Asset managers will rake in almost half a billion pounds from investors in funds that consistently underperform, a new study has found.

Bestinvest’s latest Spot The Dog review found that the amount of cash held in ‘dog funds’ has jumped 54% in the past six months from £29.6bn to £45.4bn as some larger funds have been tagged with the unwanted label.

‘Dog funds’ are any that have failed to beat the benchmark over three consecutive 12-month periods and underperformed by more than 5 percentage points over the entire three years.

Jason Hollands, managing director of Bestinvest, said: “This is a lot of savings that could be working harder for investors rather than rewarding fund companies with juicy fees.

“At a time when investors are already battling inflation, tax rises and jumpy stock markets it is vital to make sure you are getting the best you can out of your wealth. While turbulence has increased recently, that’s no excuse for consistently failing to match benchmark returns, sometimes by drastic margins.”

In total there were 86 funds to make the list, some of them run by biggest names in the industry.

Although Schroders does not appear on the list with the firms with the most assets in underperforming funds, it runs funds for two of the companies that do: HBOS and Scottish Widows.

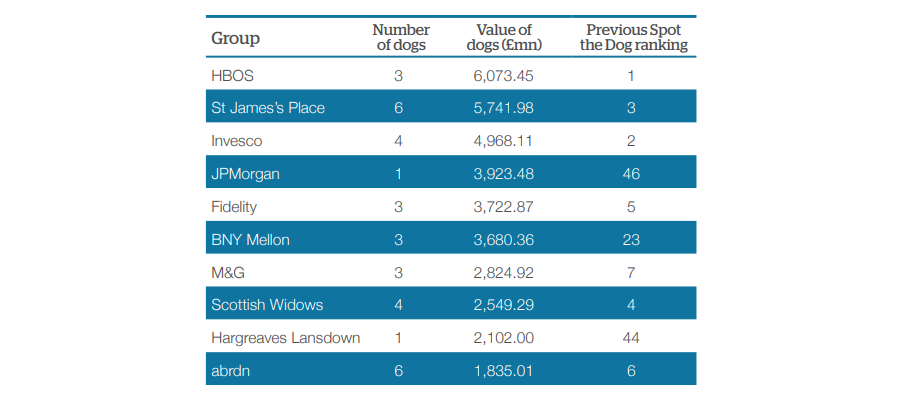

The asset managers with the most amount of investors’ cash in ‘dog’ funds

Source: Bestinvest

UK wealth manager St James’s Place is second. Hollands said: “Part of its USP is that it can pick top managers from across the market, hand them segregated mandates, which it can then monitor closely.

“However, it has all gone a little paw-shaped in recent years, including investing with the ill-fated Woodford Investment Management. It now sits second on our dog list, with £5.74bn in underperforming funds.”

Invesco has dragged itself from second to third. At the start of last year the firm had 11 funds in the study, making it the biggest dog firm, but it has trended in the right direction since. Last time out it was second and this iteration it has come out in third place, with just four funds on the list.

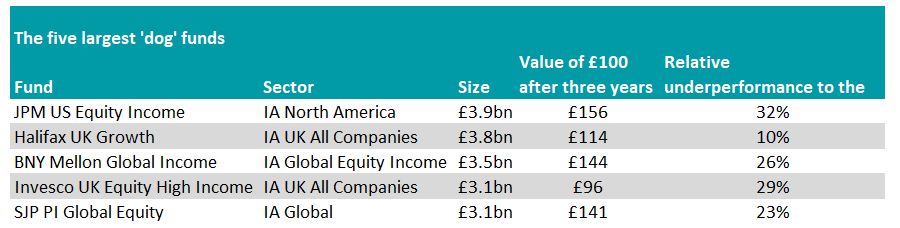

Among the worst performers is the JP Morgan US Equity Income fund, which runs £3.9bn and underperformed its North America index by 32%.

That is the only ‘great dane’ fund – ‘dog’ portfolios that run more than £1bn – among the bottom 20 performers. However, it is not the only fund to run billions of pounds and underperform, the study found.

Halifax UK Growth (£3.8bn), BNY Mellon Global Income (£3.5bn), Invesco UK Equity High Income (£3.1bn) and SJP Global Equity (£3.1bn) all failed to avoid the report.

Source: Bestinvest

Turning to individual sectors, 39 funds on the list came from the IA Global and Global Equity Income sectors. Between them, they accounted for £18.5bn of investors’ cash.

“In recent years, the US has come to dominate the indices by which many funds are measured. The MSCI World, for example, has around two-thirds of its market capitalisation in the US,” Hollands said.

“This has presented a dilemma for active managers: either hold significant amounts in the US or technology with the resulting lack of diversification and income (technology stocks don’t tend to pay dividends), or risk weakness versus the benchmark.”

One prominent fund to make the report was M&G Global Dividend. This ‘fallen star’ has been struggling for some time, but at least has the ‘excuse’ that dividend companies remain very out of favour, Hollands said.

Meanwhile, Jupiter and River & Mercantile each had two funds on the list – the Global Value and Merlin Worldwide funds for Jupiter, and the Global Recovery and Global High Alpha for R&M.

Those in the IA Global Equity Income sector fared worse. Around 55% of the money in the sector was in ‘dog’ funds, with 14 portfolios making the list.

“If global funds have it tough, global equity income funds have it even tougher,” Hollands said. “These funds are typically benchmarked against the MSCI World Index or MSCI AC World Index, which are now weighted 69% and 61% respectively to the US.”

Last year the ‘Big 6’ US growth names – Apple, Microsoft, Amazon, Tesla, Alphabet and Meta – contributed almost 30% of the entire return from the MSCI AC World Index total return. Four have never paid a dividend.

“As such, it’s been near impossible for global income funds to beat the main global indices – they tend to be underweight, both the US and growth stocks in particular. In 2021, performance has been more evenly spread across markets and sectors, but dividend stocks have still struggled,” Hollands noted.