Personal Assets has the lowest exposure to equities since the global financial crisis as rising interest rates make the risk of a recession “highly probable”, according to manager Sebastian Lyon.

In the trust’s half-year report to the end of October, the FE fundinfo Alpha Manager revealed its net asset value fell 3.6% versus a 5.8% drop for the FTSE All Share benchmark.

The past six months have been a testing time for investors who had spent much of the past decade gradually increasing their risk by buying into equities, often without realising it.

This is because bond yields have been so low that in some cases investors have been paying to own them, which has led to the acronym TINA – ‘there is no alternative’ to stocks.

Over this time, stock markets have become increasingly more expensive, yet this year that trend has reversed. Interest rates are higher while inflation is rampant.

“Consequently, we are experiencing the fastest tightening of financial conditions since the Federal Reserve was established a century ago. This year the Fed has increased rates at a breath-taking pace, from near zero to 4%, while the Bank of England has followed to a more modest 3% base rate,” said Lyon.

He cited US investor Warren Buffett’s quote – “Interest rates are to asset prices what gravity is to the apple” – to explain why this market condition has forced down shares, which he argued had been in a bubble.

“Bubbles are notoriously difficult to recognise, in real time, but with hindsight we can see that the strong run on equites, immediately following the pandemic in 2020 and 2021, had similarities with the dotcom bubble of 1999,” said the Personal Assets manager.

“This time the market peaked with the enthusiasm for 'meme stocks' and unprofitable technology investments in the spring of 2021, and since then the bubble has been deflating.”

He said that the market conditions are akin to the aftermath of the tech bubble but warned that this time around there are few assets that look attractive, with rising yields hitting bond markets.

“The US dollar has been the only place to hide. Gold has also protected capital in most currencies including sterling, euro and yen. With these notable exceptions there have been few ports in the storm of falling equity prices,” added Lyon.

However, inflation-linked bonds have dragged lower, as has the gilt market, which took a further hit from former chancellor Kwasi Kwarteng’s mini-Budget. Alternatives such as real estate have not been unscathed either.

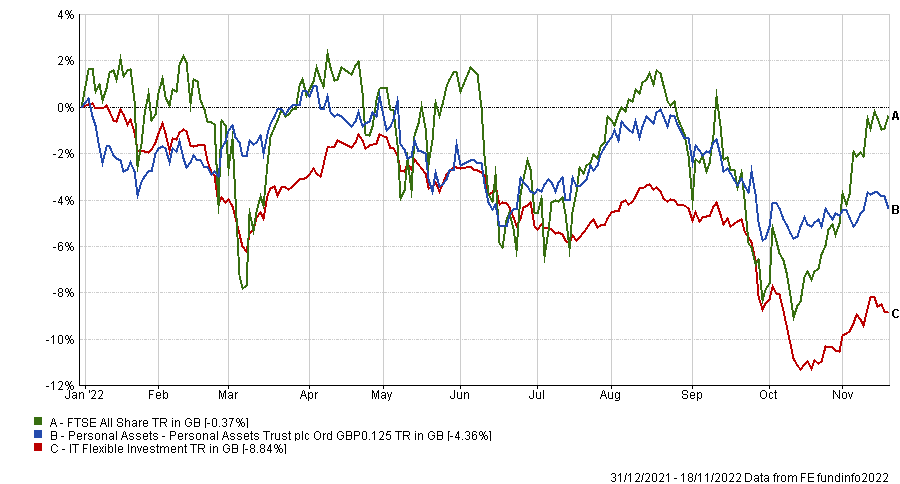

All of this has combined to make a tricky six months for the £1.8bn trust, which has lost 2.4% on a total return basis while the index is up 0.6% over this time. As such, so far this year Personal Assets is behind the benchmark, as the below chart shows.

Performance of trust vs sector and benchmark in 2022

Source: FE Analytics

This is a change for the trust, which typically holds up well during periods of volatility and is used by investors as a defensive asset.

Lyon said it had been a “very challenging period in which to protect capital”. Having already reduced the trust’s exposure to equities in 2021, he slashed it again during the summer bear rally, taking the position down to 25% – the lowest since 2008.

“The company invests in highly liquid assets, providing us with flexibility when valuations reach attractive levels. We have always sought to avoid illiquid 'lobster pot' investments, which are easily entered and hard to exit,” he said.

Last year the Personal Assets manager said there would be an upcoming battle between the inflation protection that stocks can provide and the threat of future rate rises. “That battle is now raging,” he noted.

And it is one that stocks may lose in the short term. Indeed, he warned that the bear market “has room to run” and that “the risk of recession is highly probable”, suggesting that this will likely hit companies’ bottom lines in 2023.

Although TINA may be dead, it is not all bad news. Indeed, Lyon has moved the trust towards bonds and in particular some short-dated gilts which are yielding more than 4% – a return not offered in more than a decade.

“A cost of capital and a risk-free rate (if only in nominal rather than real terms) is now available. This is a material and welcome change for savers and investors. It also provides an anchor to valuations which has been missing for too long,” he said.