Latin America is widely perceived as a risky bet, with many investors preferring a broader allocation to emerging markets. However, some experts argue it still deserves some consideration, before being completely written off.

Starting off on a positive note, one might be enticed by the region’s current performance: over one year, the IA Latin America sector outperformed the wider Global Emerging Market sector by 22 percentage points, as the graph below illustrates.

Performance of IA sectors over 1yr

Source: FE Analytics

This outstanding performance can be justified by the rise of commodities this year, an explanation on which many experts agree, including Charles Stanley investment analyst Rob Morgan.

“Latin American equities have been in something of a sweet spot following a dire previous few years owing to a high level of energy and commodities exposure,” he said.

“Its natural resources giants have been handily placed to reap the rewards of higher prices and to help fill the deficit in various markets left by sanctions on Russia. Prospects going forward similarly depend on the outlook for commodities prices. Economies and companies stand to do well if they remain buoyant.”

But experts were hesitant to highlight any opportunities among the Latin America funds, with the political landscape being a major concern.

Indeed, both Fraser Harker, investment analyst at Seven Investment Management (7IM), and Ben Conway, head of fund management at Hawksmoor Fund Managers, said they did not recommend any portfolio in the sector.

The upcoming election in Brazil, by far the largest of the economies and thereby exposures in funds, does not help things and could be an additional source of volatility for the already risky peer group.

“Whoever is in power will need to grapple with a tricky domestic environment of high inflation and low growth. Shares are cheap, but there are abundant reasons for that,” said Morgan.

But John Malloy, Redwheel’s emerging markets portfolio manager, saw plenty of opportunities in the region, mostly based on strong commodity prices, improving current accounts, competitive currencies and attractive equity valuations – all of which should be positives for Latin American equities.

“Latin America is poised to continue to outpace most markets in the next five years, especially as the outlook for large banks in Brazil remain attractive due to a combination of higher interest rates and strong loan growth,” he said.

In healthcare, he expects an ageing population to put significant strain on public health systems, paving the way for disruptors in private healthcare through new technologies such as telemedicine, care co-ordination and digital platforms – which are becoming important tools to improve service quality and control medical inflation.

Of course, there are tailwinds for commodities too. With electric vehicles being the main driver of lithium demand, he believes Latin America will benefit from the large demand and lagging supply, leading to deficits as it’s expected to grow 20% to 25% annually in the medium term.

“Many company fundamentals are robust and we believe that now offers a good entry point for the asset class,” he concluded.

Ben Yearsley, director at Fairview Investing Limited, provided an additional reason why one might want to buy into the region.

“As emerging market funds are turning more focused on Asia, if you want diversified emerging exposure you need to add more specialist funds,” he said.

In such case, his recommendation would be a Brazil fund to add to a more general emerging markets fund. His choice was either JPM Brazil or BNY Mellon Brazil, whose performance is outlined below.

Performance of funds against sector over 1 yr

Source: FE Analytics

“You might get a small crossover with a broad emerging market fund but never that much. For broad exposure I would look at Fidelity Emerging Markets, which would pair well.”

If using this strategy, Charles Stanley’s Morgan also warned about unwittingly ‘doubling up’ on commodities exposure, with one needing to bear in mind that with two-thirds of the market cap in materials or financial stocks, a dedicated Latin American fund may behave quite similarly to a natural resources fund in the short term.

However, for those wanting to allocate specifically to the region, he recommended iShares MSCI EM Latin America UCITS ETF as one option.

“I don’t currently have a preference on an active fund for dedicated exposure,” he said.

However, it is worth noting that Lazard Emerging Markets has an 18% allocated to the region and would make sense for investors that want higher-than-average exposure to the region, but want to leave that choice up to an emerging market fund manager.

“It is a broad emerging markets fund worth considering for its highly disciplined, quality value approach applied by an experienced and long serving team, albeit it does tend to struggle when market sentiment prioritises more expensive, fast-growing businesses,” he said.

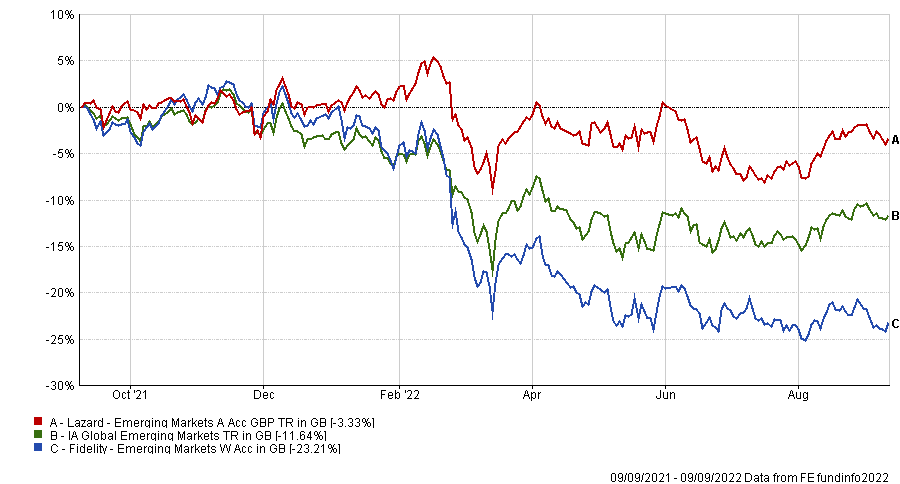

Performance of funds against sector over 1 yr

Source: FE Analytics

Finally, Jason Hollands, managing director at Evelyn Partners, highlighted BlackRock Latin American Investment Trust PLC, but with a caveat: “With attention now increasingly focused on coming recessions, investors should mindful that commodity demand may fade,” he said.