Ongoing Covid-related issues, inflation and energy price concerns made for a less exciting month in markets in September following the relative excitement at the end of summer.

Bond markets have already begun pricing in earlier rate hikes in response to rising inflation, which in the UK is currently well above the Bank of England’s 2% target at 3.2%, according to the latest data from the Office for National Statistics (ONS). The Bank of England has forecast inflation to reach 4% by the end of the year.

However, Ben Yearsley, Fairview Consulting director, said at this stage it was “still all talk” and that there was a sense that “the genie is out of the bottle, and they may have left it too late”.

Generally inflation concerns centre around the fact that no one is entirely sure what will happen, and if something does, when it will occur.

“Is it transitory due to the base effects of falling prices in 2020 or has the huge stimulus thrown at economies combined with shutdowns, and supply chain disruptions ushered in a new era of sustained higher inflation?” Yearsley asked.

In the UK this was compounded with the ending of the government’s furlough scheme. Yearsley said that the recent labour shortages, especially along supply chains, have been contributing to higher inflation. With more than 1 million people now coming off the furlough scheme - likely into unemployment - this could exacerbate the issue.

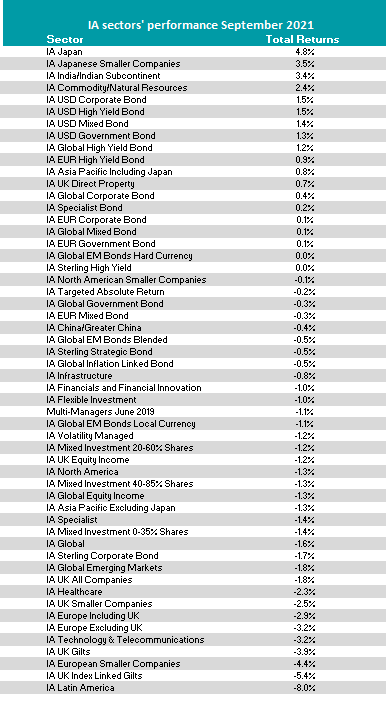

This was reflected in the sector performance for September with the major UK equity sectors, IA UK Equity Income, IA UK All Companies and IA UK Smaller Companies, all making a loss for the month.

Source: FE Analytics

Despite the UK generally benefitting from the rotation into value earlier in the year it has remained unpopular with investors.

Major European sectors, IA Europe Including UK, IA Europe Excluding UK and IA European Smaller Companies also underperformed in September following similar hikes in inflation.

Yearsley said “September felt like a ‘nothing’ month”, as political and economic issues dampened investor enthusiasm.

Neil Birrell, Premier Miton chief investment officer and manager of Premier Miton Diversified Growth fund, said that the Eurozone rate of inflation is just above expectations, at 3.4%, making it “the highest level for 13 years and when stripping out food and energy the core rate is 1.9%; the highest since 2008.”

He said: “The ECB has been trying to stimulate some inflation for a while and it is now getting it; like other central banks they are expecting this spike to be transitory. Time will tell, but nothing is certain at present with plenty of contradictory data and views around.”

At the other end of the table Japanese equities had a very strong month, with the IA Japan and IA Japanese Smaller Companies sectors taking the top spots, up 4.8% and 3.5% respectively.

The outperformance was largely down to the resignation of Prime Minister Yoshihide Suga, who had become increasingly unpopular over his handling of the pandemic and Japanese economy.

This political shake-up in Japan caused investors to try and capitalise on the outlook for a new leader bringing a better economic picture and plan.

Another high performing sector was IA Commodity/Natural Resources, returning 2.4% during the month.

This was mainly down to rising oil and energy prices. The price of Brent crude oil rose by almost $6 per barrel alone.

Oil markets are currently caught between a strong macro context pushing towards renewable energy meaning that less money is being put into long-term oil projects. This means companies want to drip-feed their supplies as much as possible. The overall energy crisis has also added to the supply shortage, pushing up prices.

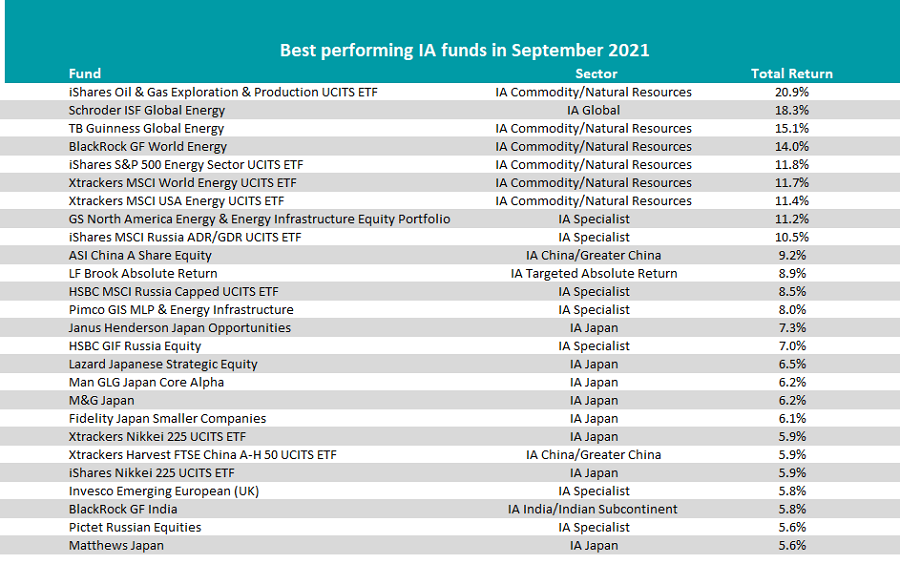

It’s therefore no surprise that funds directly linked to the oil price were among the best performers for September.

