November was a broadly positive month for investors with bonds and equities on the rise, while the top fallers were in the alternatives space.

Starting with the macro, Europe and UK inflation reached double digits, with some arguing that the domestic market is heading for a recession next year.

Yet it was further afield that the headlines were drawn to. Perhaps the biggest news of the month was in China, where protests over the government’s handling of the pandemic and its continued Covid-zero policy has driven disgruntled citizens to action.

In the world of central banks, the Bank of England and Federal Reserve hiked interest rates by 0.75 percentage points last month, although the UK still lags the US with base rates at 3% here and 3.75%-4% across the pond.

Yesterday, Fed chair Jerome Powell said the US central bank could start to slow down as early as this month, causing equities to bounce.

Ben Yearsley, director at Fairview Investing, said: “Yet again central banks drive markets. Powell’s comments yesterday about moderating the pace of rate hikes sent markets sharply up.

“However surely of more importance was the comment about rates needing to be higher than previously thought and those higher rates will need to be maintained for longer. The short-term stimulus of smaller hikes may wear off when reality hits.”

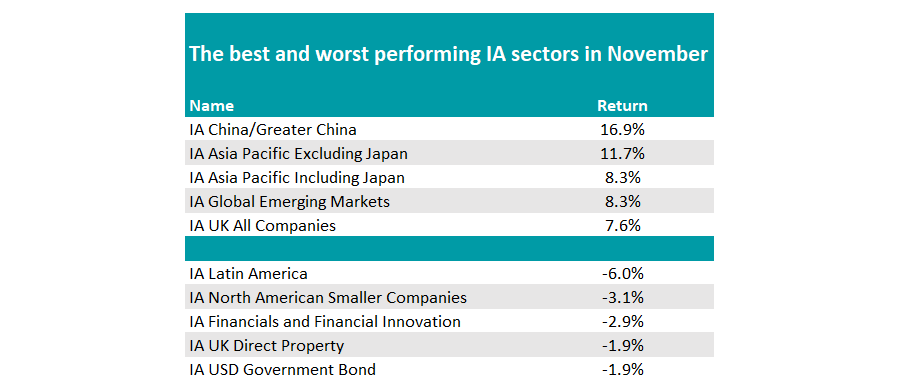

This short-term shot in the arm for US stocks was not enough to land either the IA North America or IA North American Smaller Companies sectors in the top five for the month, however.

The list was dominated by the news in China. Despite the protests, the Hang Seng index gained 26% in November while the Shanghai Composite was up more than 8%.

Source: FE Analytics

“Chinese stockmarkets rallied strongly after hints of a relaxation in strict Covid rules – although shortly after this happened more cities were locked down again,” Yearsley said.

Four of the top five sectors – IA China/Greater China, IA Asia Pacific Excluding Japan, IA Asia Pacific Including Japan and IA Global Emerging Markets – were swayed by signs the policy may be coming to an end.

The other was the IA UK All Companies sector. The FTSE 100 was the best performing developed market, up around 7% for the month as investors recovered from the short-lived Liz Truss administration.

“I’m not sure many at the start of 2022 would have put the UK down as one of the best performing markets but that’s the way it is now looking. There is clearly something to be said for stodgy companies paying nice dividends in a complicated market backdrop. In the new world of higher rates, income will probably continue to be an important focus,” Yearsley said.

At the other end of the table, IA Latin America continued its yo-yo 2022. The sector has consistently appeared at the top or the bottom of the rankings throughout the year as investors use it as a play on commodity prices, which dipped in November, with the exception of gold.

