Many investors have shied away from the UK stock market in recent years, but Ninety One’s Matt Evans thinks that a combination of strong companies and attractive valuations could soon start to tempt them back.

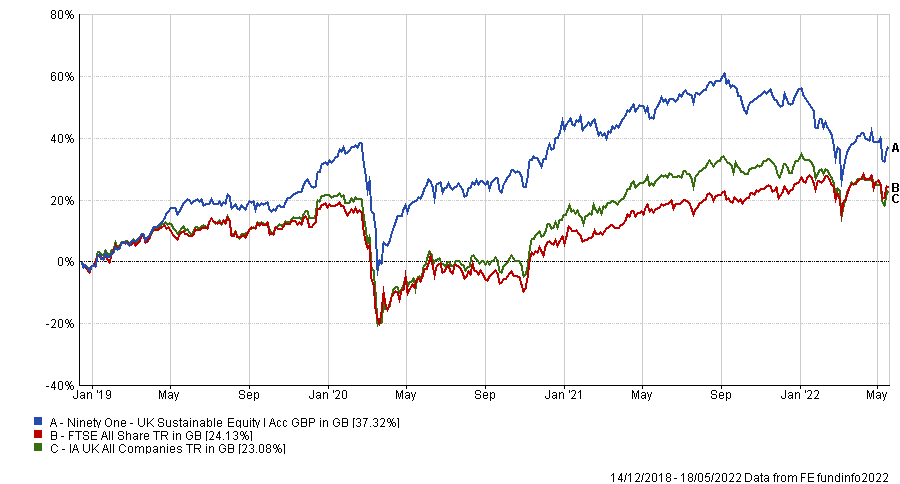

Evans has made a 37.3% return through his Ninety One UK Sustainable Equity fund since he launched it at the end of 2018, putting it in the top quartile of the IA UK All Companies sector. The FE fundinfo Alpha Manager specialises in UK equities, also running Ninety One UK Smaller Companies and previously managing a set of UK portfolios for Columbia Threadneedle.

While investors have been pulling money out of the IA UK All Companies sector for some time, the £149m Ninety One UK Sustainable Equity fund is among those that have captured net inflows and has taken in around £80m of investor monies over the past 12 months, according to FE Analytics.

Here, Evans tells Trustnet what makes his sustainable fund different to its peers, how the UK has become “un-investable” to global investors and why the industrials sector is showing promising signs.

Total return of fund since launch

Source: FE Analytics

What’s your investment process?

The key element of our process is the focus on three pillars of sustainability.

The first pillar is financial sustainability, where we basically look to understand the company's business and financial model.

The second pillar is internal sustainability and that's looking at how efficiently a company makes the most useful their resources. We ask ‘is this company a really good corporate citizen?’

And then the third pillar of this model is positive impact: it's simply about the products and services that a company delivers and how they contribute towards a more sustainable future.

The key is really how those three pillars interact on each. It's this combination and how they interplay that make us consider it a compelling investment case.

With so many ESG funds launching, what sets you apart from the rest?

I think the key differentiator is that we’re all-cap, so it gives you exposure to the best that the UK has to offer. The UK market can be very inefficient, which is why I've got an all-cap approach. Certainly, at the lower end there's a greater chance of market inefficiencies.

We want access to those companies that are best placed to deliver sustainable solutions while also having good financial metrics.

Sustainability is absolutely critical and we think is a key long-term driver, but you still have to be very cognizant that there's a value for everything. By having this bottom-up approach, you can ensure that you still have a portfolio that is well balanced and actually paying a fair price.

Have you sold any holdings because of ESG issues?

Yes, we sold out of a software company called Blue Prism. The management team went through some changes and we just felt, through numerous engagements, that they were a little bit resistant to evolving the governance structures, their reporting lines and investing in their sales team.

It was a good business, but it didn’t fit that three-pillar rationale we’re looking for in a business and that made us sell out.

