Fewer than 4% of European equity funds have scored a top rating for both their investment performance and environmental, social and governance (ESG) factors, research by Trustnet shows.

In this ongoing series, we are highlighting funds that hold both an FE fundinfo Crown Rating of five – which puts them in the top 10% of funds for investment performance in recent years – and AAA status under the MSCI ESG Fund Ratings – which examines the ESG scores of underlying holdings, funds’ ESG momentum and exposure to the worst-rated companies.

Here, we turn our attention to European equities, which tend to have a good reputation when it comes to ESG thanks to strong corporate governance standards and regulation promoting sustainable practices.

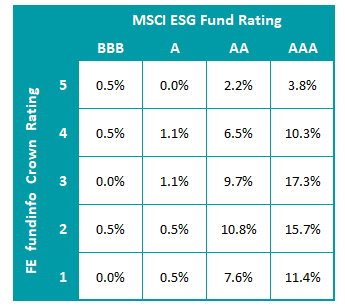

There are 185 funds in the IA Europe Excluding UK, IA Europe Including UK and IA European Smaller Companies sectors that have both an MSCI ESG Fund Rating and an FE fundinfo Crown Rating. Of these, just under 60% (108) have been rated AAA for their ESG characteristics.

However, the field narrows significantly when the FE fundinfo Crowns are applied: only seven funds – or 3.8% of the sample – hold a top rating under both systems.

Distribution of European equity funds by FE fundinfo Crown Rating and MSCI ESG Fund Rating

Source: FE fundinfo, MSCI

Fidelity European is probably the most recognisable of the European equity funds with five FE fundinfo Crowns and an MSCI ESG Fund Rating of AAA. The £3.4bn fund is top quartile in the IA Europe Excluding UK sector over one, three, five and 10 years.

The fund is not a sustainable investment fund but ESG is “a central pillar” of the research and investment processes across Fidelity’s strategies. Under MSCI’s methodology, 67% of the fund’s underlying holdings have an ESG rating of AAA or AA, meaning they are classed as ‘ESG Leaders’.

Pictet Quest Europe Sustainable Equities is the only other of the seven shortlisted funds to run more than £1bn. It has made top-quartile returns in the IA Europe Including UK sector over one, three, five and 10 years.

This is a dedicated ESG fund and, according to MSCI, 83% of its holdings are ‘ESG Leaders’. However, the fund is designed mainly for institutional investors.

The £480m Carmignac Portfolio Grande Europe fund not only holds five crowns alongside its AAA rating for ESG but also has an FE fundinfo Alpha Manager at the helm: Mark Denham.

ESG is a key factor for the fund: it aims “to generate capital growth while implementing a socially responsible investment approach formalised by a sustainable investment objective”. Its factsheet contains a wealth of ESG information, including the fact that around three-quarters of its portfolio is invested in ‘ESG Leaders’.

GAM Star European Equity is another fund run by an FE fundinfo Alpha Manager, this time Niall Gallagher. It also has a strong track record, sitting in the IA Europe Including UK sector’s first quartile over three, five and 10 years.

While this is another fund without a sustainable buzzword in its name, GAM Investments says ESG considerations are “integral to fundamental financial analysis” as “long-term sustainable returns are dependent on stable, well-functioning and well governed social, economic and environmental systems”. Some 61% of its holdings are ‘ESG Leaders’.

The only other funds that hold an FE fundinfo Crown Rating of five and an MSCI ESG Fund Rating of AAA are New Capital Dynamic European Equity, MFS Meridian Continental European Equity and MFS Meridian Blended Research European Equity.