Terry Smith’s Fundsmith Equity is a popular choice for UK investors seeking to gain global exposure through a growth-focused portfolio, with its £22.2bn of assets under management making it one of the largest open-ended funds in the Investment Association universe.

The fund remains a good option for investors, although it failed to beat the MSCI World index for the first time in its history last year. It made 22.1% versus the index’s 22.9%.

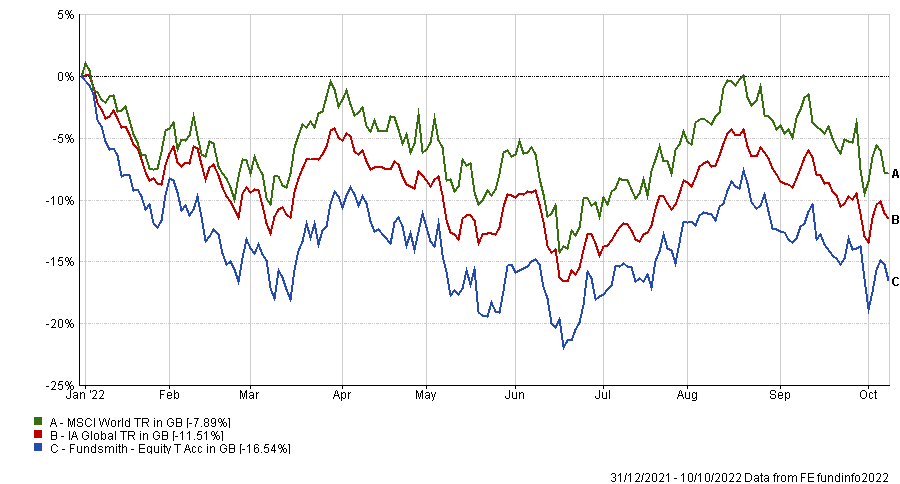

This year the performance has been much more dramatic, with the fund down 15.2% while the index is down 7.8%. It is also the first year that the fund is in danger of failing to beat its average peer, with the IA Global sector down 11.5%.

Total return of fund vs sector and index in 2022

Source: FE Analytics

As such, now may be a good time to consider diversifying a portfolio to hedge bets in case the fund’s style is set for a bout of underperformance.

When considering other global options for their strategies, investors should be aware of which funds have moved in parallel to Fundsmith Equity to avoid increasing their exposure to the same type of risks.

As described by Nick Wood, head of fund research at Quilter Cheviot, Fundsmith has “a low turnover, quality-growth approach.”

This particular strategy means that the fund has underperformed its IA Global sector in the short term, having suffered from the market disaffection with the growth style, but it has achieved substantial returns over 10 and five years.

“There are plenty of other managers that sit in that space – albeit all doing something slightly different and coming to slightly different outcomes,” said Wood.

All such funds are likely to have a high correlation to Fundsmith Equity.

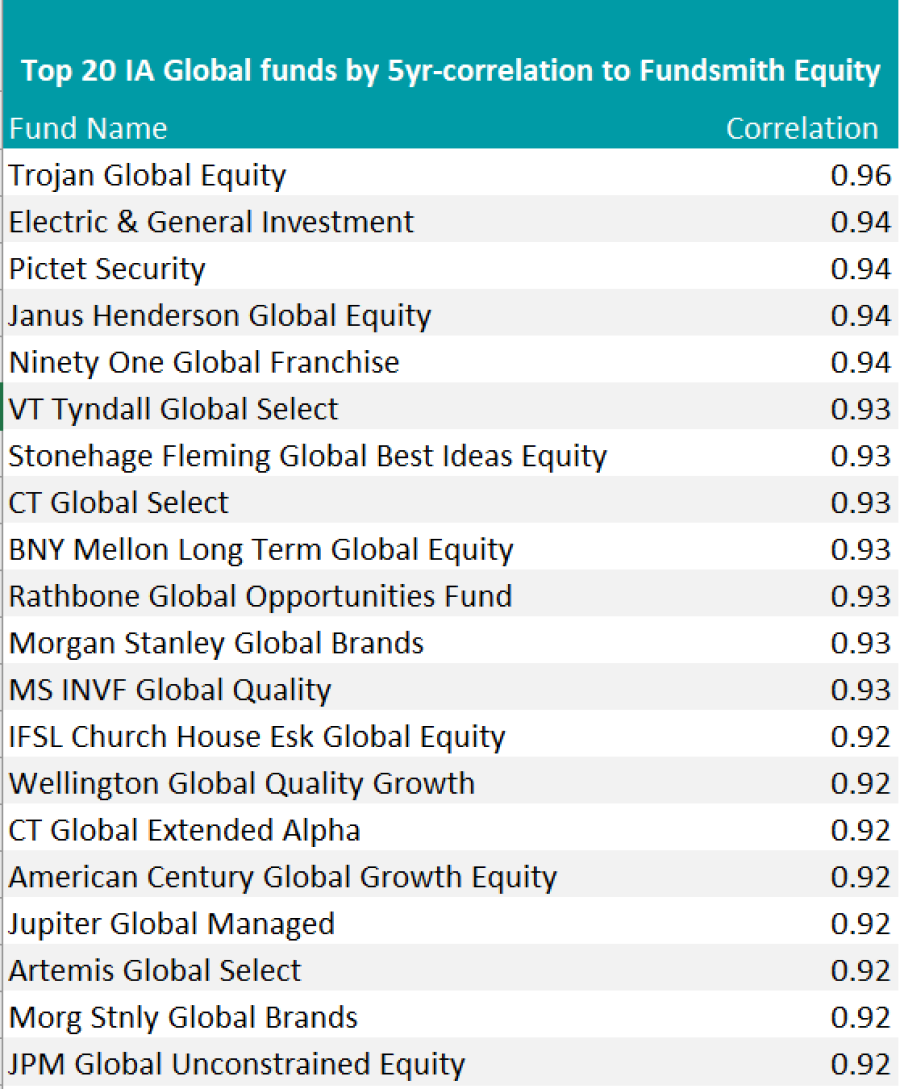

At 96%, the highest correlation is with the £400m Trojan Global Equity fund, followed in second position by the £95m Carvetian Electric & General Investment fund, with which Fundsmith shares similar allocations to the telecom, media, technology and healthcare sectors.

