While portfolios across many sectors have suffered outflows this year as investors get cold feet, the Baillie Gifford Responsible Global Equity Income fund received £446m in new capital over the past six months.

With income-paying funds looking increasingly attractive in this high inflationary environment, investors may be asking themselves what else can be held alongside the fund to boost their portfolios performance.

It has proven more popular in this time than the non-environmental, social and governance (ESG) version Baillie Gifford Global Income Growth.

Both portfolios have the same management team, consisting of James Dow, Toby Ross and Ross Mathison, but the sustainable version has been the better performer, beating its stablemate by 4.2 percentage points since launching at the end of 2018.

Returns were up 64.6% over the period, also beating the IA Global Equity Income average by 27.9 percentage points, but Louis Tambe, senior investment analyst at City Asset Management, said that investor’s preference for it over the sister fund is largely due to its ESG mandate.

Total return of fund vs sector since launch

Source: FE Analytics

He said: “A reason for the responsible fund receiving more inflows recently is likely the continuation of the increasing number of investors requiring a greater focus on ESG criteria from fund managers, despite some negative headlines this year.”

That being said, both funds contain the same nine assets within their top 10 holdings, just with slightly different allocations, so investors could expect a similar performance from both.

Here, Trustnet asks industry experts what funds will compliment Baillie Gifford Responsible Global Equity Income and, by association, the Baillie Gifford Global Income Growth portfolio.

A good diversifier could be the Dodge & Cox Global Stock fund as its value approach offers a distinct alternative to Baillie Gifford’s growth-dominant strategy.

Although value was out of favour for much of the past decade, the fund still managed to beat its peers in the IA Global sector by 52.3 percentage points, generating a total return of 224.7%.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

Likewise, the fund is up 7.3% so far in 2022, while the rest of the sector is down 8% on average, as volatile markets have sent growth funds crashing down.

Tambe added that it “has generated strong risk-adjusted returns but with a different style of investing, therefore increasing diversification of your portfolio without sacrificing returns”.

Alternatively, the Artemis Positive Future may be a good partner alongside the Baillie Gifford funds, according to Juliet Schooling Latter, research director at Chelsea Asset Management, although its ESG angle makes it a strong option for those that want to do good with their cash.

The relatively young fund, which was launched in April last year, is down 28.5% since inception, but its bias to mid-caps means there is little overlap in holdings.

Schooling Latter added: “The sustainable approach provides a further tilt to non-cyclical growth companies as it favours those that are tied into the long-term beneficiaries of changing consumer attitudes.”

Tom Sparke, investment manager at GDIM, said that another good pairing for ethical investors could be with another fund from the same firm, Baillie Gifford Positive Change.

The £2.6bn portfolio managed by FE fundinfo Alpha managers, Kate Fox and Lee Qian, was launched almost two years before the Responsible Global Equity Income portfolio and its total return of 201.1% is more than three times higher than the IA Global sector average.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

Although they’re both ESG funds from the same asset manager, they only have one stock in common and their investment strategies differ significantly, according to Sparke.

He said: “It has a strong focus on tangible ESG-positive outcomes and compliments its stablemate very well, exhibiting relatively high volatility and a growth-heavy portfolio of stocks.”

Sparke added that Positive Change fund contains a well-diversified portfolio of strong assets and can be held as a core holding within investors’ portfolios.

Tertius Bonnin, assistant manager at EQ Investors, said that he does not hold Baillie Gifford Responsible Global Equity Income and would instead suggest investors look at the Trojan Ethical Global Income fund, rather than backing the Baillie Gifford fund in the first place.

The portfolio was launched in January last year as an ESG alternative to the Trojan Global Income fund, which lead manager, James Harries, has led since 2016.

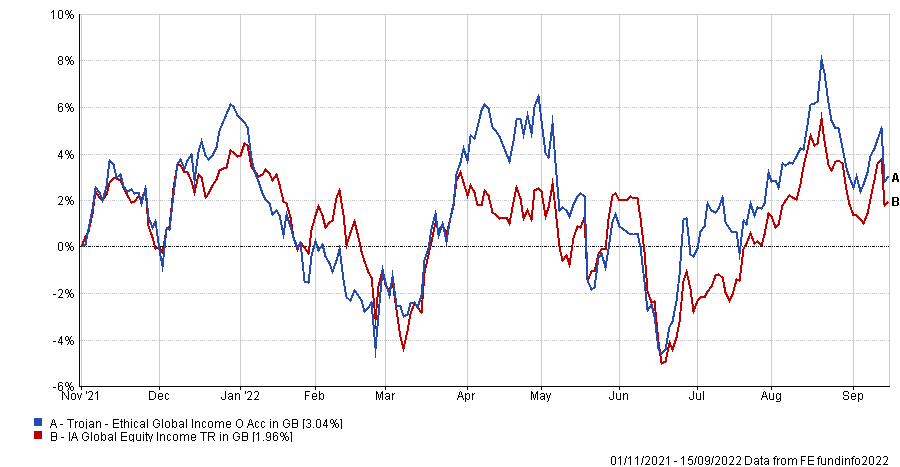

Despite being a fairly new fund, it has outperformed the IA Global Equity Income sector since launch with a total return of 3%.

Total return of fund vs sector since launch

Source: FE Analytics

Bonnin said that he likes Harries’ tried and tested model, which helped lead the Trojan Global Income fund to the top quartile over the past five years.

He said: “The fund gives exposure to a global portfolio of high-quality companies which must stand up to scrutiny following a rigid analysis of financially material ESG factors, and a decomposition of revenue involvement to ensure revenues are long-term.”