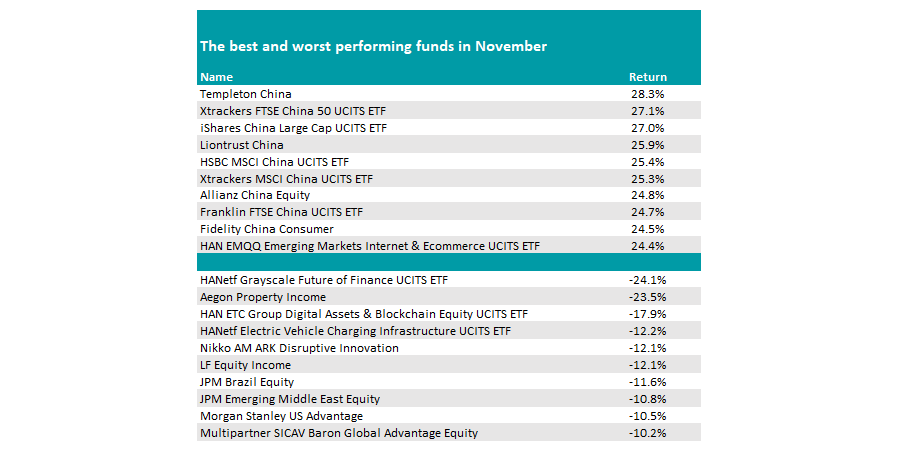

Turning to individual funds, those investing in China dominated, with Templeton China the best investment you could have made at the start of the month. The fund rose 28.3% and was closely followed by exchange-traded funds (ETFs) Xtrackers FTSE China 50 and iShares China Large Cap.

“China’s performance is a complete reversal of October when of course the foot of the table was entirely populated by China funds,” Yearsley noted.

The foot of the table was more of a mixed bag with a mix, with growth funds such as Morgan Stanley US Advantage and Nikko AM Ark Disruptive Innovation again propping up the table. They were joined by funds investing in Brazil as well as property portfolios.

Source: FE Analytics

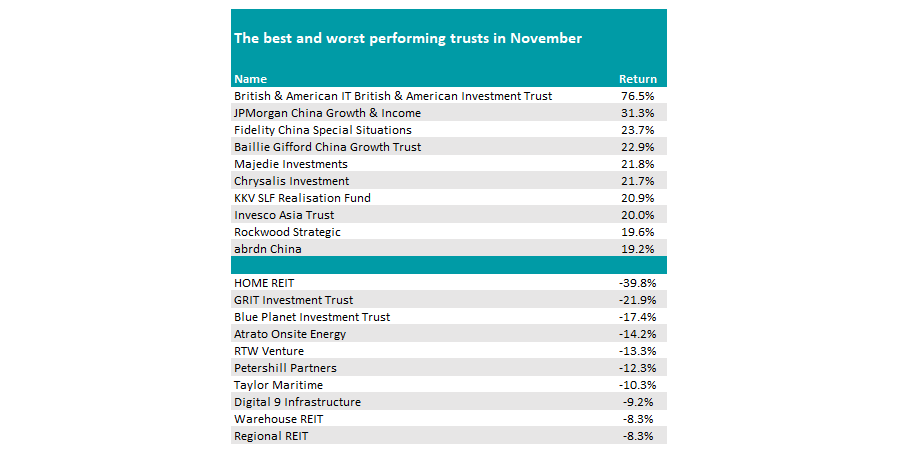

In the investment trust universe it was a similar story, with China portfolios dominating the list. At a sector level, funds in IT China/Greater China made 24.3% while there were big gains for Asian trusts too (Asia Pacific was up 12.8% while the Asia Pacific Equity Income rose 15.7%).

Here, European trusts performed slightly better than their UK counterparts, although both regions performed strongly. Conversely, property and Latin American trusts disappointed.

The best performing trust was British & American. The small portfolio tends to swing wildly and the 76.5% gain last month only takes it back to its level in the spring.

Source: FE Analytics

Meanwhile, JPMorgan China Growth & Income, Fidelity China Special Situations and Baillie Gifford China Growth Trust all made more than 20%.

At the other end, property trusts HOME REIT and GRIT both struggled, making the biggest loses over the month, down 39.8% and 21.9% respectively.