Investing in emerging markets has been a patience game for many investors, one that may not even yet be worth it.

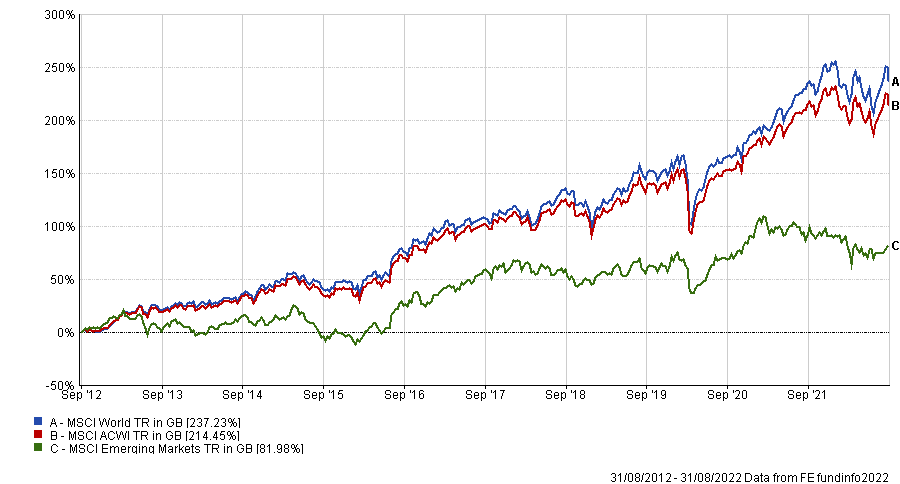

Indeed, over the past decade, the MSCI World index (which excludes emerging markets) has beaten the MSCI ACWI index (which includes them) by more than 22 percentage points.

The difference is even starker when comparing with emerging markets solely, with the MSCI Emerging Markets index making almost a third the returns of the global developed market benchmark.

Performance of indices over 10yrs

Source: FE Analytics

However, with inflation running rampant across the developed world, analysts are predicting that most major economies will fall into recession.

Emerging markets, which have not enjoyed the success of their developed counterparts, could therefore come into their own.

If this is the case, one fund worth considering is the Redwheel Global Emerging Markets fund, which has made 132.9% since it launched in 2015.

Below, manager John Malloy explains how his fund has achieved success, why he is confident about copper and how the stars are aligning for emerging markets.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

What is your process for managing the fund?

We take a macroeconomic, top-down approach, combined with a thematic growth approach to come up with high-conviction stock ideas.

Our process it to invest in growth but at a reasonable price and I think everybody is realising now that growth can be overvalued, so that it is important to us.

Emerging markets offer great opportunities and we want to find well-run businesses where we understand the management strategy but are not paying too much for it.

Why should investors pick your fund?

We are active managers and have been investing in emerging markets for a long time, so have a diverse and experienced team behind us.

The strategy is approaching its 10-year anniversary and it has outperformed over that period from anywhere between 3% and 4% annualised overall.

The process is well defined and has been proven over that decade. We have incorporated a strong ESG [environmental, social and governance] process into that as well, which has resulted in good stock picking.

Why is now the time to switch from developed markets?

Emerging markets go through cycles like all other markets. We are currently going through the end of a growth cycle in developed markets, which was a period when emerging markets suffered.

EM stocks have done well historically when commodities are strong, which we saw in the early 1990s and 2000s. Looking at Latin America, for example, around 50% of the exports are commodity related, making it one big commodity play.

What has happened is, because commodities were weak and growth was focused on technology, emerging markets were out of favour.

We have gone through periods where we have not been bullish on emerging markets in 2012-14 but we think now the stars are somewhat aligning.

The growth differential is starting to improve and emerging market growth will likely be higher than the developed markets. In the next few weeks we will see that the US is in a recession, so there is very little growth.

What have been your best and worst stocks this year?

One of the best stocks we’ve had year-to-date is Sociedad Quimica y Minera. It is a Chilean lithium company – the largest in the world – and is up 64% this year.

In terms of the largest losers, that would be in Brazil. It is a company called Hapvida, which is down 37% year-to-date. That is a hospital operator and it also provides insurance. That has had problems around Covid and also because of a merger integration.

Is there an area you are most excited about?

We are very excited about copper. As a commodity the price has come down this year, but 40% of the world’s copper comes from places like Chile and Peru. We own two companies: First Quantum Minerals in Panama and Zambia and Ivanhoe Mining in the Democratic Republic of Congo.

We think both have tremendous upside and long-term growth potential and fit into the climate change theme that we think will continue for many years.

It is not just a play on the copper price, which does not have to go up from here for these companies to make money. We think they are good growth prospects because of their assets. They have very good mines.

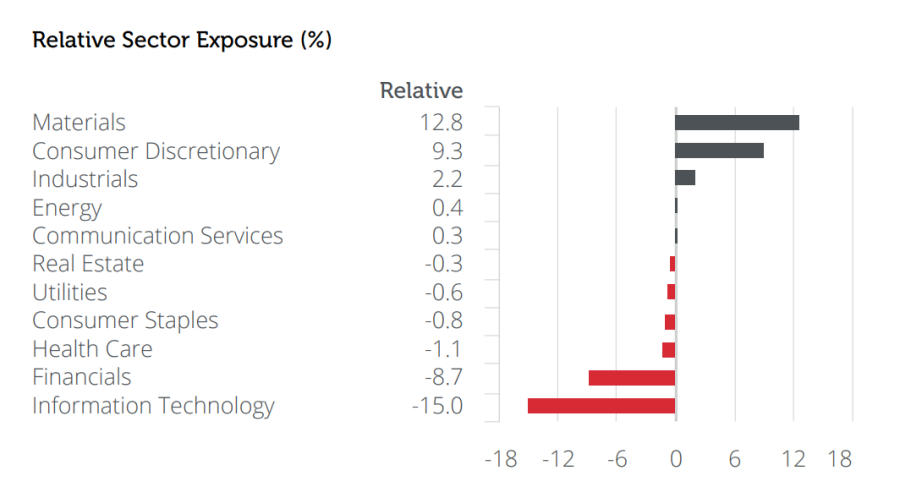

We have had an overweight to materials and industrials for some time and it is an area we have been able to add alpha in over 10 years. It is a growth area that is often overlooked, but given the changes we are seeing in terms of climate action, we think it will end up coming into focus even among core growth managers.

Fund allocations

Source: Redwheel

You are also overweight China. Is that recent?

We were underweight China last year by about 9 percentage points. We moved to an overweight earlier this year, perhaps too early, but that has started to work in the past few weeks.

China we think offers a good opportunity. The economy is starting to recover and the stocks are discounting a lot of the bad news, so we have a positive outlook on the country.

How do you incorporate ESG into the fund?

We incorporated ESG into the strategy when we started 10 years ago and that wasn’t the topic of the day back then. It is part of core due diligence and have our own scoring system. We think it is an alpha driver in emerging markets, which has helped us to identify strong companies.

What do you get up to outside of fund management?

I spend a lot of my day looking at stocks as I am 24/7 on markets as ours never stop. On the side I enjoy fishing as I live in south Florida. I have also played guitar since I was 10 years old.