Active funds fell behind their passive rivals in three-quarters of the Investment Association’s sectors during the turbulent opening quarter of 2022, research by Trustnet shows.

Markets were rattled during the first three months of the year by inflation soaring to multi-decade highs, the tightening of monetary policy by the Federal Reserve, Bank of England and other central banks, and the invasion of Ukraine by neighbouring nuclear power Russia.

Against this backdrop, active fund managers in most peer groups appear to have lagged behind passive strategies and lost more their investors’ cash. Of the 53 Investment Association sectors that are home to at least one tracker, the average active fund made a total return lower than that of the average passive fund.

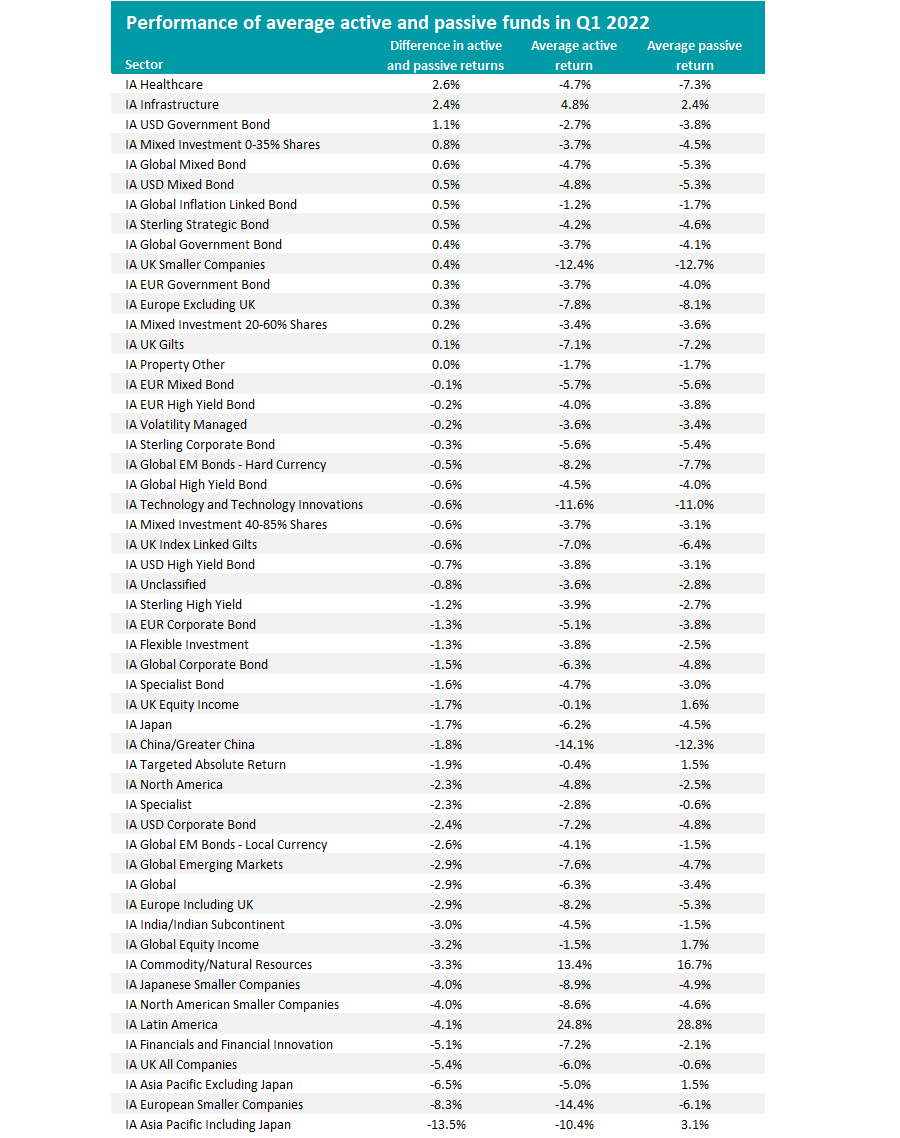

The results of this research can be seen below, ranked by the difference in performance between active and passive funds.

Source: FinXL. Total return in sterling, between 1 Jan and 31 Mar 2022

Active funds in the IA Healthcare sector had the best showing. The average active fund did lose money in the volatile conditions of the three months in question, falling 4.7%, but this is better than the 7.3% drop from their average passive peer.

Two of the active funds in the sector did make a positive return over the quarter: GAM Multistock Health Innovation Equity was up 1.9% while Polar Capital Healthcare Blue Chip gained 1.2%. But it wasn’t all good news for active funds, shown by the 19% fall in the Baillie Gifford Health Innovation fund.

IA Infrastructure, in second place, is one of just three sectors where the average active fund made a positive return in 2022’s first quarter (the other two are IA Latin America and IA Commodity/Natural Resources).

The average active infrastructure fund was up 4.8% over the three months in question, double the 2.4% made by passive. The best performers were LF Macquarie Global Infrastructure Securities (up 11.3%), FTF ClearBridge Global Infrastructure Income (up 10%) and LF Canlife Global Infrastructure (up 8.5%).

When it comes to the other sectors where active funds were in the black, some decent returns were made: the average active IA Latin America fund was up 24.8% while active funds’ average return was 13.4% in the IA Commodity/Natural Resources sector.

But the average index tracker was ahead in both peer groups, making 28.8% in the IA Latin America sector and 16.7% in the IA Commodity/Natural Resources sector. This puts these sectors towards the bottom of the table, where active funds had the worst showing against their passive rivals.

Other popular sectors where the average active fund outperformed last quarter include IA Sterling Strategic Bond, IA UK Smaller Companies and IA Europe Excluding UK.

But it has to be noted that just six funds from the 233 that reside in these three peer groups made a positive return during the first quarter. These were MI Downing UK Micro-Cap Growth (up 22.4%), VT Argonaut Equity Income (4.3%), LF Lightman European (3.2%), Schroder European Recovery (1.3%), Carmignac Portfolio Global Bond (0.3%) and FP Carmignac Unconstrained Global Bond (0.1%).

In the IA Global sector – which is the largest peer group in the Investment Association universe – the average active fund made a 6.3% loss over the period.

Some positive returns were seen. Schroder ISF Global Energy was up 29.6% on the back of surging energy prices and the outperformance of value stocks helped Kennox Strategic Value make 11.5% while another 10 funds were up by more than 5%, including JOHCM Global Opportunities, M&G Global Dividend and Dimensional International Value.

But this wasn’t enough to ensure that active global funds stayed ahead of passive, as the average index tracker in IA Global sector lost just 3.4% during the year’s opening quarter.

Among IA UK All Companies funds, another mainstay of investor portfolios, the average active strategy lost 6% while the average index tracker was down just 0.6%. Only three active funds were up more than 5% for the quarter (and one of them is a ‘smart tracker’): Invesco UK Opportunities (up 9.1%), VT Munro Smart-Beta UK (6.8%) and Dimensional UK Value (5.4%).

The worst performing sector was IA Asia Pacific Including Japan, where the average active fund was 13.5 percentage points behind its passive rival, while active members of the IA European Smaller Companies and IA Asia Pacific Excluding Japan sectors also put in a weak showing.