UK equities remain at a significant discount to their global peers despite the relatively strong performance of the FTSE this year, according to Ian Lance and Nick Purves of the Temple Bar Investment Trust.

However, the managers warned that while valuations are already low, UK investors should expect the domestic market to fall further than the 4.6% by which it is already down in 2022.

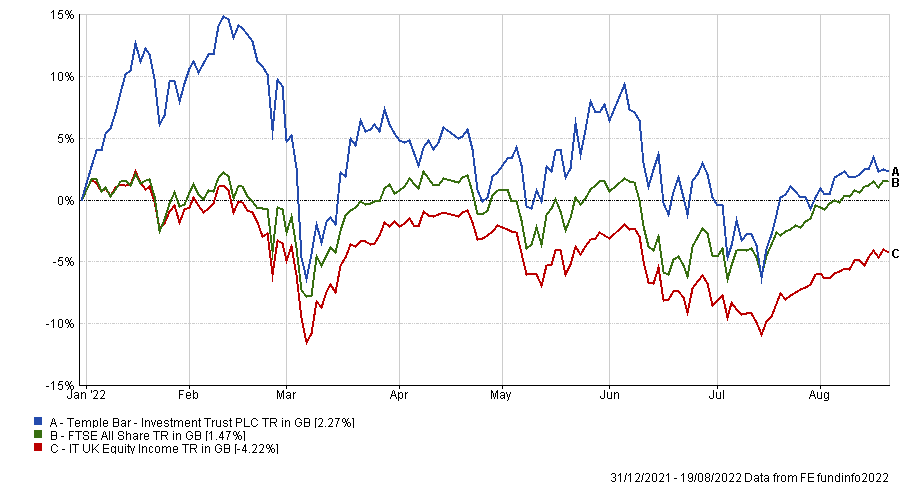

Performance of trust year-to-date vs index and sector

Source: FE Analytics

“Forecasting the macro-economic environment is notoriously hard,” said the managers, speaking in the trust’s half-year report.

“But we can say that rising interest rates and higher commodity prices act as a tax on consumption and thereby reduce levels of disposable income and corporate profits.

“Although we do not attempt to forecast if, or when, the UK economy might go into recession (we might already be in one), we can say that the outlook for corporate profits in the short term is particularly uncertain.”

The good news is that patient investors who can cope with “shorter-term uncertainties” can expect relatively attractive returns from UK equities if they buy and hold for the long term. One example of such uncertainty is around energy and commodities – even though stocks in these sectors have been significant contributors to the trust’s performance this year.

Shell, BP and Total Energies

Portfolio holdings Shell, BP and Total Energies have done well in 2022 on the back of rising oil and gas prices, and while the managers said it is impossible to predict where the price of these commodities will go in the next few months, the cheap starting valuations of these companies bode well for investors.

“These shares are valued on price-to-earnings [P/E] ratios of 8x to 9x, assuming $60 a barrel of Brent oil,” they explained.

“Oil prices at the time of writing are around $100 a barrel, and we therefore take the view that there is a considerable margin of safety built into the share prices of all three companies.”

Standard Chartered

Standard Chartered has been another strong performer in the portfolio over the past six months, profiting from rising dollar interest rates. The managers said that while this could also lead to credit stresses and increased loan loss provisions, the bank has been significantly de-risked over the last few years and lending standards have improved.

“It is likely that credit provisions will not need to be increased from current levels,” they said.

“Standard Chartered’s tangible net asset value per share was 960 pence at the end of 2021 and a 10% return would therefore equate to around 100 pence of earnings, a P/E ratio of less than 6x at today’s share price. The company is priced at less than 8x this year’s expected earnings.”

Vodafone

Vodafone was challenged by price deflation in its European markets, but the managers of Temple Bar saw potential in its €12bn holding in the separately quoted mobile infrastructure company Vantage Towers.

“Vantage Towers contributes relatively little in the way of cashflow to the group,” they said. “We believe that if the company were to monetise this asset and return at least a portion of the proceeds to shareholders, the remaining business would be valued on a P/E ratio of around 8x. The company also has the potential to improve its below-industry-average margins through market consolidation, particularly in the UK and Spain.”

Pearson

Pearson has been struggling to migrate from paper to digital textbooks, but Lance and Purves noted educational publishing is “still an attractive business, offering the prospect of healthy returns”.

The managers noted how Pearson’s share price jumped in March on the back of two separate bid approaches from the private equity firm Apollo.

“Although both bids were rejected by the management team as undervaluing the company and therefore came to nothing, the approach serves to highlight the undervaluation in the company’s shares,” they added.

Royal Mail

Moving on to detractors from performance, the managers pointed out Royal Mail is a low-margin business which suffered as investors believed that parcel volumes would normalise post-pandemic and costs would inflate.

“Although RMG’s UK business may lose money this year, the group has recently re-iterated its medium-term targets of 5% margins in its UK business and €500m of profits in its international operations,” the managers said.

They added there were significant opportunities in productivity improvements that could be achieved through higher levels of automation, and in the company’s international operations, which do not face the same challenges in respect of the trade unions as domestically.

“At a relatively modest 10x earnings before interest and taxes (EBIT), this suggests a valuation of around £3.5bn for the international business alone, indicating that investors are placing a substantial negative valuation on Royal Mail’s UK business,” the managers said.

Currys

Currys currently generates more than 50% of its profits from its high-quality overseas operations, primarily in the Nordics. Valuing the Nordic profits at even a modest multiple suggests that the company’s UK operations (with £5.5bn of revenues) are included in the group’s valuation for free.

“The company’s two-year target is to generate free cashflow of £150m per annum, and while there is much uncertainty around this number, if it is successful, it suggests very significant potential upside to today’s share price,” said Lance and Purves.

Marks & Spencer and ITV were the other main detractors from performance.

The managers finished by reminding UK investors that if they focus on medium- to long-term profit potential rather than overreact to short-term news flow, they can do very well.

“Investors should not forget that the purchase of an equity entitles the shareholder to a long-term stream of cashflows and that a temporary reduction in those cashflows due to an economic downturn does relatively little to alter the long-run intrinsic value of the share,” they added.