Exchanged-traded funds (ETFs) giving exposure to areas such as quality companies, oil & gas stocks and index-linked bonds are currently generating some of the highest returns of their sector, Trustnet research shows.

Over 2021 so far, the highest return from the entire Investment Association universe has come from an active fund – Guinness Global Money Managers, which is up 37.1% (as at 24 August).

It’s followed by more active funds, with most focused on UK smaller companies: Consistent Opportunities Unit Trust (37%), Aberforth UK Small Companies (36.9%), Liontrust UK Micro Cap (36.2%) and Fidelity UK Smaller Companies (33.6%).

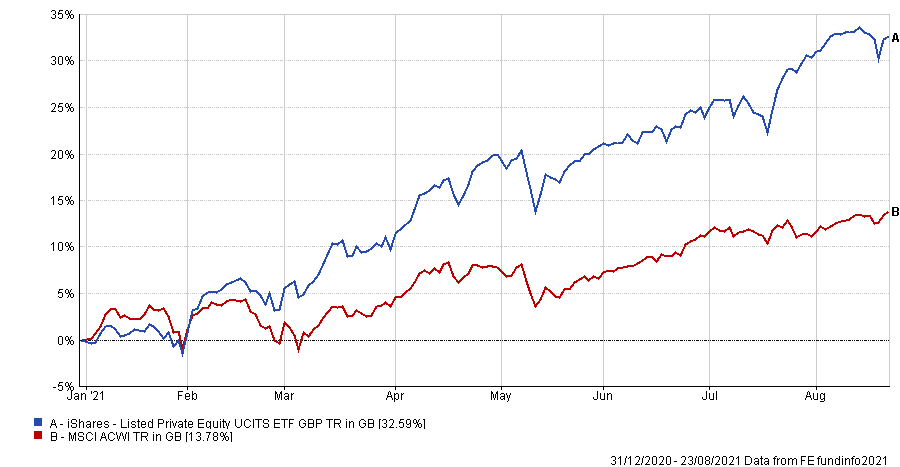

However, you don’t need to go too far down the performance table to find an ETF, with iShares Listed Private Equity UCITS ETF being the eighth best performer this year with its 32.6% total return.

Performance of ETFs vs global equities over 2021

Source: FE Analytics. Total return between 1 Jan 2021 and 24 Aug 2021

It tracks the S&P Listed Private Equity index, which means it offers exposure to private equity companies from North American, European and Asia Pacific that are trading on developed market exchanges, but that invest in unlisted companies. Top holdings include Blackstone, Partners Group and Brookfield Asset Management.

This year has been a busy one for private equity firms. In the first half of 2021 there were more than $500bn in deals, taking global merger & acquisition activity to an all-time high.

As it resides in the IA Specialist sector, iShares Listed Private Equity UCITS ETF doesn’t have a decile ranking for its performance (the differing approaches in that sector mean peer rankings are deemed inappropriate).

However, it has made the second highest return of any IA Specialist fund over the period in question, just behind the active Alquity Indian Subcontinent fund’s 33.4% return.