Source: FE Analytics

iShares Oil & Gas Exploration & Production UCITS ETF was the best performer overall, making 20.9%.

Schroder ISF Global Energy, TB Guinness Global Energy, BlackRock GF World Energy and various world energy trackers made up the month’s best performers.

As with the sectors several IA Japan funds also featured at the top of the table.

Janus Henderson Japan Opportunities was the best IA Japan fund, making 7.3%. The fund is run by Junichi Inoue and has an FE fundinfo Crown Rating of four.

The all-cap fund does currently have a bigger large-cap allocation among its top 10 holdings, including brands such as Toyota Motor, Sony Group, Mitsubishi, Nintendo and Olympus.

Over the past year the fund’s performance has slipped but Inoue said in the half-yearly report that this was down to a lack of cyclical allocation in the portfolio, meaning it lost out in the value rally earlier this year. He said, while this was the right decision, the fund’s natural bias towards quality weighed on performance during that time, but he didn’t view it as a long-term situation for markets and therefore the fund.

Man GLG Japan Core Alpha was another outperforming Japan fund, making 6.2% in September.

The £1.3bn fund is run by Jeff Atherton and Adrian Edwards and its performance followed a strong year generally due to its value bias. Over one year it’s the best performer in the IA Japan sector.

Square Mile Research and Consulting cautioned investors that the fund can be more volatile and vulnerable to movement in the Japanese stock market, especially over shorter time frames. Still, they said it can be a “powerful way of generating returns for those prepared to invest for the long-term and who can accept the volatility.”

Other outperforming IA Japan funds were Lazard Japanese Strategic Equity, M&G Japan and Fidelity Japan Smaller Companies.

Source: FE Analytics

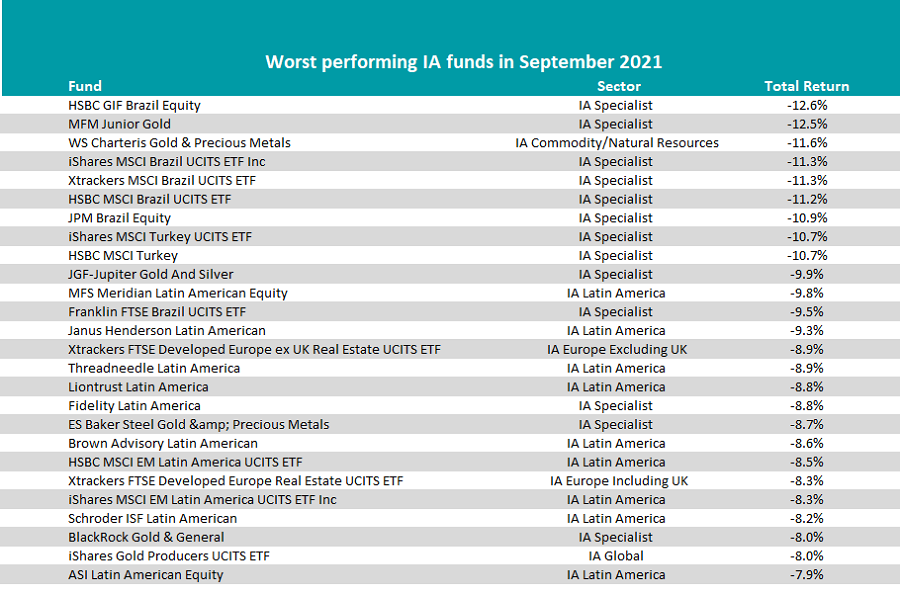

At the other end of the table Latin America and Brazil funds dominated the worst performers. It came as the Brazilian market – the largest constituent in Latin American benchmark indices – the Bovespa recorded a 10.4% loss, in sterling terms.

HSBC GIF Brazil Equity was the worst performer overall losing 12.6%. Various other Brazil ETFs also underperformed, such as iShares MSCI Brazil UCITS ETF and Xtrackers MSCI Brazil UCITS ETF, HSBC MSCI Brazil UCITS ETF.

IA Latin America fund MFS Meridian Latin American Equity lost 9.9%, indirectly affected by the bad run in Brazil.

Other underperforming funds in the month were Brown Advisory Latin American, Janus Henderson Latin American and Liontrust Latin America.

Breaking up the list were several gold funds, including WS Charteris Gold & Precious Metals, which lost and BlackRock Gold & General and Jupiter Gold And Silver.

Gold itself had a lackluster month with the gold spot price falling around $60 in September.