It is still possible for investors to make money from the biotech sector in an environment of tightening monetary policy – so long as they avoid the more speculative areas of the market in favour of companies that are already generating revenue with a clear path to profitability.

This is according to Peter Wen, US small- and mid-cap healthcare analyst at Schroders.

Investors surged into the biotech sector in the US last year, with more than 100 companies floating on the stock market, raising nearly $15bn ($12.7bn) between them. At the beginning of 2021, the biotechnology subsector comprised 11.4% of the Russell 2000 index, while the healthcare weight stood at 20.5%.

However, the bubble now appears to have burst, with the Nasdaq Biotechnology index down 26.5% in dollar terms since its peak last August. The healthcare sector now makes up just 14% of the Russell 2000 index, driven down by the fall in biotechnology – this now makes up just 6%.

Performance of index (in $) since 2021 peak

Source: FE Analytics

Wen said this crash shouldn’t have come as too much of a surprise.

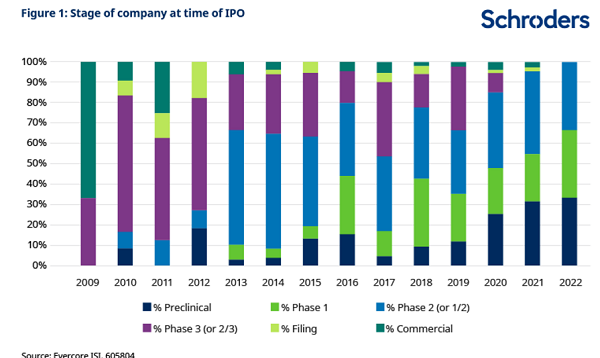

“Biotech companies that were at an unproven preclinical stage or in Phase 1 or 2 of the development of their drug rose from a small fraction of IPOs from 2010 to 2012 to more than 90% of IPOs in 2021, and 100% in 2022,” he explained.

“Companies developing pre-Phase 3 drugs are still highly speculative because they lack much or any human clinical data to demonstrate the probability of their success, but many investors are keen to bet that they will prevail.”

Wen said the mini bubble was fuelled by the growth of ‘crossover funds’. These provide a link between private and public markets by investing in the last fundraising round of a private company before selling those shares to the public markets when it floats.

“These investors thrived during the IPO boom of the early 2010s, specifically starting in 2013, giving biotech start-ups access to larger pools of capital,” the analyst continued.

“However, biotech companies that crossover funds favour are still considered experimental and are far from a commercial stage. The crossover fund movement caused artifice in the market, as many investors found themselves stuck owning public biotech companies that came public too early in their life cycle.

“Such companies fell prey to a vicious and endless requirement of attempting to raise capital in an illiquid market every few quarters, merely to keep afloat.”

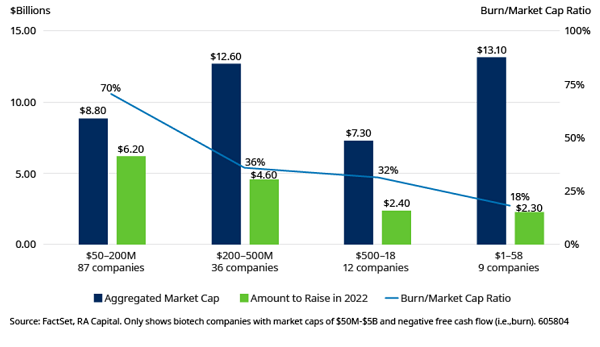

Wen noted that public development-stage companies cumulatively need to raise about $15bn by the end of 2022, just to fund one year of cash burn. If they can’t do this, they must cut their burn rate, which forces them to reduce their R&D efforts, and “impairs their likelihood of successful drug discovery”.

“These early-stage companies are constantly looking for the next investor to fund their burn rate,” Wen added.

He noted that smaller companies now comprise the majority of businesses in the biotech sector.

In an environment of rising inflation and interest rates, where capital is scarce, avoiding the sector completely may sound like the most sensible course of action at this time. However, Wen said it is still possible to eke out decent returns from biotech, so long as you focus on companies that possess validated clinical data – with drugs or treatments that have passed Phase-3 clinical trials at least – and are not “bullish on funding experiments”.

“We focus on companies that offer drug products backed by unequivocal science, supported by well-designed clinical trials that can meet the high standards of the US Food and Drug Administration (FDA),” he explained.

“Their drug products address unmet clinical needs that are reimbursed by the government and insurance companies in order to drive commercial success.”

Additionally, he said these companies generate revenue and possess a path to profitability without the need for any additional dilutive capital raises.

“This philosophy limits exposure to the problems of early-stage biotech companies that ultimately burn cash and survive at the mercy of willing investors seeking to fund their next science project,” he finished.