When fund managers are asked what business characteristics suggest a company is well placed to cope with high inflation, their first answer is usually pricing power, which sounds obvious.

However, Mike Kerley (pictured), manager of the Henderson Far East Income Trust, said that while the ability to pass on price increases is taken for granted in developed countries, it is less clear-cut in Asia where domestic brands don’t have the same pedigree.

Inflation is expected to average 4.5% this year in Asia, about half the level in the US and the UK. Kerley said this was because countries in the region didn’t embark on the sort of Covid stimulus programmes we saw in the West, while China is holding back its economy through the continued use of lockdowns.

The manager admitted that inflation is likely to move higher from its 4.5% level when China fully re-opens, and said this will have a material impact on the way he manages money. But he said his method of approaching this problem is completely different to the strategy used by his counterparts in the West.

“This is because the pricing power for most of the companies we look at sits upstream. The further you go down that supply chain, the margin always gets smaller and smaller. The companies that really have the pricing power are the companies that produce the primary goods,” he explained.

“In the Western world, you have strong brands with pricing power at the end of the supply chain. But branding in Asia is not as strong, you don't have Burberry and LVMH, the kinds of companies that can put their prices up as costs rise.

He added: “So most of the portfolio is focused on areas upstream, whether that's oil & gas, semiconductors rather than companies that make laptops, or even food supply.”

High inflation has driven interest rates higher in the US, leading to a stronger dollar, which Kerley admitted doesn’t tend to correlate with outperformance from Asian and emerging market economies. Yet he said that while he is seeing the negative impact of dollar strength, he claimed it wouldn’t do the sort of damage it has done in the past, as deficits are relatively narrow compared with historical levels.

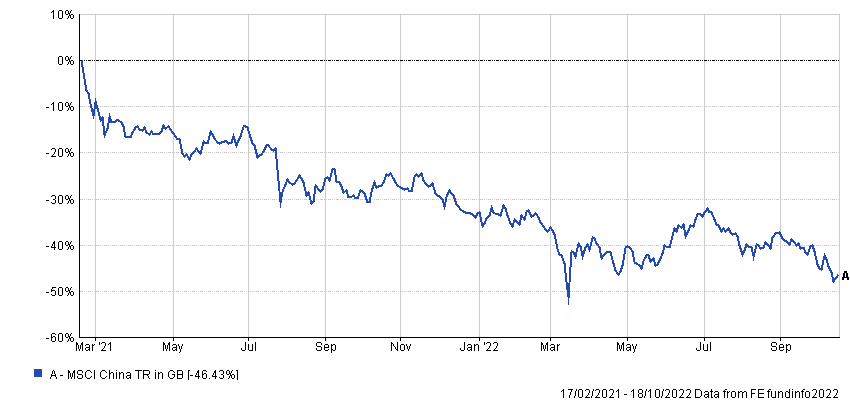

Another major concern for investors in Asia is political risk in the region’s dominant economy, China. The MSCI China index has been on a downward trend ever since the government’s heavy-handed intervention in sectors such as private education and energy last year, and has fallen 46.4% since its 2021 peak.

Performance of index since 2021 peak

Source: FE Analytics

Kerley said that while the de-rating was justified, this threat is now fully priced in, and valuations are attractive considering the level of innovation taking place in the economy. The manager claimed this separated China from the Asian nations that are at the biggest risk of a correction in the short term.

In a recent article on Trustnet, Pacific Horizon Investment Trust portfolio manager Ben Durrant revealed his portfolio’s biggest overweight was to India, partly due to a trend of digitalisation which is transforming the country.

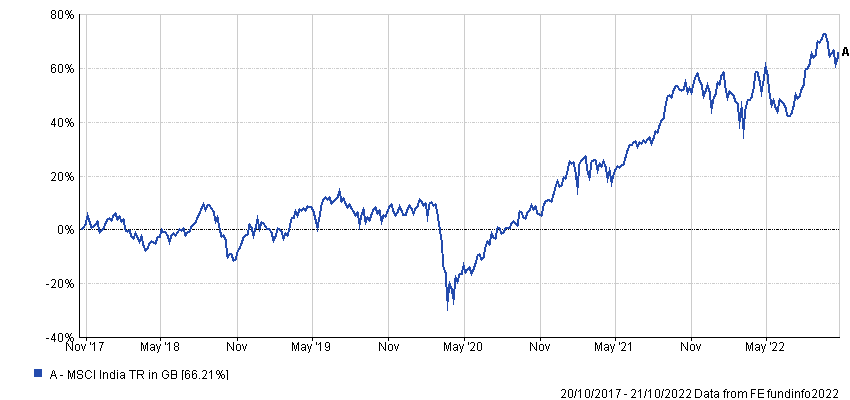

However, Kerley said that while he appreciated the long-term tailwinds working in India’s favour, he is put off by its “sky-high” valuations.

Performance of index over 5yrs

Source: FE Analytics

“There is a decent structural story and the companies are well managed,” he explained. “We'd like to invest in India, but not at these valuations. They are just too high considering the significant short- and medium-term risk: it is massively reliant on the import of energy.

“Although the government is subsidising it, this is feeding into its fiscal deficit, and inflationary issues in India are worse than they are in most other Asian countries.”

This means that Kerley’s exposure to India is at the uppermost end of the supply chain, in one of the few areas of the country that he said still offers value.

“We own its oil companies, which are state owned – some of the cheapest energy companies in the world are in India,” he added.

“They are certainly at the whim of government policy, but are trading at 6 or 7x earnings rather than 20x.

“It's all about evaluating the risks in the price and what your expectations are. In my mind, I would rather own stocks in the right sectors that are cheap than overpay for stocks which are exposed to a growth theme but are significantly overpriced in the short term.”