More funds of smaller size also take up several positions at the top of the table, including Janus Henderson Global Equity, Ninety One Global Franchise, VT Tyndall Global Select and CT Global Select.

US-focused $6bn Pictet Security came third, accompanied by other sizable funds such as Stonehage Fleming Global Best Ideas Equity, BNY Mellon Long Term Global Equity and Rathbone Global Opportunities.

As Wood anticipated, several growth-biased funds were positioned in the top half of the table, including some sustainable options such as Sarasin Responsible Global Equity and Fidelity Sustainable Consumer Brands (89%), Janus Henderson Global Sustainable Equity and Aberdeen Standard Global Sustainable Equity (88%).

Any global smaller company strategies that happen to be in the IA Global sector also showed between 85% and 75% correlation to Fundsmith, with abrdn’s and Invesco’s being the first and last in the range. Consumer discretionary specialists were also in this bracket.

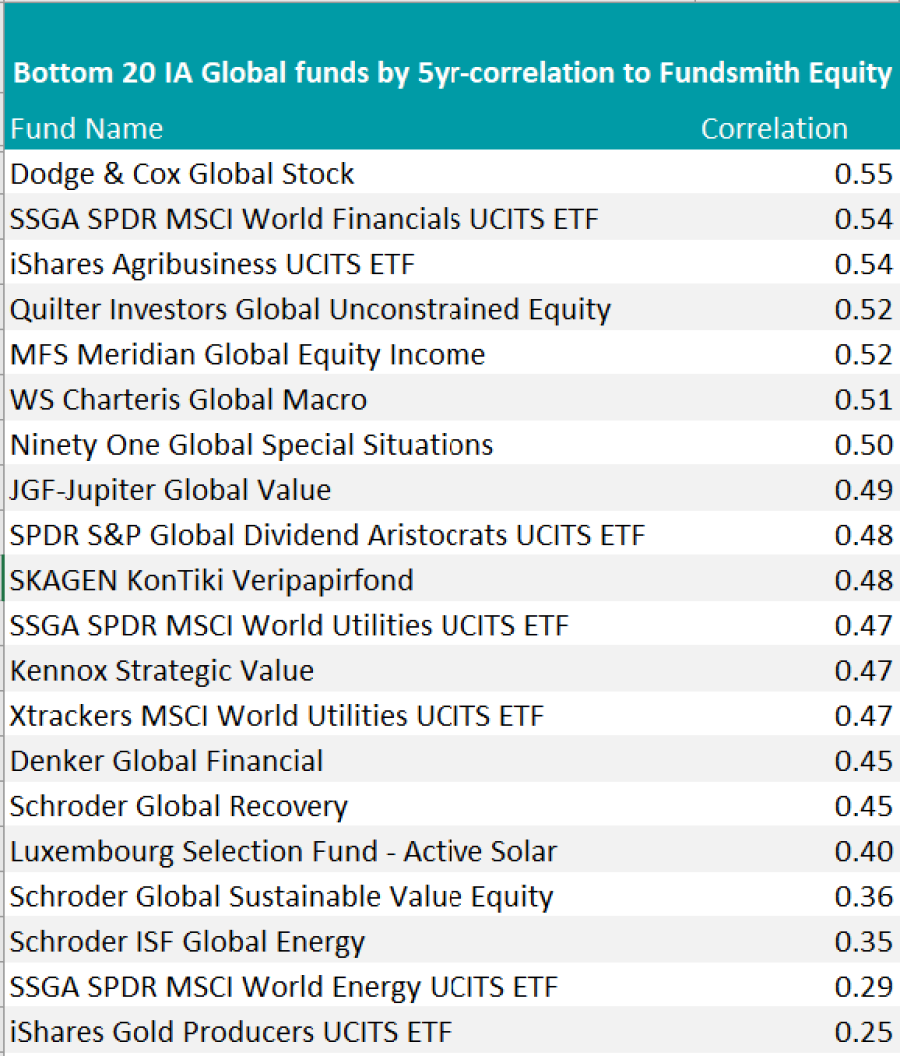

Financial services and other sectoral approaches displayed modest levels of correlation to Fundsmith Equity, with solutions such as Denker Global Financial (45%), iShares Agribusiness UCITS ETF (54%), SSGA SPDR MSCI World Financials ETF (54%) as the main examples.

At the foot of the list were two exchange traded funds (ETFs), SSGA SPDR MSCI World Energy (29%) and iShares Gold Producers (25%).

Energy funds proliferated here as well, with Schroder ISF Global Energy (35%) and Luxembourg Selection fund Active Solar (40%) being but two examples.

Value funds in general were mostly relegated to the mid and bottom half of the table. With an average correlation of 58%, the most and least correlated were MI Metropolis Value (72%) and Schroder Global Sustainable Value Equity (36%).