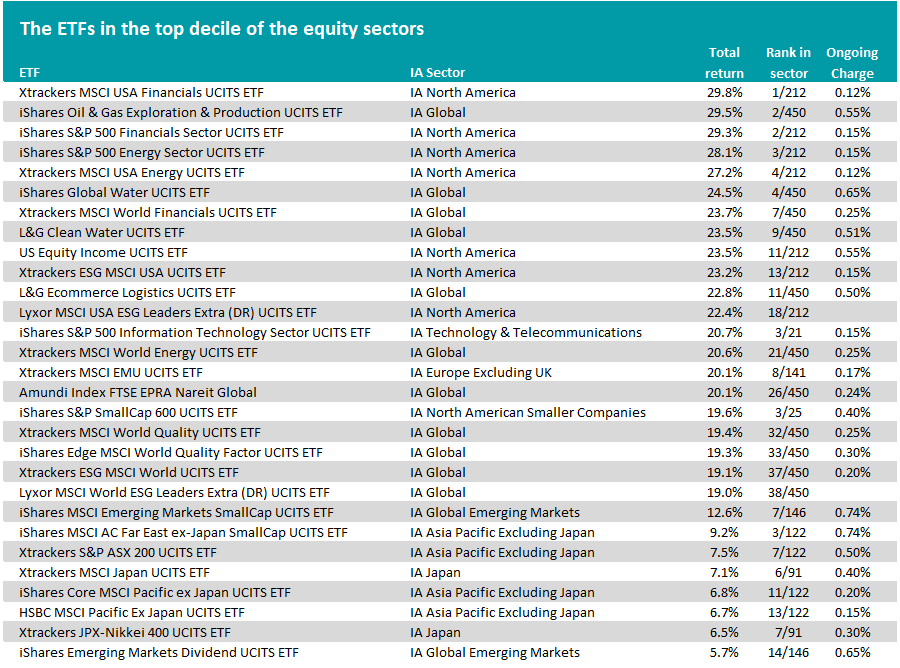

But as the table below shows, it is far from the only ETF sitting in the upper end of its peer group over 2021 so far. Indeed, there are 29 ETFs currently in the top decile of the Investment Association’s various equity sectors.

Source: FinXL. Total return between 1 Jan 2021 and 24 Aug 2021

The table is topped by Xtrackers MSCI USA Financials UCITS ETF. The tracker’s 29.8% makes it the best-performing member of the IA North America sector this year.

It focuses on large- and medium-sized US financial services stocks, with JPMorgan Chase & Co, Berkshire Hathaway and Bank of America being its biggest holdings.

The ‘re-opening trade’ caused investors to flock into cyclical stocks such as banks, boosting their shares as the global economy restarted from 2020’s lockdowns. Banks – and other financial stocks such as insurance – are also seen as good investments when inflation is rising.

Other ETFs benefitting from this include iShares S&P 500 Financials Sector UCITS ETF and Xtrackers MSCI World Financials UCITS ETF.

Energy stocks were also buoyed as investors bought into cyclicals, while commodity prices climbed when demand spiked for the likes of oil and other basic materials as the global economy re-opened.

ETFs such as iShares Oil & Gas Exploration & Production UCITS ETF, iShares S&P 500 Energy Sector UCITS ETF and Xtrackers MSCI USA Energy UCITS ETF jumped into the top decile of their sectors.

Some of the other themes of 2021 that can be gleaned from the above table include a preference for quality (Xtrackers MSCI World Quality UCITS ETF, iShares Edge MSCI World Quality Factor UCITS ETF), continued interest in tech (iShares S&P 500 Information Technology Sector UCITS ETF, L&G Ecommerce Logistics UCITS ETF) and the outperformance of smaller companies (iShares MSCI Emerging Markets SmallCap UCITS ETF, iShares MSCI AC Far East ex-Japan SmallCap UCITS ETF).

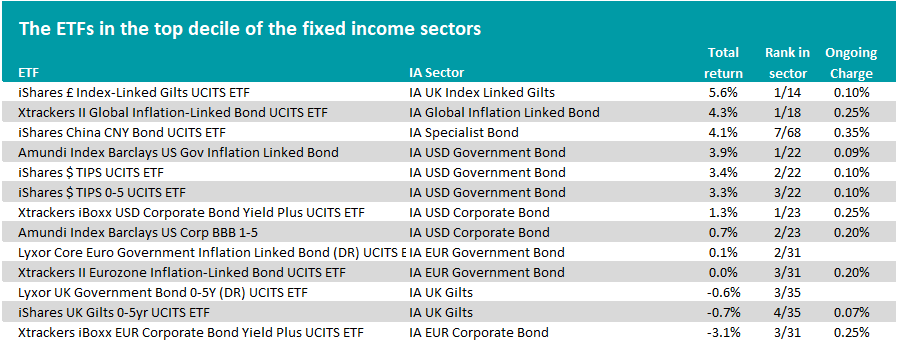

Source: FinXL. Total return between 1 Jan 2021 and 24 Aug 2021

There’s another 13 ETFs that are in the top decile of the Investment Association’s fixed income sectors.

Bonds have generally had a tougher 2021 than equities, as a stronger economy and higher levels of inflation tend to create headwinds for fixed income assets.

One thing to note here is that 12 of these 13 ETFs currently hold a top-five ranking in their fund sector, suggesting that active bond managers have struggled to add value in this environment.