Markets have reacted positively to the news that Rishi Sunak will be the next prime minister, but investors have pointed out that his work is only just starting.

After losing out to Liz Truss in the summer leadership contest, Sunak was yesterday named as the new leader of the Conservative Party – and therefore UK prime minister – after a new race was started when Truss stepped down last week.

After weeks of market turmoil following the Truss administration’s mini-Budget – with sterling dipping a historic low, gilt yields climbing and mortgage rates being pushed higher – there was a positive reaction after Sunak was named the leader of the Conservatives.

Steve Clayton, fund manager at HL Select, explained: “Yesterday, after the announcement at 2pm, bond markets saw yields tumble, in sharp contrast to their moves in reaction to the mini-Budget a few short weeks ago. Yields on longer-dated bonds have fallen to around 3.75%, which if sustained ought to offer some hope that mortgage rates may soon start to ease.”

But Schroders economist George Brown pointed out that calming the markets is just one of the pressing tasks that the new prime minister has to deal with.

Brown argued there are three distinct groups that Sunak has to assuage as quickly as possible, the first of which is investors and their demands for public finances to be put on a sustainable path

“Markets have reacted positively to his appointment on account of his fiscally conservative reputation and prior experience as chancellor. But this credibility needs to be cemented by the fiscal statement scheduled for 31 October,” he said.

Secondly, the “warring tribes” of Conservative MPs need to be reunited. The party’s moderate and right-wing factions went into battle during the summer’s leadership contest and tensions were aggravated further when Truss appointed loyalists to key Cabinet positions while ousting those who had supported her rival.

“A Cabinet reshuffle that better reflects the ideological spectrum of the party would go some way in promoting harmony among Conservative MPs,” Brown said.

The third group that Sunak needs to win over – the voters – is arguably his greatest challenge of all, according to Brown. This is not only because of the severe reputational damage suffered by Conservatives over the past month but because many of the headwinds hitting the UK are from overseas and therefore out of his control.

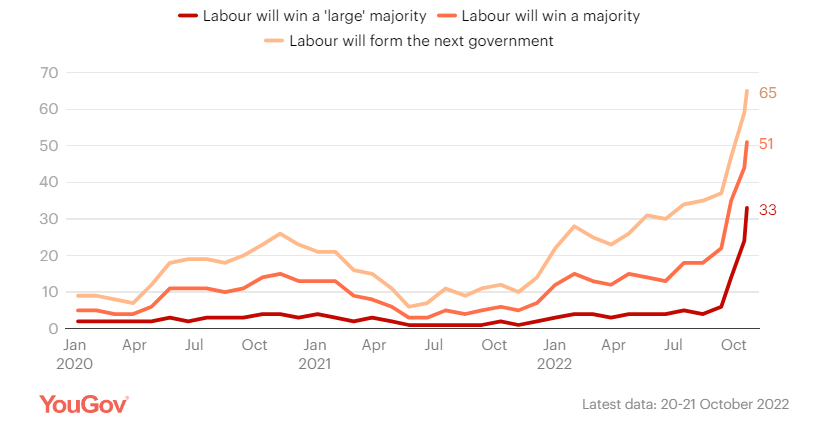

What is the most likely result of the next general election?

Source: YouGov

As shown above, a YouGov poll (carried out before Sunak won the leadership race) found that two-thirds of Britons think Labour will form the next government and half think they will win an outright majority.

“It will be hard to placate all three at the same time. Few things are as unpopular with voters as tax rises and fiscal austerity, although the alternative would put the prime minister firmly on a collision course with investors,” Brown said.

“As a former chancellor, he will be acutely aware of the need to bring down the UK’s borrowing costs by reducing spreads. Sunak therefore has no choice but to level with the public that difficult decisions need to be taken in the best interests of the country. It is a hard story to sell, especially as the clock ticks ever closer to a general election.”

Trevor Greetham, head of multi-asset at Royal London Asset Management, said that Sunak’s presence in Number 10 should appeal to the first group – investors – although the UK economy still looks to be in for a rough ride.

“Rishi Sunak becomes prime minister at a time of high inflation and great economic uncertainty,” he said. “While a more orthodox approach to fiscal policy should calm the bond markets, the prospect of public spending cuts as the Bank of England raises interest rates will do nothing to ease recession fears.”

GAM Investments investment director Charles Hepworth, meanwhile, thinks the prime minister has a better chance of winning over his Conservative colleagues than the UK electorate - although he doesn’t rule this out entirely.

“While Sunak will likely restore a sense of union and relative calm within the beleaguered Conservative Party - with an economy sharply deteriorating and expected to be in recession for quite a while - there is little he can do in the next two years to galvanise the party’s chances at the next general election,” Hepworth said.

“But then who would have given you odds just a few years ago that a 42-year-old Hindu ex-hedge funder would be the First Lord of the Treasury? Perhaps it is too early to write off the UK just yet.”