The structure of investment trusts allows them to ‘squirrel’ excess income away and pay it out to shareholders during difficult periods. This gives them the ability to maintain or increase dividends, even when their underlying holdings are cutting theirs.

Among the trusts that have made the best use of this facility are what the Association of Investment Companies (AIC) calls the ‘Dividend Heroes’, which are vehicles that have increased their pay-outs for more than 20 years in a row.

The AIC also highlights the Next Generation Dividend Heroes, which have increased their dividends for at least 10 years in a row.

Below, Killik analysts Mick Gilligan and Jack Stockdale highlight one Dividend Hero and one Next Generation Dividend Hero that they think offer good yields, are well placed to continue their progressive dividend policy, and look attractive in the current market environment.

City of London is one of the world’s oldest investment trusts. Originally formed in 1860 to acquire a brewing business, it became a diversified investment trust in the 1930s.

It is not just the trust that has a lengthy track record – manager Job Curtis has headed up City of London since 1991.

Curtis targets a yield that is between 10% and 30% higher than that of the FTSE All Share, by holding a portfolio of UK stocks that are well positioned to grow profits and thus dividends over the longer term.

“The portfolio has a large-cap bias, a consistently higher yield than the UK market, higher quality (stronger profitability and lower financial leverage) and a greater value bias,” said Gilligan and Stockdale.

The trust has raised its dividend for the past 56 years, the longest record of any investment trust.

“This covers the 1970s, the early 1980s and early 1990s recessions, the technology boom and bust, the financial crisis and the pandemic,” the analysts noted.

“The trust has revenue reserves (undistributed income from prior years) equating to 48% of the current year’s dividend and capital reserves equating to 3.7x the current year’s dividend payment. The shares trade on a 5.5% historic yield.”

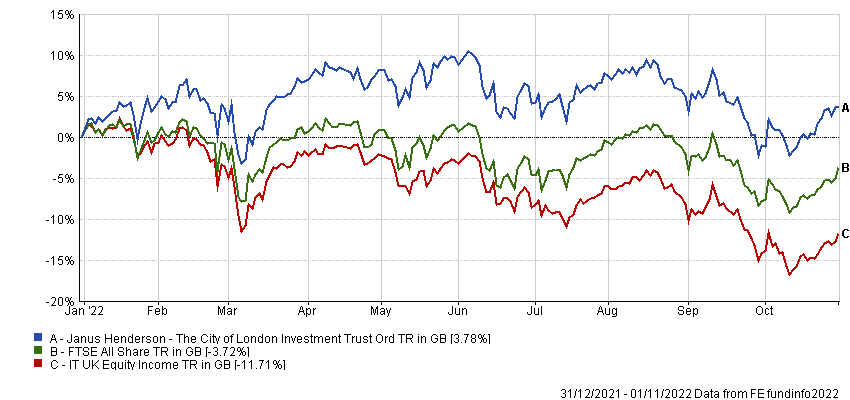

Curtis has benefited from his position in oil & gas stocks and tobacco this year, which have helped the trust make a positive return while its IT UK Equity Income sector and the FTSE All Share index are both down. City of London also still trades at a slight premium.

Performance of trust vs sector and index in 2022

Source: FE Analytics

While many commentators have claimed this year’s market correction has opened a buying opportunity for long-term investors, Curtis recently said his trust wouldn’t be the best vehicle to take advantage of any recovery.

“The difficult thing for an income investor is you might see some long-term value in a stock, but you have to wait for it to be back in the dividends before you invest,” he explained.

“So we’re probably not the best vehicle for a recovery – you would need to buy into things when they’re really in a crisis and losing money, so not paying a dividend.”

Murray International also aims to deliver an above-average yield, as well as long-term growth in dividends and capital. While City of London must invest at least 80% of its assets in UK-listed stocks, Murray International has a global mandate.

Bruce Stout has managed the trust since 2004. He adopts a flexible approach, investing in both developed and emerging equity markets, as well as global bond markets.

