UK assets flopped in August while emerging market specialists thrived as the typically quiet month had more talking points than usual.

The big topics for the month were inflation and rate hikes. The latest 0.5% hike by the Bank of England, which took the rate up to 1.75%, was the biggest increase since 1995, and the European and the US central banks are also expected to continue on a more hawkish path, in their attempt to tame inflation.

Meanwhile, inflation hit 10.1% in the UK and was at similar levels in the rest of the Western world. With no improvements on the horizon – quite the opposite, as the energy crisis will see no respite in October, when the new, high price cap will set in – UK experts forecast prices will go up anywhere between 18% (according to Citibank) and 22% (Goldman Sachs).

On this backdrop, the fell 1% while the MSCI World index remained broadly flat for the month, a rare month in which the domestic market has failed to beat the global peer group in 2022.

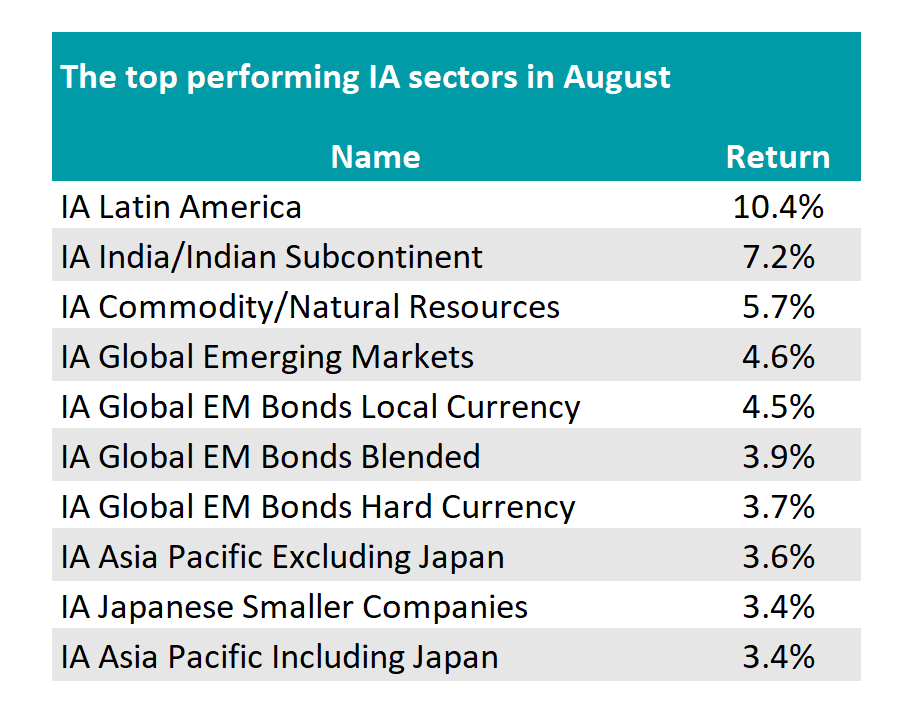

As a result, the IA UK Equity Income, IA UK All Companies and IA UK Smaller Companies sectors were among the worst 10 sectors of the month, with performances ranging between -2.6% and -6%.

However, the worst performing sector was IA UK gilts, with an average return of -6.6%. The asset class particularly suffered from the expectations for ongoing double-digit inflation, according to Ben Yearsley, director at Fairview Investing.

Source: FE Analytics

“August was the worst month for benchmark 10-year gilts for more than 35 years with the yield rising from 1.84% at the end of July to finish the month at 2.8% with reduced confidence over the economic stability meaning investors demanded a higher return for holding UK debt,” he said.

