Nick Train has attributed the improved performance of his Finsbury Growth & Income Trust in the third quarter of 2022 to a growing realisation among investors of the importance of owning quality businesses in the current challenging environment.

Back in May, Train apologised to shareholders for the disappointing performance of the trust, which suffered from the switch in market leadership from growth to value stocks, particularly commodities and energy.

As recently as July, he said, “I rub my eyes in disbelief at the prices of our worst-performing shares”, considering the health of the underlying businesses.

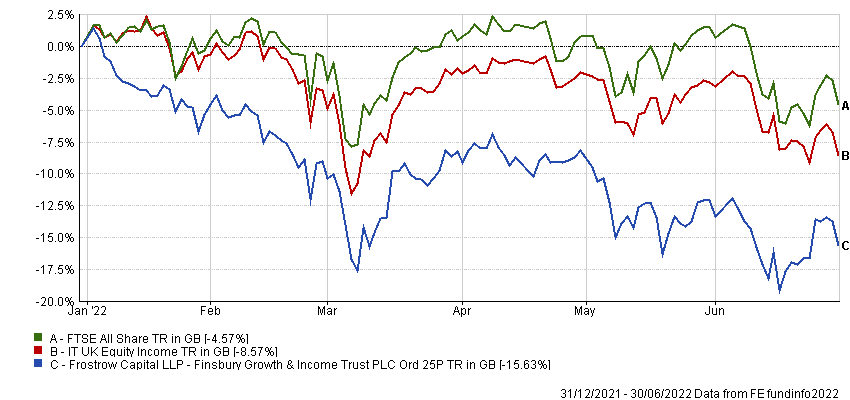

Finsbury Growth & Income Trust fell 15.6% in the first six months of the year, compared with losses of just 4.6% from its FTSE All Share benchmark and 8.6% from its IT UK Equity Income sector.

Performance of trust vs sector and index in H1

Source: FE Analytics

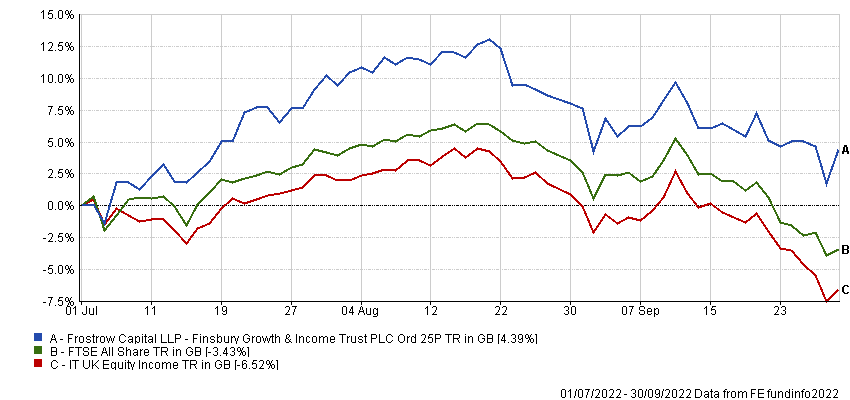

In the next three months, however, the trust made 4.4% while its benchmark and sector fell 3.4% and 6.5%, respectively.

Performance of trust vs sector and index in Q3

Source: FE Analytics

Train took this upturn as a vindication of his strategy.

“While there are some stock-specific factors that help explain this improvement, we believe it is more helpful to analyse it as a shift in investor preference,” he commented.

“A shift back to the sort of industries and companies that have always formed the backbone of all our UK portfolios.”

The manager noted that confidence in the sustainability of high valuations for young technology companies continued to wane over this time – reflected in a fall of more than 30% in the Nasdaq index this year.

While he holds some technology companies in his portfolio – such as Experian, Hargreaves Lansdown, London Stock Exchange, RELX and Sage – he said these are very different businesses to the “latest generation of Nasdaq darlings” and started the year at much lower valuations, which is why their share prices have held up better.

Performance of index in 2022 ($)

Source: FE Analytics

“Meanwhile, the growing macro-economic disturbance afflicting many nations has also weakened investors’ confidence in the earnings power of cyclical businesses,” Train added.

“As a result, investors have turned for their equity exposure to the shares of durable, conservatively financed and steadily compounding companies on the expectation their business operations are likely to be less adversely affected than the average. We own a lot of this type of company – deliberately so.”

He said a review of the best-performing portfolio constituents in the third quarter of 2022 endorsed this analysis, with notable positive contributions from Diageo, Hargreaves Lansdown, Experian and Sage.

The manager said all of these have well-merited reputations for predictable cashflows, generated from brands or business franchises that their customers are likely to continue patronising in all but the most adverse economic circumstances.

Meanwhile, there were also share price gains in September for two major portfolio holdings that announced changes in senior management – Burberry and Unilever.

“No doubt those management changes have alerted investors to the possibility of a change in business strategy (or even, perhaps, in ownership) and their share prices have risen accordingly,” he continued.

“Certainly, we analyse the strategic value of Burberry and Unilever to be meaningfully higher than the value currently accorded to either in the stock market.”

While Train has been encouraged by the recent uptick in relative performance, he said he doesn’t just hold “durable, conservatively financed and steadily compounding companies” because they outperform during difficult conditions, but because they do so over entire economic cycles.

For example, he admitted there are times when Diageo’s ambition to increase its annual sales at a steady 6 to 7% per annum looks uninteresting, as investors believe they can get faster growth elsewhere.

Yet over the long term, he said the “remorseless reliability” of Diageo’s growth should allow it to surpass that of others that may have “hared ahead” over shorter periods.

“In summary – while it is easy to categorise our investment approach as purely ‘defensive’, we do not see it as such,” Train added.

“Instead, it is our hope that by holding concentrated positions in such exceptional and predictable companies as those mentioned above and others – AG Barr, Fever-Tree, Heineken, Mondelez, Rathbones, Remy Cointreau and Schroders – we can not only protect our clients’ capital in difficult times, but also generate competitive absolute returns over all longer time periods.”