The IA UK Equity Income sector could double in size in the coming years if investors can overcome their post-Brexit antipathy, Premier Miton’s Emma Mogford has said.

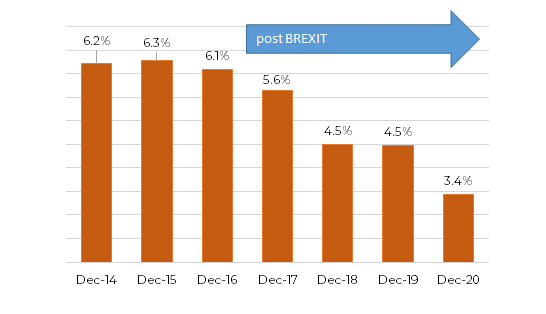

Currently the IA UK Equity Income sector makes up 3.4% of total funds under management across all of the Investment Association (IA) universe. Prior to the Brexit vote in 2016 it was around 6.2%.

Funds under management in the IA UK Equity Income sector as % of total*

Source: Investment Association (IA)

*Data is up to the end of May 2021

If allocation to the IA UK Equity Income sector returns to pre-Brexit levels it would double in size, from £45bn to £83bn.

Mogford, who runs the Premier Miton Monthly Income and Premier Miton Optimum Income funds, said the rise would be subject to several factors, but the largest hurdle was to encourage overseas investors to return to Britain.

Since 2016, a Brexit deal has been finalised, Jeremy Corbyn’s Labour party lost the general election and the dark days of the pandemic appear to have passed – all risks that had held back investors.

The vote to leave the European Union (EU) was the main trigger point for both domestic and overseas investors reducing their exposure to the UK market generally, driven by the lack of political stability, Mogford said. The latter has “always been important to long-term investors.”

However, the discounted investment opportunity those years out in the cold created has made the UK look cheap compared to other markets – a major selling point according to Mogford.

Other key reasons are that the UK is a host to major international brands and the UK equity income market has a strong history of paying dividends, which has made it a hub for income investors in the past.

The manager said: “I can’t think of a better time in my career to be adding to UK equity income funds than right now given the scarcity of income in other asset classes and the relative cheap valuation of many British companies.”

This potential influx into the UK equity income could be particularly important due to the high dividend concentration in the market.

If the sector were to double in size it follows that these companies will become more highly rated and play an even bigger role in the market, meaning investors will have to make conscious investment choices to create diversification and avoid this dividend concentration risk.

This also implies that investors need to get involved earlier to benefit, as holding out could lead to missed opportunities.

Not everyone agreed that this growth was likely or that the UK was the best investment option, however.

Sam Witherow, JPM Global Equity Income fund manager, said that the region’s unpopularity wasn’t just because of Brexit.

He said it was an “unarguable fact” that the UK has some of the slowest growth due to its large-caps, which tend to be in lower-growth industries, such as mining, tobacco or consumer staples.

There are also issues with a “fetishization” of dividends in the UK, Witherow said, which has led to a lot of companies distributing themselves while underinvesting in the business.

“These issues of underinvestment and overdistribution and slowing growth, all of that is a fundamental reality and that hasn’t been driven by fund flows and investors’ bullish or bearish views after Brexit,” Witherow said.

“It’s the simple fact that those UK conglomerates are growing slower than their global peers. I’ve always said to someone thinking about putting on UK allocation – why wouldn’t you just go global?”