The rotation into value has pushed some of the repeat offenders in Bestinvest’s bi-annual ‘Spot the Dog’ report out of the ‘dog house’, resulting in the lowest number of underperforming funds since summer 2019.

The latest edition of the report identified 77 so-called ‘dog funds’ that have underperformed in each of the past three years, with £29.54bn worth of assets currently invested in these underperforming portfolios.

The reason for this drop has been the market rotation out of growth and into value, catalysed by the rollout of several effective Covid-19 vaccines paving a path out of the pandemic and sparking a ‘reopening trade’.

This shift caused some of the funds in the hardest hit sectors to improve massively, bringing them out of the ‘dog house’.

Jason Hollands, managing director of Bestinvest (pictured), said this has been a “much better period” for managers who target cheap, undervalued shares in sectors such as energy and financials rather than high growth companies.

This is demonstrated by the high number of dog funds found in the North America (19), a market known for its growth bias.

Fund houses such as JP Morgan, Schroders and Invesco, which all have several deep-value funds, have consequently seen “far fewer errant pooches this year,” the report said, because of the shift.

“The sharp rebound in some of last year’s worst hit sectors – such as energy and financials – has enabled a lot of previous offenders to escape inclusion as more recent, shorter-term performance has been strong, lifting them out of our filters,” Hollands said.

It’s not all down to a style rotation though with fund groups “upping their game” and regenerating previously poor performing portfolios.

The report noted an “increasing willingness” among groups to “bring their underperforming funds to heel”, either through replacing managers or altering their systems.

One key note is that it’s not so straight forward for investors to realise that their money is invested in a ‘dog fund’, Hollands said, because not all of them lose money. Out of the 77 funds on the list, only 21 lost investors’ money over three years.

The director added that in most cases rallying markets have “masked the fact that the decisions made by the managers of dog funds have actually detracted from the returns their investors might have received”.

“Such funds represent poor value for money given the fees investors have paid,” Hollands added.

Another key finding was the lack of small-cap funds on the list, something the study identified last time as well. This is despite small-caps being riskier strategies.

This finding suggests that fund managers have a better success rate when investing in less researched parts of the market, which are also off the radar of passive funds, Hollands said.

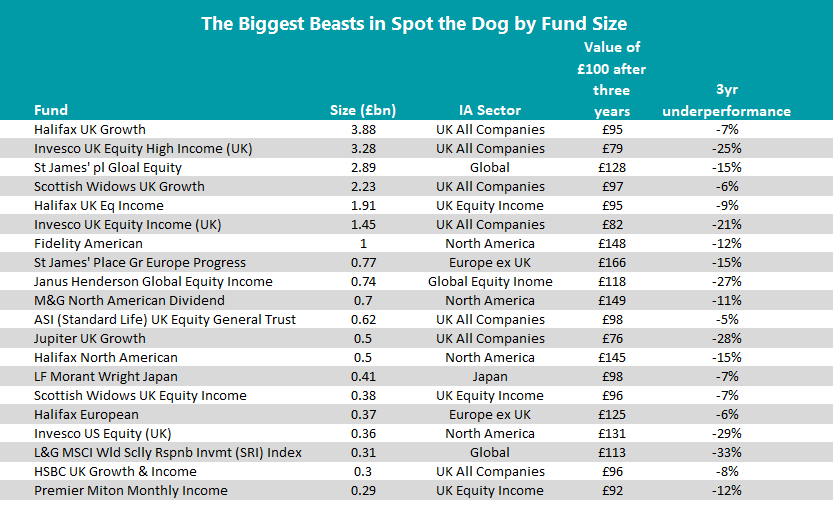

On the other hand, there were seven funds over £1bn, so-called ‘Great Danes’.

These portfolios are run by some of the fund industry’s “most recognisable names”, the report said, such as St James’s Place, HBOS and Scottish Widows.

Source: Bestinvest

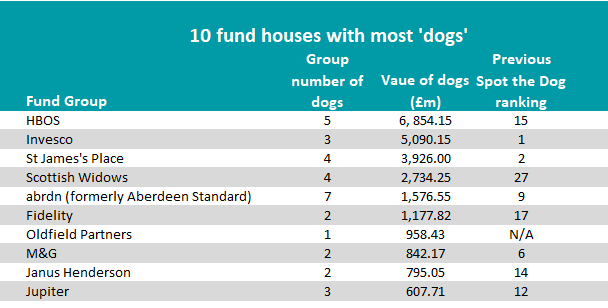

This year, HBOS took the top-spot for most underperformers – five funds, running £6.85bn. The group knocked Invesco off the list, which had held the title for six consecutive reports, though it still has three ‘dog’ funds on the list, totalling £5.1bn. This is a “significant improvement” for the fund group on its previous 11 underperformers.

Source: Bestinvest

Breaking down into the regions and, as mentioned above, North America had the most dog funds. The sector suffered when technology stocks took a hit earlier in the year as inflation concerns spiked, though the number of dog funds has decreased because the “sharp outperformance” of tech.

Some of the US dog funds were: GAM North American Growth, Liontrust US Income, Royal London US Growth Trust, Threadneedle US Equity Income and BMO North American Equity.

The UK had 17 funds on the list, up from the 14 last time. This total is across the UK All Companies and UK Equity Income.

Although the UK has been a massive beneficiary of the move to value and cyclical stocks during the recovery, the number of UK dog funds did move up marginally as the “recovery for the UK stock market lost momentum”.

The UK was out of favour with investors for several years because of its “natural tilt” to areas such as energy and banking which lagged the rallying growth sectors and were extremely vulnerable to the impacts of the pandemic. Added to this was Brexit uncertainty, which just resolved at the start of 2021 with a trade deal.

The IA UK All Companies sector has nine dog funds in this edition versus 29 last year.

Bestinvest had seen a “notably better performance over the past six months” in the fund.

‘Repeat offenders’ Invesco UK Equity Income (UK) and Invesco UK Equity High Income have also come under new management. Ciaran Mallon and James Goldstone took over from Mark Barnett in May 2020.

“Turning round these multi-billion pound supertankers was always likely to be tough, but there are no signs of improving performance yet,” the report said.

Other UK All Companies funds on the list are BMO UK Mid-Cap, HSBC UK Growth & Income and Scottish Widows UK Growth.

In IA UK Equity Income, one of the biggest notes is the “end of the ‘Woodford effect” in the sector as LF ASI Income Plus – which was previously managed by the fallen star – and HL Multi-Manager Income & Growth trust - had a big holding in his funds – moved off the list.

“Hopefully, investors can start to put the sorry episode behind them,” Bestinvest said.

The IA UK Equity Income sector has eight dog funds, including three Premier Miton portfolios (Premier Miton Monthly Income, Premier Miton Optimum Income and Premier Miton Income) and BNY Mellon Equity Income.