A difficult few years have led to a shake-up in the FE fundinfo Alpha Manager rankings, with high-profile names such as Michael Lindsell and Hideo Shiozumi stripped of the coveted award, while Baillie Gifford had the highest number of new entrants.

The Alpha Manager rankings assess the performance of a fund manager over their career, including all the funds they have managed. They are designed to distinguish the top 10% of fund managers who have consistently performed well over the longer term.

Risk-adjusted alpha and consistent performance over a benchmark are the two main criteria used, although there are some exemptions, including managers that have run a fund for less than 48 months or where there are four or more people in charge. A full breakdown of how the title is awarded can be found here.

Overall, 52 new names were given the Alpha Manager title, with five from Baillie Gifford: Lee Qian, Kate Fox, Kirsty Gibson, Stephen Paice and Moritz Sitte.

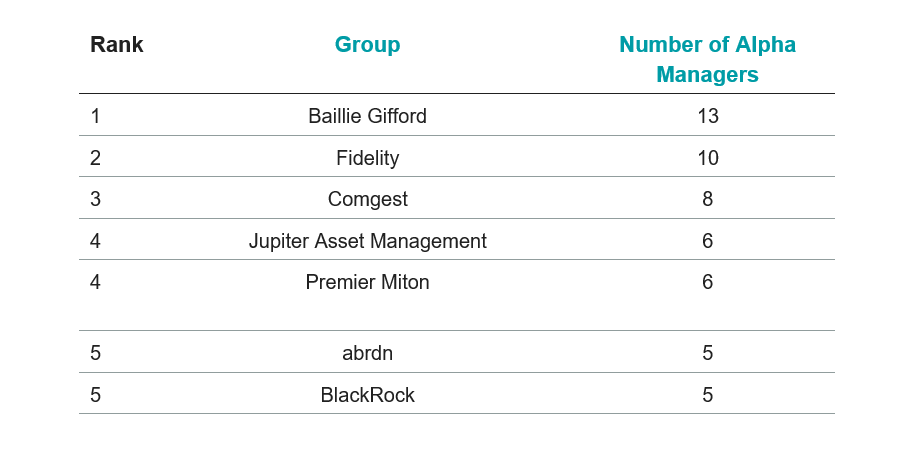

The firms with the most Alpha Managers

Source: FE fundinfo

Charles Younes, research manager at FE Investments, said: “Although they have had a tumultuous year, the performance of Baillie Gifford’s managers has been impressive over the long term and has led to the highest number of its managers per group making the list.

“This is because, although they have suffered from market rotations, structurally they remain sound and have not altered their investment approach, being able to generate alpha returns.”

Meanwhile, firms that have recently taken part in a large merger – Premier Miton and abrdn – saw their managers join the list for the first time.

Fidelity, the firm with the most Alpha Managers in the most recent shake-up, made a net loss of one rating, taking its total from 11 to 10, while Comgest remains in third despite dropping from 10 to eight.

Turning to individuals, Abby Glennie, who has co-managed a number of funds alongside Alpha Manager Harry Nimmo for several years, finally received a rating of her own.

Her largest fund is the £2.2bn ASI UK Smaller Companies portfolio, which she has helped to manage since 2003. During this time, the fund has made 1,088%, more than double the gains of its average IA UK Smaller Companies peer and Numis Smaller Companies plus AIM (excluding investment companies) benchmark index.

Total return of fund vs sector and benchmark since manager start

Source: FE Analytics

Other high-profile names include Charles Montanaro, of the eponymous fund group, as well as Carlos Moreno from Premier Miton, Guy Anderson of the Mercantile Investment Trust and Marlborough duo Eustace Santa Barbara and Siddarth Chand Lall.

Younes said: “Despite the market rotations over the past year, the new additions once again demonstrate the value of high-quality active management.

“Despite not being in favour at the present time, the investment styles of many of the new entrants – some of whom are primarily growth and equity managers – have not impacted on their underlying performance, which has been impressive through this latest market cycle.”

Making way were 51 outgoing managers, including Lindsell and Shiozumi. The two Japan fund managers have had great success over the past decade. The former’s Lindsell Train Japanese Equity fund has made 159%, 15 percentage points ahead of its average IA Japan peer, while the latter’s FTF Martin Currie Japan Equity portfolio has topped the sector, returning 453.1%.

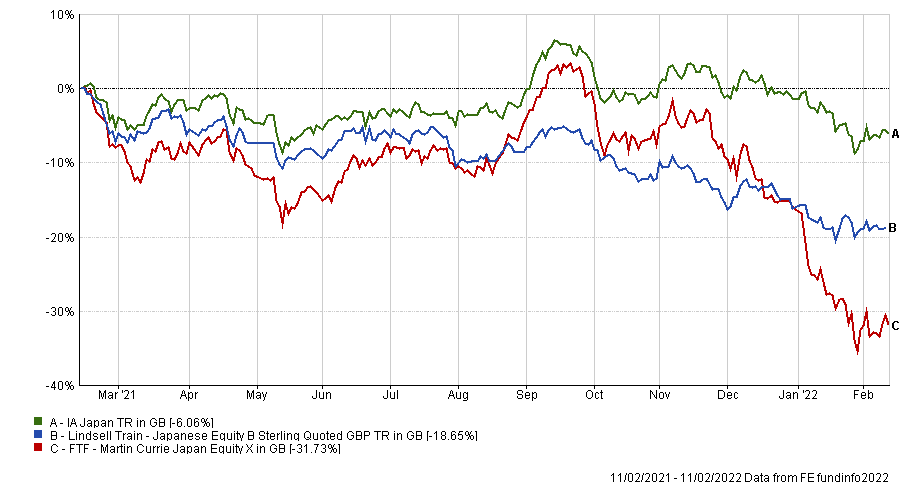

Total return of fund vs sector and benchmark over 1yr

Source: FE Analytics

However, both funds have struggled in recent years for different reasons. The Lindsell Train fund invests in quality-growth stocks, which have been caught out by the rotation towards value names. This contributed to a 18.7% decline over the past year.

Shiozumi’s fund buys fast-growing small- and mid-cap names, a strategy that has worked wonders over the long term, but failed spectacularly in 2021, leaving the portfolio down 31.7% over 12 months.

Giles Hargreave and Charles Plowden also fell off the list after they stepped down from their respective Marlborough and Baillie Gifford funds.

When it comes to Investment Association sectors, IA Global had the most Alpha Managers, at 56, up from 43 in August 2021.

This is followed by the IA UK All Companies sector with 29 Alpha Managers (11 more than last year), and 22 from the IA Europe ex UK sector (six more than last year).