Best-buy lists are tricky beasts to get right. They not only need to cater for a large swathe of investors – all with different needs and risk tolerances – but also consistently pick the top-performing funds.

It is rare therefore that a platform drops funds that have been historic winners, but in the latest rebalance of it Best Funds list, Bestinvest has cut two investor favourites.

Liontrust Special Situations has been an exceptional UK fund for many years, returning 239% over the past decade, more than double the gains of the FTSE All Share index and more than 100 percentage points more than its average IA UK All Companies sector rival.

It has also been a longstanding pick for Bestinvest’s Best Funds list, but failed to make the cut in its latest rebalance.

Performance of fund vs sector and benchmark over 10 years

Source: FE Analytics

The fund targets companies that are able to sustain growth across the cycle and benefit from hard-to- replicate and resilient characteristics, such as ownership of intellectual property, high recurring revenue models and excellent distribution networks.

Jason Hollands, managing director of corporate affairs at Tilney, said: “The reason the fund has come off is due to its size, which now towers at £6.6bn. There are of course larger funds around, but Liontrust Special Situations has long taken a multi-cap approach, including significant exposure to smaller companies. Almost a quarter of the portfolio is in AIM stocks. We think a more modest fund size is conducive to such a strategy.”

Also on the way out was the £2.6bn Trojan Income fund. Longstanding manager Francis Brooke is stepping back from running money at the end of the year and so the fund is in a handover phase, with Blake Hutchins, who joined Troy Asset Management from Investec in 2019, set to take over as the lead manager at the end of the year.

“He had a respectable track record at Investec, but this is a much bigger fund, so we think that for now we want to see how the things settle in,” Hollands said.

Performance has been poor in recent times. Over the past year, the fund has been the worst performer in the IA UK Equity Income sector, making 5.4%, while its average peer and the FTSE All Share have made more than 20%. It has also been below average over three, five and 10 years.

Performance of fund vs sector and benchmark over one year

Source: FE Analytics

Incoming funds included the Royal London Sustainable Leaders Trust. Although a UK equity fund, the portfolio, run by Mike Fox, makes use of the ability to invest up to 20% of its cash overseas.

The circa 40-stock portfolio sits at the “light green” end of the ethical spectrum, screening out manufacturers of armaments, tobacco, nuclear power generation, fossil fuel extraction and animal testing (for household goods or cosmetics).

“It focuses on businesses with socially useful products and services, that lead their industries for strong environmental, social and governance criteria,” Hollands said.

Artemis UK Select has also been bumped onto the list. It is managed by Ed Legget, who is supported by Ambrose Faulks, and the pair take a multi-cap and benchmark-unconstrained approach, investing in UK-listed companies of all sizes.

They look for companies with future growth in earnings and cashflows, which will drive a valuation rerating over time.

“If we had to categorise the style, it would be focused on ‘undervalued growth stocks’, not merely being cheap shares. An additional feature of this fund is that the managers can short stocks (exposure to shorts via equity derivatives is capped at 10% of the fund), providing a further source of potential return,” Hollands noted. Both funds have been top-quartile performers over the past three, five and 10 years.

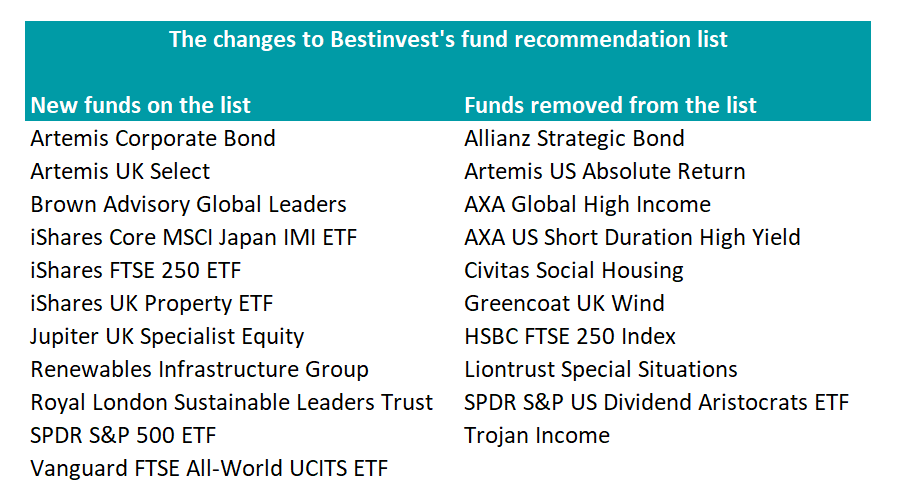

Below is a full list of incoming and outgoing funds from the latest rebalance.

Source: Bestinvest