More than 20% of funds have been hit with their worst maximum drawdown on record in recent months as the market deals with a series of headwinds.

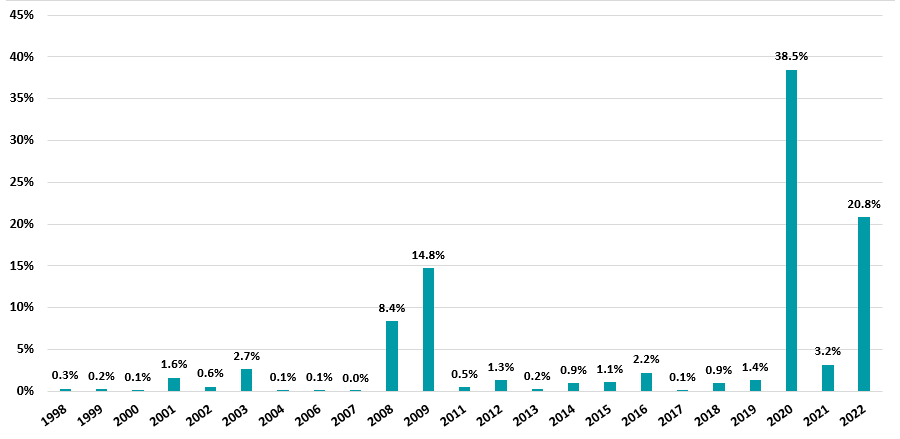

With markets still volatile and losses being seen across stock and bond markets, Trustnet looked at the 12-month maximum drawdowns for all current Investment Association funds, going back to 1998.

Of the 5,000 or so funds that are active in the UK industry today, 20.8% - or just over 1,000 funds – suffered their largest ever drawdown in the 12 months to the end of May 2022.

This is down to the broad-based sell-off that has been hitting markets since the turn of the new year, when investors have had to price in surging inflation, rising interest rates, spluttering economic growth, China’s renewed Covid lockdowns and Russia’s invasion of Ukraine.

Percentage of funds with worst maximum drawdown on record

Source: FinXL

Some sectors have been struck harder than others, with every member of the IA UK Index Linked Gilts sector posting their largest maximum drawdown on record over the past 12 months.

The worst fall here came from AXA Sterling Index Linked Bond (maximum drawdown of 26.1%) while the small hit was recorded by Scottish Widows UK Index Linked Tracker (maximum drawdown of 18.8%).

Meanwhile, the other sectors where a significant number of members are sitting on some of their worst losses include IA UK Gilts (97.4% of funds with worst maximum drawdown occurring in the past 12 months), IA EUR Mixed Bond (71.4%), IA EUR Government Bond (57.5%), IA Sterling Corporate Bond (57.4%), IA Global Corporate Bond (56%) and IA China/Greater China (50%).

At the other end of the spectrum, no funds in the IA EUR High Yield Bond, IA India/Indian Subcontinent, IA Japanese Smaller Companies, IA Latin America and IA USD High Yield Bond have posted their largest maximum drawdown in the past 12 months.

When it comes to the more mainstream sectors, 26.2% of IA Global funds are going through their worst maximum drawdown on record. These include Baillie Gifford Global Discovery (-47.6%), ASI Global Smaller Companies (-29.8%) and Fundsmith Equity (-15.2%).

The UK sectors are holding up somewhat better, reflecting the fact that the UK market has proven more resilient than many of its international peers in 2022.

Just 2.8% of IA UK All Companies funds have incurred their biggest maximum drawdown ever in the past 12 months, while this figures falls to 2.4% for the IA UK Equity Income sector.

On an individual fund basis, the table below shows 25 of the funds are have just had their biggest drawdown on record, ranked by the size of that drawdown.

Source: FinXL

Liontrust Russia is at the top, after its portfolio plunged when Russia invaded Ukraine and was hit with a series of sanctions from the international community in response.

But many of the other funds on the list have suffered because of the market rotation away from growth stocks towards value, which was caused by the onset of higher inflation and rising interest rates.

Nikko AM ARK Disruptive Innovation, MS INVF US Growth, Baillie Gifford American, Morgan Stanley US Advantage and T. Rowe Price Global Technology Equity are examples of funds that enjoyed strong returns when the growth style was in favour but have posted big losses since it lost market leadership.

Of course, the figures presented above include funds with relatively short track records and fewer encounters with significant sell-offs than those with longer histories.

Of the 25 funds highlighted above, for example, only one-fifth were in existence when the market crashed following the global financial crisis of 2008.

This mean that for many funds we looked at in this research, the Covid crash of 2020 was the only other serious market event they’ve had to ride out.

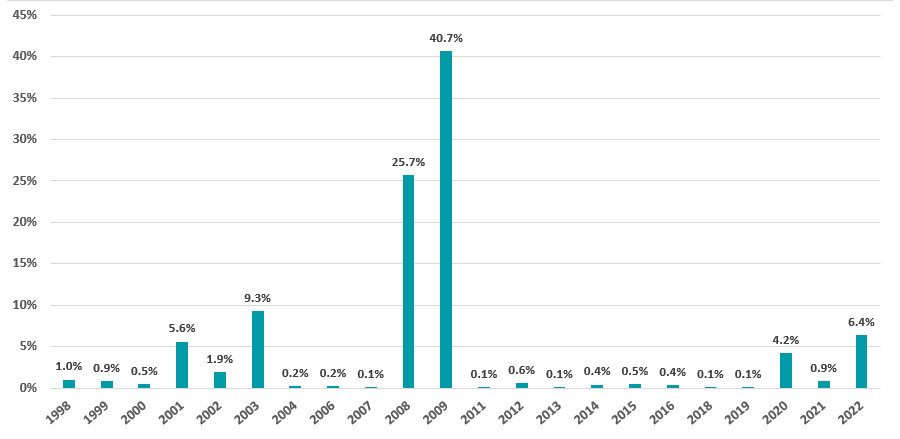

So when we re-ran the numbers to only include funds that have been around since 2007 or before, a more reassuring picture emerged.

Percentage of ‘older’ funds with worst maximum drawdown on record

Source: FinXL

As the chart above shows, just 6.4% of the funds that have been around since the financial crisis or longer are currently going through their worst drawdown.

For these older funds, the worst time in their history is still 2008/2009, when investors were panicking about a potential collapse of the global banking system and the devasting economic and financial consequences this would have.