Economic activity is essentially the combination of human endeavour with raw materials, such as energy and minerals. Productivity is, at its most basic, the amount of energy someone is able to convert into goods and services. This is why energy is so fundamental to economics and politics and why wars are regularly fought over access to resources, especially energy.

European politicians, the UK included, had a dream that they could replace fossil fuels and nuclear energy with cheap renewables, given the help of subsidies. At the same time, politicians also put huge barriers to new investment in traditional energy resources. On top of this, the ESG movement in investment accelerated these moves, giving companies a cost of capital advantage if they reduced investment in traditional energy.

While we are believers in the energy transition in the long term, the market distortions caused by these interventions are now being felt. At the margin, Europe (including the UK) is now extremely dependent on imported gas, especially at times when renewables are not producing. Even before the Ukraine situation, Europe had difficulties with gas supplies in winter. Now an unwillingness to buy Russian gas has led Russia to divert its gas supplies into China and India, whose demand and payment is more consistent.

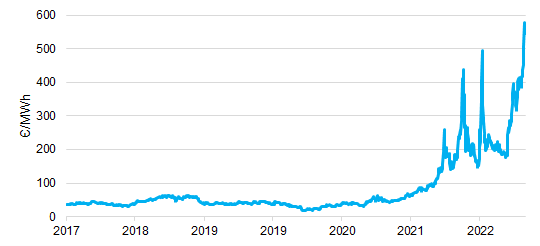

Even in the traditionally low demand summer months, energy prices in Europe have continued to shoot higher. We show German 1-month forward electricity prices below and it is clear that prices were already on a dramatic upward trend well before the Ukraine situation.

German 1-month forward electricity prices

Source: Bloomberg, 25 Aug 2017 to 24 Aug 2022

Obviously, predicting what happens this winter is difficult, but the impact on European competitiveness and hence, European consumer incomes is already painful.

Europe has for many years been a competitive exporter and its citizens have enjoyed high standards of living as a consequence. Importing cheap Russian energy and adding value using European knowhow was the bedrock of this economy. Those exports fuelled high standards of living in Europe and paid for imports of raw materials and consumer goods.

If we ignore the unlikely scenario of a peaceful resolution in Ukraine, and Russia resuming its preference to export to Europe, then the solutions to this crisis can only be very long term. Replacing Russian gas supplies is a very long-term project and certain sacred cows will need to be sacrificed. Building nuclear plants takes five years at least, as do liquid natural gas facilities. Until electricity storage is solved, renewables are not a viable major energy source and indeed their manufacture requires large amounts of imported steel, metallurgical coal and minerals from Russia, China and elsewhere. Even reinitiating fossil fuel exploration will take years not months.

Europe has a deep wound, and it may take years to mend. At this point, policymakers don’t seem to even be willing to properly address the situation, with German politicians recommending cold showers and Spanish ones demanding aircon be run only at uncomfortably high temperatures. These ‘sticking plaster’ recommendations suggest the reality of the situation, that there is no easy solution to a problem that has been years in the making.

Europe, including the UK, is faced with the prospect of massively reduced competitiveness, reduced consumer disposable incomes, and potentially, energy rationing as a consequence of government interventions in the energy markets. Yet the solutions proposed are apparently going to be further government meddling in the energy markets.

This feels like a dangerous place to have any major positions in companies exposed to these forces, hence, by historical standards, we have relatively low exposure to the euro, the UK and European domestic economies and European exporters. Winter is coming and it is likely going to be cold and dark.

David Jane is a multi-asset manager at Premier Miton Investors. The views expressed above should not be taken as investment advice.