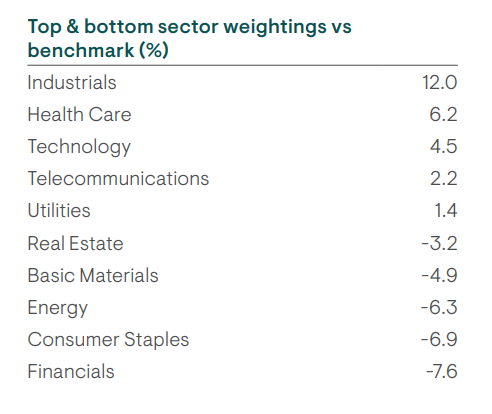

You’re overweight industrials – do you see more opportunity there?

I think the positive impact of industrials is a lot more measurable and the financial models in many of them are also very appealing.

Our focus is really looking at where companies can deliver products and services that contribute to solutions, or where they’re going really going above and beyond and having a material impact.

There's some really good UK industrials that have good global footprints and are providing real solutions in numerous industries.

Take Johnson Matthey, for example - it's a UK industrials business producing catalytic converters for internal combustion engines.

They reduce the amount of pollution and improve the efficiency of cars, so they are reducing carbon that comes out of a vehicle through their products and services. That's what we mean by a solution where you can have a measurable positive impact through using their products

Source: Ninety One

What have been your best stocks over the past year?

Through the past 12 months, it's been companies like RELX, which is a database business with very resilient revenue streams and has been growing really consistently with very strong cash

They’ve proved their worth through a difficult period and it’s been very good for its share price performance – I think shares were up 15-20% over the past 12 months, so it’s a good holding.

We added National Grid about a year ago and there’s been about a 30% upside to that. It’s been a really good addition given how the market has changed shape in that time.

Lat year, the market was really overlooking National Grid so we found a good opportunity and valuations were cheap given the outlook.

It's got a really interesting position in the energy transition - electricity infrastructure and the energy grid as a whole needs investment.

What was your worst?

The biggest detractors over the last 12 months were actually two of the biggest contributors for the 18 months prior to that.

One of them is AJ Bell, the savings platform business, which we think is really well paced structurally to continue structural growth but valuations had got to very, very high levels.

What’s your favourite holding?

Everyone tells you not to have favourites, but you do. You never want to be too emotionally attached that you don’t make the right decisions.

One of my most exciting stocks is a sustainable buildings company called Accsys Technologies. They basically use a process called acetylation to give softwood the properties of hardwood, which means it's structurally very resilient.

It saves significant amounts of carbon in buildings and it’s hugely in demand. They’re investing heavily in new facilities at the moment, which should allow them to fulfil this ever growing demand.

With £836m leaving UK equity fund last month, are you worried that investors losing confidence in the UK?

That was a big number, but we’ve been suffering outflows for ages in the UK. Many international investors have seen the UK as un-investable for a while, so we've been quite an unloved market and traded at a discount to other global indices.

It’s been going on for quite a long period of time, so it’s no bigger a concern today as it was before - it's not something that worries me any more than it always has.

Interestingly, there's been a real large number of corporate buyers of UK assets recently, which does tell you that maybe some value is appearing in the UK. Equally, we don't want all the good UK companies to be taken over, but that could bring investors back into the UK market at some point.

How has the fund changed in this market rotation?

The big changes we made over the last six to nine months has been a move up the market-cap spectrum, because we've recycled out of the faster growing high valued growth names.

The environment has got tougher in lots of areas and by their nature, we've found more resilience in some of the bigger business just because they're more established and valuations have been better.

Last year, the market was overlooking stocks like National Grid, so we found a good opportunity to add to that name. It was getting really left behind but it plays a really interesting role in the energy transition and our electricity infrastructure really needs investment.

Those valuation opportunities were more in the large-caps and in some of those more traditional defensive areas that we're still able to find some good opportunities.

What do you like to do outside of work?

I just love being outdoors exploring all the great places that England has to offer, mainly by the sea.

I’ve got quite into surfing recently and it’s great because my son also enjoys it. Having time together in that kind of space and freedom just always feels great because we're in such a regimented world - there's something I love about being in the sea.