“The portfolio has a large-cap bias, a consistently higher yield than the FTSE All World Index and a greater value bias,” said Gilligan and Stockdale.

“It currently has an emerging market bias, with 27% in Asian equities and 13% in Latin American equities. Bonds represent 8% of the portfolio.”

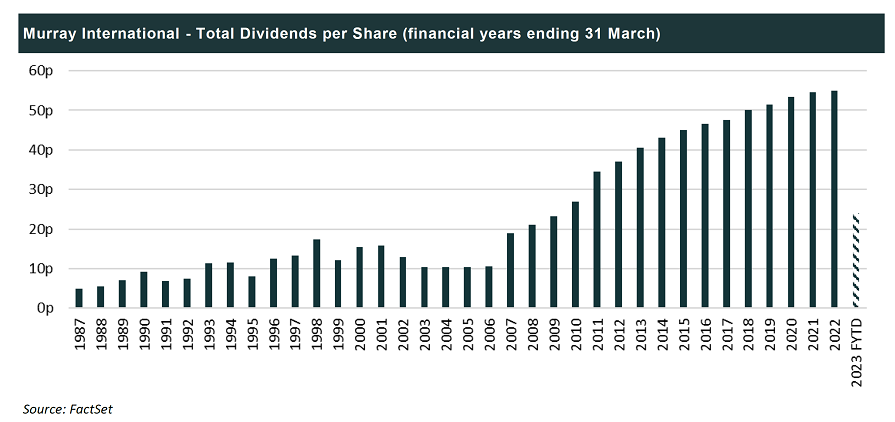

The trust has raised its dividend for the past 17 years and currently has revenue reserves equating to 90% of the current payment.

“It prefers to pay dividends fully from revenue and revenue reserves, rather than seeking to distribute from capital,” the analysts added. “The shares trade on a 4.6% historic yield.”

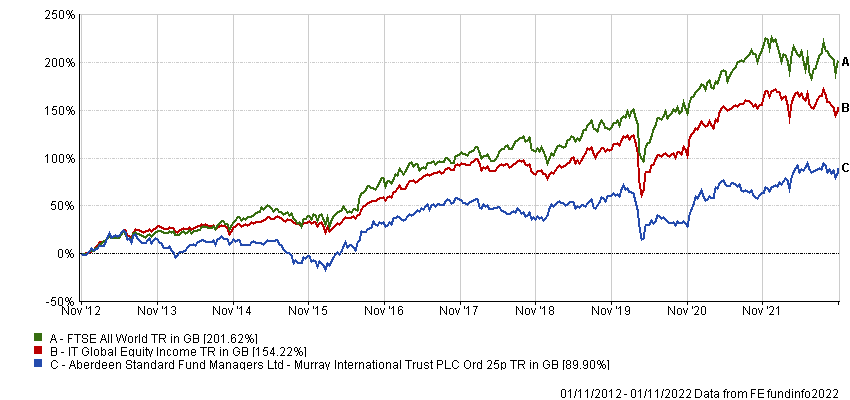

Stout has long been regarded as a ‘permabear’, and his cautious, value-based approach led to him underperforming during the bull run of the past decade. However, this same approach has helped Murray International deliver double-digit gains this year while its IT Global Equity Income sector and FTSE All World benchmark have fallen.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

The manager recently warned Trustnet readers that we are a long way from “peak fear”, despite the recent market falls.

“As long as we are having a conversation in a rational manner, then I would say we have not yet reached peak fear. When you get the real stress points, people do not want to talk about it. People do not want to look at their portfolios or at valuations,” he said.

Stout said that the final two months of 2008, when the market made consecutive double-digit losses, was a good example of “indiscriminate selling”.

“We have not had any of that yet,” he continued. “A lot of the selling now has been around the tech names in the US, which are down 60 to 70%. That’s irrelevant. Look where they were. I don’t know why the valuations were that high, but they might still be 100% or 200% too expensive because there might not actually be a good business there,” he said.