A period of underperformance is sometimes the best time to invest in a fund or region for investors willing to look past short-term returns, according to Ben Conway, head of fund management at Hawksmoor.

Many investors are tempted to sell out of a fund after a lacklustre run but Conway said this underperformance could be down to simple reasons such as its style going out of favour - which happens with essentially all investments at some part of the cycle.

"If you have identified a manager that has got a really good long-term track record that's gone through a bad patch, because their style is out of favour or whatever, that could potentially be that's a very powerful combination and a really good time to invest,” he said.

In the same way that near-term underperformance is not evidence of a bad fund, then near-term outperformance is not a guarantee of long-term returns.

Investors are “kidding themselves” that top-performing funds can repeat this over another one, three and five years because that is historically hard to do, the Hawksmoor director said.

“Who can do that? Who can metronomically outperform year in year over that longer time. It doesn't happen very often: no-one has solved investment,” Conway said, who added that backing a process and investment case is more important than following what is in fashion.

There are several funds within the Hawksmoor multi-asset range - Hawksmoor Distribution, Hawksmoor Global Opportunities and Hawksmoor Vanbrugh – that have experienced some near-term underperformance but are still worth holding, according to Conway.

Prusik Asian Equity Income

Prusik Asian Equity Income is “a classic example of what we’re talking about here,” Conway said

The offshore fund run by Tom Naughton, a manager Conway said has a good long-term track record but near term has struggled. Indeed the fund ranked 282 out of 288 in the Off Equity - Asia Pacific ex Japan sector for returns in 2020.

Naughton has run the fund since launch almsot a decade ago and since then it has beaten the sector average and the benchmark. This outperformance has been achieved with a value bias, a style which has been out of favour with markets for the majority of that decade.

Performance of fund vs sector and index since launch

Source: FE Analytics

“There was nothing wrong with the portfolio of companies that they held, it's just that other things did a lot better - expensive stocks got more expensive,” Conway explained.

This means that the fund is currently very cheap relative to the benchmark, which Conway said makes it an ideal investment opportunity when combined with a strong manager like Naughton.

“The potential for returns from this portfolio from here on in are fantastic,” he said, because of two main reasons.

First, there isn’t something fundamentally wrong with the process “because the managers aren’t picking bad companies”, just a style bias in markets is against them.

Second, the fund has a high re-rating potential.

“If the portfolio is going to get rerated back to just the mean, it will deliver really, really amazing returns,” Conway said.

“In a world where markets have been in a bull market for 12 years to be able to say that about a portfolio of equities is really great.”

GVQ UK Focus

Another fund investors should not lose faith in is GVQ UK Focus, Conway suggested.

Alongside using with the unloved value investment style, GVQ UK Focus had to content with its investment region being terminally out of favour with international investors while, as the chart below shows, it fell much harder than its peer and the market in the 2020 coronavirus sell-off.

For Conway it is the managers’ investment ability that still makes this fund a worthwhile holding.

He said managers Jamie Seaton and Oliver Bazin are able to find excellent valuation opportunities even though markets are not exactly cheap by historical standards.

“The fund has some really fantastic upside potential,” Conway said.

GVQ UK Foucs is a concentrated fund of 35 stocks, all of which are undervalued according to the managers’ metrics.

Over 10 years the fund has beaten the IA UK All Companies sector and FTSE All Share benchmark.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

“And it’s had a cracking 2021,” Conway added. It is currently 43rd out of 252 funds in its sector after making 15.8%.

Polar Capital Japan Value

The third fund is Polar Capital Japan Value, an encapsulation of most things investors have not enjoyed the past few years.

But the fund has two major attractions, according to Conway.

The first that Japan is one of the cheapest markets globally, which with record high valuations popping up in developed markets is an attractive quality.

Second is the potential for value to come back into style.

“So it’s been out of favour for a very long time, performance looks very poor," the Hawksmoor director said.

“But where I think you get that powerful combination, if the market rerates at the same time as this style coming back into favour the potential returns are fantastic."

The investment picture around Japan has recently had some positive momentum. The IA Japan and IA Japanese Smaller Companies were the best performing sectors in September, receiving a boost from the resignation of prime minister Yoshihide Suga, who had become unpopular after his handling of the pandemic and Japanese economy. The political shift caused investors to try and capitalise on the outlook for a new leader brining in better economic objectives.

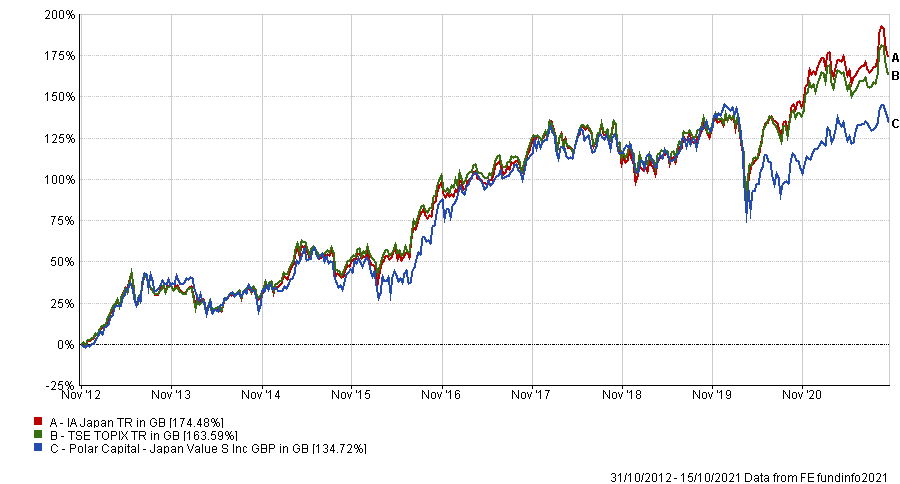

The Polar Capital Japan Value fund has lagged the IA Japan sector and TOPIX index over the long-term, making 134.7% since launch nine years ago

Performance of fund vs sector and index since launch

Source: FE Analytics

|

Fund |

OCF |

|

Prusik Asia Equity Income |

1.25%* |

|

GVQ UK Focus |

1% |

|

Polar Capital Japan Value |

0.85% |

*According to its latest KIDD