years when stocks are down such as 2018 and 2022.

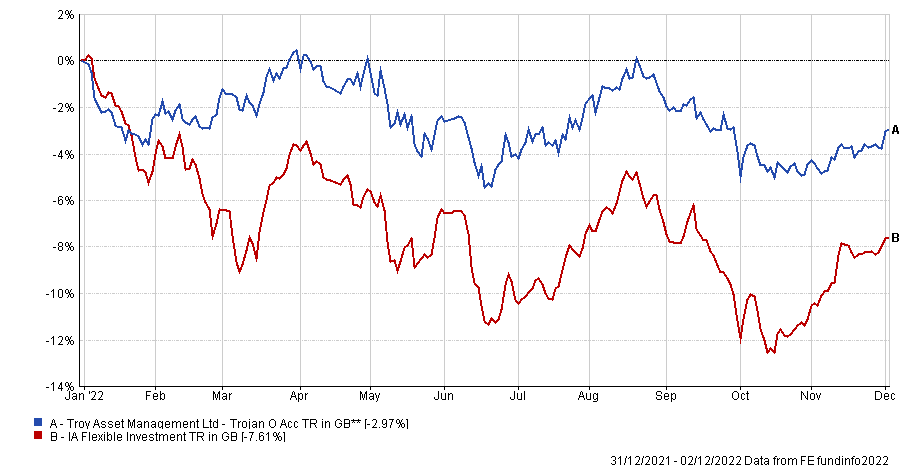

Trojan

Next up is the £6.4bn Trojan fund run by FE fundinfo Alpha Manager Sebastian Lyon of Troy Asset Management. The priority across all of the asset manager's funds is to protect investors’ capital.

It is another in the first quartile of the IA Flexible Investment sector in 2022 (and other difficult years), thanks to its preference for quality stocks, gold and cash – although its allocation to index-linked bonds will have hampered returns this year.

Performance of fund vs sector over 2022

Source: FE Analytics

“Lyon likes to keep things simple, a quality we like. Capital preservation is key: he aims to shelter investors' wealth just as much as growing it,” Hill said.

“Avoiding large losses has been an important characteristic of the fund and it has tended to come into its own and hold up well in weaker markets. Given its cautious approach, it’s not likely to keep up when share markets are performing strongly though.”

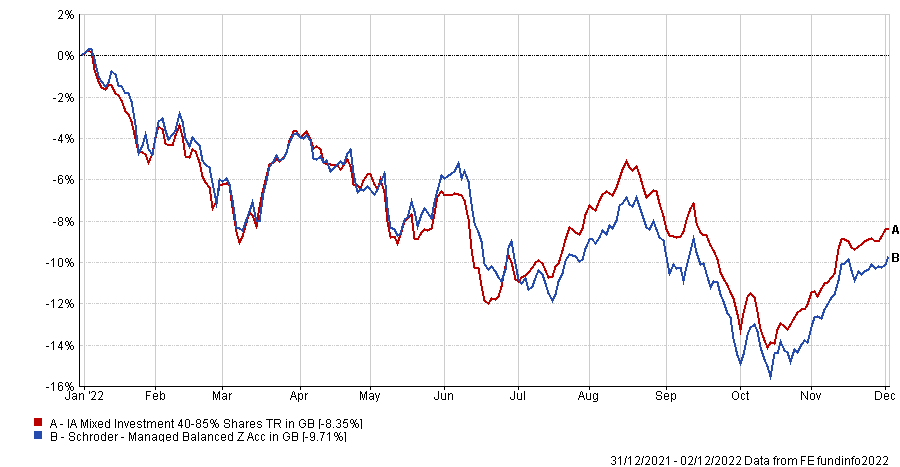

Schroder Managed Balanced

Hargreaves Lansdown’s final pick for uncertain markets is the £1.9bn Schroder Managed Balanced fund, which is run by Johanna Kyrklund and Remi Olu-Pitan. It is a fettered fund of funds, which means it invests in other funds run by Schroders, and is a balanced portfolio aiming to make reasonable returns across the market cycle.

Performance of fund vs sector over 2022

Source: FE Analytics

Hill said: “The fund provides exposure to a broad range of assets including global shares and bonds. Collectively it’s invested in hundreds of different companies and bonds, offering a high level of diversification in one convenient investment.

“The fund could form the core of a portfolio aiming to deliver long-term growth or add some stability to a portfolio mostly invested in shares.”

Schroder Managed Balanced is in the IA Mixed Investment 40-85% Shares sector’s third quartile this year; unlike the previous two funds, it tends to spend more time ranked in the middle of its peer group, rather than jumping to the top in bear markets then underperforming during bull runs.