Artemis Investment Management has restructured its bond funds after investment duo James Foster and Alex Ralph announced they were leaving the firm.

Foster, head of fixed income at Artemis, is to retire from fund management at the end of the year. He has managed the £1.8bn Artemis Strategic Bond fund alongside Ralph since 2005, who has also left the company with immediate effect.

During their tenure, the fund made investors 126%, eighth best among the 25 IA Sterling Strategic Bond peers with a long enough track record.

Total return of fund vs sector since launch

Source: FE Analytics

Foster also co-managed the bond part of the £700m Artemis Monthly Distribution fund with Jacob de Tusch-Lec running the equity portfolio. Similarly, Ralph was lead manager of the £920m Artemis High Income portfolio, with Ed Legget handling stock selection.

Their successors are a combination of existing and new managers to Artemis. Stephen Snowden, who joined Artemis in 2019 from Kames, has replaced Foster as head of fixed income.

Rebecca Young is to join the firm in November from Janus Henderson, where she has worked with veteran fund managers John Pattullo and Jenna Barnard and co-managed the Janus Henderson Horizon Strategic Bond fund.

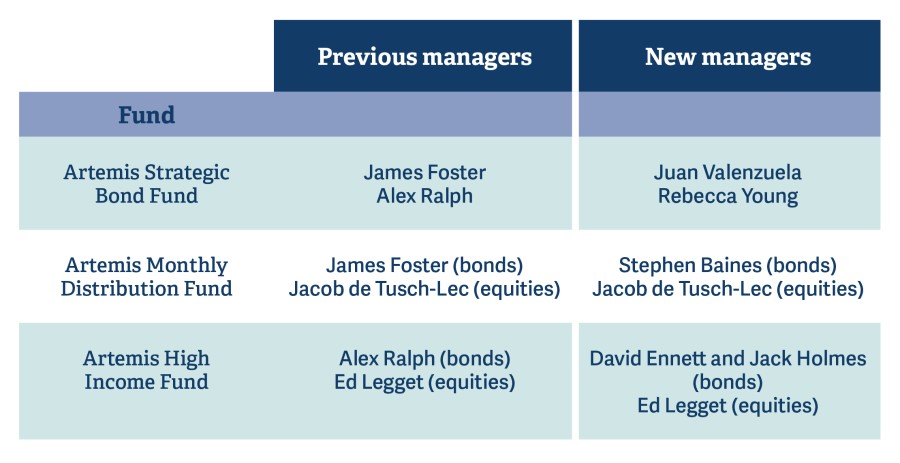

Who will now manage the funds

Source: Artemis Investment Management

Juan Valenzuela will join her as co-manager on the Strategic Bond fund, while David Ennett and Jack Holmes are to manage the High Income fund and Stephen Baines will join de Tusch-Lec on Monthly Distribution.

Darius McDermott, managing director of Chelsea Financial Services, said: “James Foster has been an exception fixed income manager over the past couple of decades and we wish him well for his retirement.”

He noted that it was a “shame” for investors, but said the changes had left the funds in “very capable hands” with the new appointments.

However, the Strategic Bond fund is to come off from his recommended funds list, “as it is being handed to a manager we are less familiar with” but will have a generic ‘hold’ rating.

“We will revisit the rating when the team has had a chance to settle into the fund,” he said.