Less than 1.5% of global equity funds in the Investment Association universe have been given the best performance and ESG track records under two leading methodologies, research by Trustnet has found.

With environmental, social and governance (ESG) factors now an important consideration for many investors, we recently looked at how many funds currently hold both five FE fundinfo Crown Rating – which puts them in the top 10% of funds for investment performance in recent years – and AAA status under the MSCI ESG Fund Ratings – which examines the ESG scores of underlying holdings, funds’ ESG momentum and exposure to the worst-rated companies.

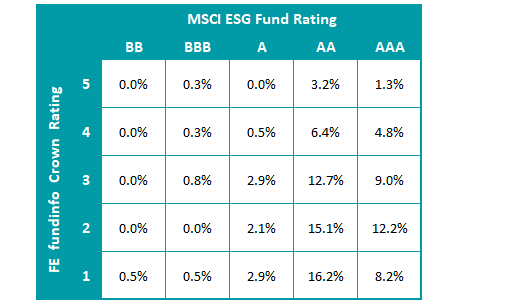

Our research found, of the 2,205 funds in the Investment Association universe that have both a FE fundinfo Crown Rating and a MSCI ESG Fund Rating, just 46 – or 2.1% – have been awarded five crowns for their performance and AAA from MSCI on their ESG stance.

As part of this series, Trustnet now turns to individual sectors to identify the funds with top performance and ESG ratings, starting with global equities.

The headline point is that of the 379 qualifying funds in the IA Global and IA Global Equity Income sectors, only five – or 1.3% – come out on top under both ratings methodologies.

Distribution of global equity funds by FE fundinfo Crown Rating and MSCI ESG Fund Rating

Source: MSCI, FE fundinfo

These five funds are Wellington Global Stewards, Dodge & Cox Global Stock, JPM Global Equity Income, Liontrust Global Focus and iShares MSCI World UCITS ETF.

We’ve ordered them above according to MSCI’s underlying Fund ESG Quality Scores, on which the letter rating is based, and only Wellington Global Stewards comes out with a perfect score of 10.

The £211m fund is managed by Mark Mandel and Yolanda Courtines, who look for companies that can generate a high return on capital while displaying “exemplary stewardship”. They define stewardship as “how companies balance the interests of all stakeholders (customers, employees, communities and the supply chain) in the pursuit of profits and how they incorporate material ESG risks and opportunities in their corporate strategy”.

Performance of Wellington Global Stewards vs sector and index over 3yrs

Source: FE Analytics

As the chart above shows, Wellington Global Stewards has outperformed its average IA Global peer and the MSCI AC World index over the past three years, but the highest return comes from the only IA Global Equity Income fund to make the shortlist: JPM Global Equity Income, which has made its peer group’s highest return - 42.2% - over the same period.

Managed by Helge Skibeli and Sam Witherow, this £393m fund does not have an outright ESG mandate although JP Morgan Asset Management does have an investment stewardship policy across its funds. This means that JPM Global Equity Income’s managers consider financially material ESG factors in their investment analysis and investment decisions.

The team-managed Dodge & Cox Global Stock fund also considers financially material ESG factors as part of its investment process. It has made 35.5% over the three years, putting it in the top quartile of the IA Global sector.

Explaining the firm’s ESG approach, Dodge & Cox said: “As value-oriented investors, we invest for the long-term and seek opportunities that have attractive earnings and cash flow prospects not reflected in a security’s current valuation. We may invest in a company with financially material ESG-related risks if we believe the company is making progress on addressing those, or if we conclude that it's still a compelling investment because of other considerations, like an attractive valuation.”

Liontrust Global Focus (known as Majedie Global Focus until earlier this year) is managed by Tom Morris, Tom Record and Hong Yi Chen; it has made a third-quartile total return of 24.2% over the past three years.

At Liontrust, each fund management team takes its own approach to integrating ESG factors into the investment process but the global fundamental team that Liontrust Global Focus is part of says it “pays particular attention to ESG risks and opportunities”.

The final fund on the list of iShares MSCI World UCITS ETF, which has a FE fundinfo Passive Rating of five crowns (this is slightly different to a standard crown rating, as trackers do not generate alpha). The fact that the MSCI World is only companies in developed markets explains the high ESG rating, as they tend to score much better than firms in emerging markets.