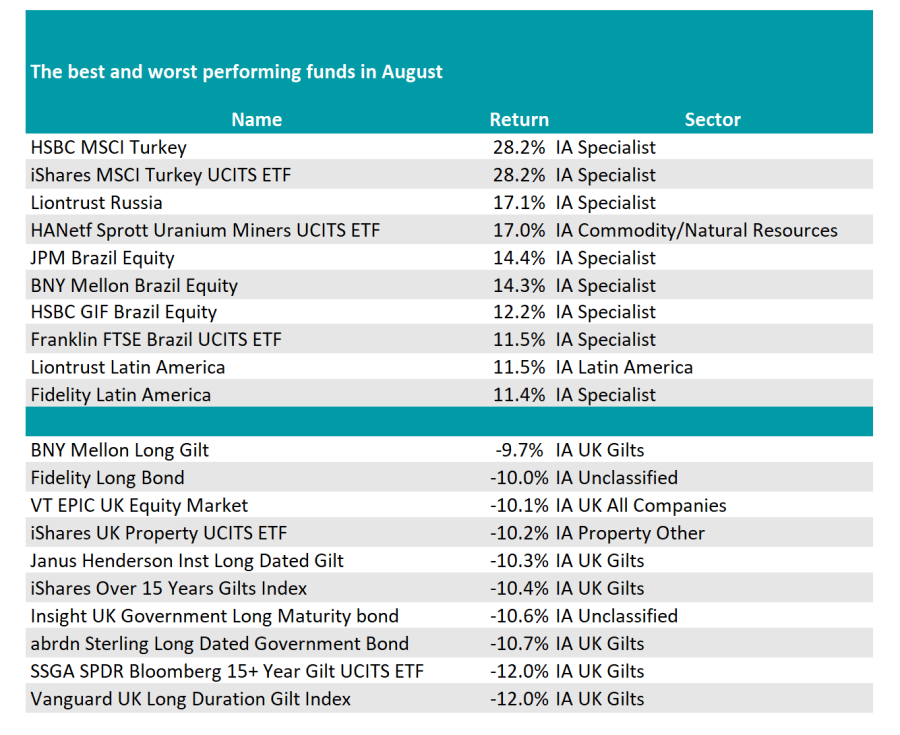

Accordingly, of the bottom 10 funds for average returns in August, eight were government bond strategies, whose returns were in the negative range of 12% to 10%.

The only two equity funds in the same bracket were the iShares UK Property exchange traded fund and VT EPIC UK Equity Market.

Moving on to the top of the list, emerging markets were the “bright spot among the doom and gloom”, according to Yearsley.

“It looks as if emerging markets are weathering the storm much better than developed markets. That’s without China coming to the party either; yes, China has been stimulating the economy recently, but giving up on the zero-Covid policy will be far more important to markets (and sentiment) in the long run,” he said.

In fact China, with its 2.2% average return, fared much better than the -7.7% of the past month, but still could not make it to the top 10, which was dominated by Latin America, up 10.3%, and India, which gained 7.2%.

Yearsley said: “It was emerging markets that led the charge in August as developed markets faltered. Latin America, despite a strongly rising dollar elsewhere was flat against the Brazilian Real. Partially driving the rise of LatAm was commodities that returned to favour in August.”

Source: FE Analytics

Looking at specific funds, the best performing emerging market was Turkey, with HSBC MSCI Turkey and iShares MSCI Turkey returning 28.2% in August.

Brazil was the second-best market, occupying four positions in the top 10.

Third on the list was Liontrust Russia. The fund has had a torrid year after the country's invasion of Ukraine, with the market shut down to Western investors. Last month it was among the worst performers, but over the summer this corrected somewhat, with the portfolio up 17%.

Commodities also deserves a mention with the HANetf Sprott Uranium Miners ETF gaining 17%.

Source: FE Analytics

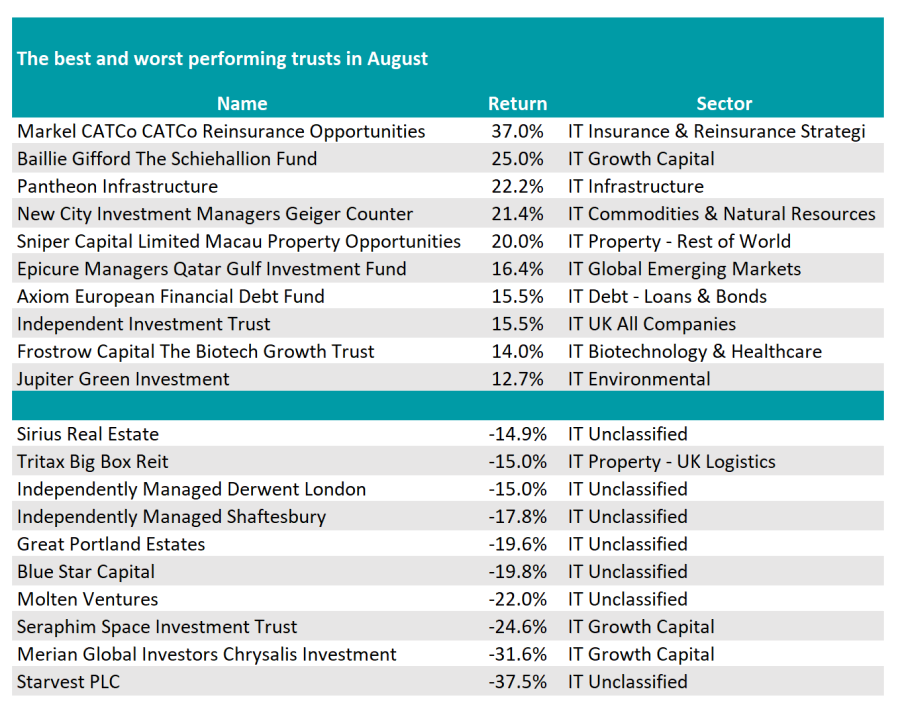

Looking at the investment trust sectors, it is similar, but slightly different. India and the Global Emerging Markets sectors both featured in the top five best performers, but the Property Rest of World sector took the plaudits with a gain of 8.9%. Infrastructure Securities were also in the mix with an average uptick of 6.1%, driven by inflation expectations, with Asia Pacific Smaller Companies and Global Emerging Markets just behind.

At the foot of the table were European Smaller Companies, Growth Capital and Property Securities.

The best trusts of the month were Catco Reinsurance Opportunities, which had another excellent month gaining over 36% to take top spot, and Baillie Gifford’s Schiehallion private equity vehicle second.

The growth portfolios of Merian Chrysalis Investment and the Seraphim Space Investment Trust were among the biggest losers, with losses of 31.6% and 24.6% respectively.