A representative of Monks Investment Trust has admitted its managers should have taken more profits from the rapid growth stocks it shares with Scottish Mortgage after they delivered excessive gains during the pandemic.

Monks invests in three types of companies: quality-growth stocks, which have high margins and a track record of compounding earnings over the long term; cyclical-growth stocks, which are exposed to long-term structural trends, such as the need for lithium batteries, but whose performance will be extremely volatile in the short term; and rapid-growth stocks, which are young, innovative companies that often create their own market, leading to disruption in established industries.

This last group surged in 2020 and early 2021 as the pandemic accelerated many long-term trends and enormous amounts of stimulus favoured momentum-driven stocks.

However, these have fallen back to earth with a bump in 2022, and this is what Jon Henry, client service director at Monks, blamed for the poor performance of the trust over the past year.

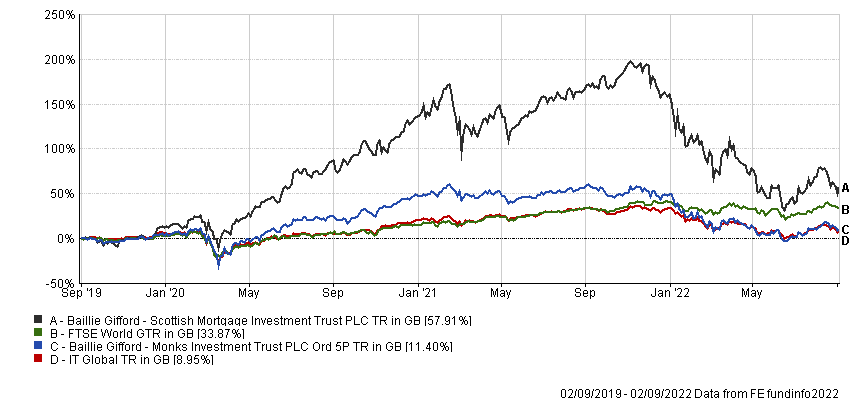

Performance of trusts vs sector and index over 3yrs

Source: FE Analytics

“We recognise we were too slow to sell down and reduce our holdings,” he said. “We clearly should have been much more aggressive in rebalancing the portfolio between growth types. Although we were selling the rapid growers, they rose so quickly that they became more than 50% of the portfolio.

“But what went up came down even quicker. In hindsight, we should have risked being more interventionist and interrupting the compounding, given the extreme nature of some of the moves in equity markets.”

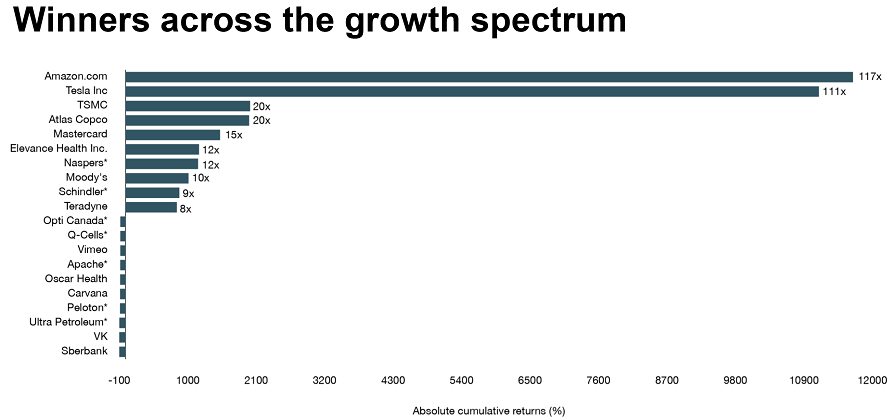

Taking profits is frowned upon by many fund managers at Baillie Gifford, due to their belief that the biggest risk is not investing in companies that could go bust, but in missing out on those that can return many times your original outlay.

As a result, most of them tend to ignore short-term swings in valuations, saying volatility is the price to pay for accessing long-term winners.

The managers at Monks are no strangers to this argument, with Henry pointing out the trust’s best performing stocks over the years have also been among the most volatile. For example, Amazon has returned 117 times the original investment, made in 2008, yet the company’s share price has fallen by more than 20% in 13 of the 14 calendar years that the trust has owned it.

Source: Baillie Gifford

However, while Henry said 2008 was also the last time that growth companies were punished on the scale seen in the market today, this doesn’t necessarily mean now is a good time to buy.

“From a valuation perspective, things are looking a lot more attractive than they were three years ago, but the sense we have on the investment desk is that we wouldn't be surprised to see further weakness in valuations,” he continued.

“What we're not doing is piling into stocks just because the share prices have fallen a long way and things are cheaper than they were.”

With further falls likely – and the environment of rising inflation and interest rates set to make life even more difficult for growth investors – why would you want to invest in a trust such as Monks at this point?

Henry said that the indiscriminate falls in the market have allowed managers Malcolm MacColl and Spencer Adair to pick up outstanding companies they have long admired, but previously felt were too expensive – Adobe being one example.

To merit investment, the managers must believe there is at least a 30% likelihood these stocks will more than double in value over five years.

“Today's valuations are an easier starting points for that hurdle,” said Henry.

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

However, there is a more fundamental reason. While the start of a monetary tightening cycle has led many investors to ditch growth stocks in favour of “short-term certainties”, Henry said that the best tactic for making money over the long term lies not in trying to second-guess the Federal Reserve, but in identifying and positioning yourself on the right side of structural change.

“Innovation and change are speeding up and spreading,” he continued. “Technological progress tips a range of industries out of the previous equilibrium. Entertainment and advertising were disrupted first in the late 1990s and early 2000s, and several trillion-dollar companies were created off the back of that.

“But that was really only the starter: we're very much now on to the main course.”

He added: “As we stand today post the sharp falls in equity markets, we are increasingly optimistic about the opportunities on offer to ambitious growth investors.”