China has long been the dominant force for emerging market investors, with returns largely driven by the success or failure of the sector’s largest country.

Over the past decade, Chinese equities, as measured by the MSCI China index, have outperformed the MSCI Emerging Markets index by 61 percentage points.

The strong run means that it now accounts for around 34% of the emerging markets index, but over the past year investors that relied on the region have been hit hard.

The Chinese government has caused concern after heavy-handed interventions in areas such as music licensing and private education led to a sell-off in many tech names.

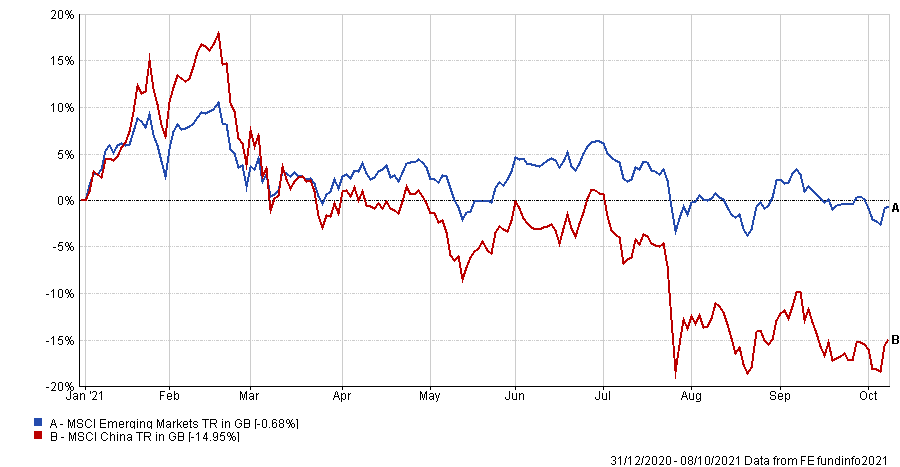

The MSCI China index has lost 15% in 2021 so far, dragging the MSCI Emerging Markets index down 0.7%.

Performance of indices over YTD

Source: FE Analytics

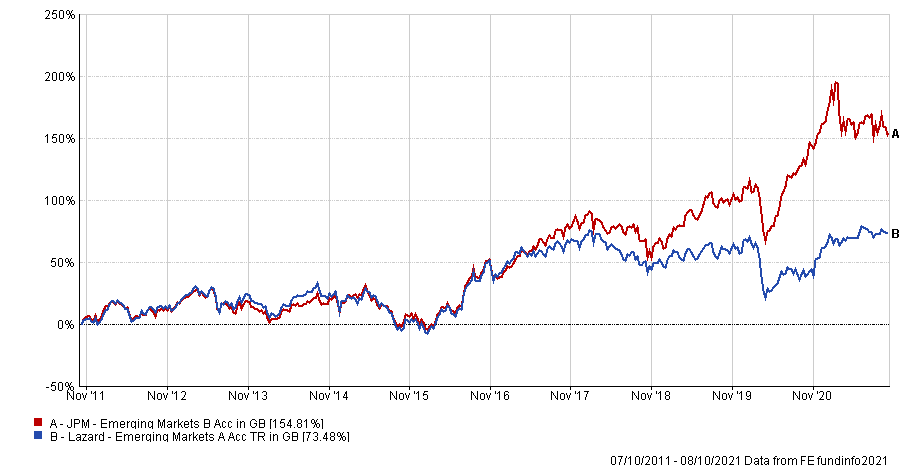

Funds with diverging views on China have therefore had very different results. The £3.4bn JPM Emerging Markets fund has more than 43% invested in the country, 9 percentage points more than the benchmark index.

While this has been the correct call for much of the past decade – the fund is in the top quartile among its IA Global Emerging Markets sector peers over this period – over the past year it has been one of the worst performers.

The fund, managed by veteran stockpicker Austin Forey as well as Leon Eidelman, holds large Chinese tech firms such as Tencent, Alibaba and Meituan in its top 10.

Conversely, the £412m Lazard Emerging Markets fund has had a troubled decade, with the portfolio among the 10 worst performers in its sector, yet over the past year it has been propelled to the top of the rankings, as its 15.4% weighting to China is significantly lower than the market and many of its peers. None of the big tech names above are listed in the fund’s top holdings.

Performance of funds over 10yrs

Source: FE Analytics

Adrian Lowcock, an independent market commentator, said the JPM Global Emerging Markets fund has benefited from a focus on quality and growth investment styles, which has led to a significant exposure to technology and software companies, particularly in China.

“This has helped it deliver strong performance over the medium and longer term, but recently performance has suffered in the short term as China has clamped down on the tech giants and investor interest in tech at any price has started to wane,” he added.

Conversely, Lazard Emerging Markets is run with a value bias, something which Lowcock said will work in its favour in the coming years.

“Which fund is suitable going forwards really depends on whether you believe inflation is temporary or will prove to be more persistent,” he added, pointing out technology stocks tend to be hit harder by rising interest rates, which are a byproduct of persistent inflation.

“I am inclined towards the latter view and therefore prefer the Lazard Emerging Markets fund,” he said.

Kamal Warraich, investment analyst at Canaccord Genuity Wealth Management, agreed. He said that Lazard would benefit from higher inflation and a steeper yield curve, while the tech-heavy JP Morgan fund “is more vulnerable to a rate-rise environment”.

“The data suggests that inflationary pressures are set to continue over the next 12 months, and possibly longer. So Lazard would be more of a hedge in a well balanced portfolio,” he said.

However, Lowcock added that both funds could sit together in a portfolio if investors were willing to own two emerging markets funds.

“This will aid diversification and also means that if your view on inflation turns out to be wrong, the portfolio doesn’t miss out. It can still be tilted towards the preferred strategy to reflect one’s views,” he said.

Rob Morgan, chief analyst at Charles Stanley Direct, also said these two funds would work well as part of a portfolio.

“We have stuck with Lazard Emerging Markets for several years now and believe the disciplined approach should pay off over a full market cycle,” he said.

“In any case, it makes a good counterbalance for more growth-orientated funds that are more likely to be well represented in investor portfolios, such as the JPM fund, which has been a really strong performer over the long term, and has really benefited from its focus on growth.”