European equity funds have had an easier time delivering low volatility without sacrificing returns than funds in Asia and emerging markets, FE Analytics data shows.

It was more common for European funds to deliver top-quartile performance while also keeping volatility low. Over 10% of European funds managed this.

However, only 4% of the funds in the Investment Association’s (IA) Global Emerging Markets, Asia Pacific Excluding Japan and China/Greater China sectors achieved this. None of the funds in the IA Japan sector managed to do so.

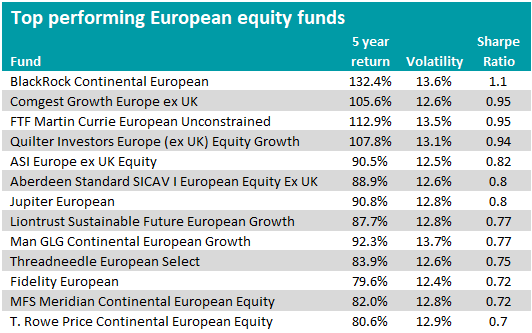

The table below shows the 13 out of 116 funds in the IA Europe ex UK sector with a five-year track record that delivered first-quartile returns and first-quartile volatility (meaning they were among the least volatile).

The funds are ranked by their Sharpe ratio – which measures the return relative to its risk.

Source: FE Analytics

The first fund that featured was the £1.1bn BlackRock Continental European fund – which delivered the highest return in the list, as well as the highest risk-adjusted return as measured by its Sharpe ratio of 1.1.

Run by FE fundinfo Alpha Manager Stefan Gries and Giles Rothbarth, the fund takes a quality-growth approach to investing.

Its largest position is a 6.2% allocation to ASML, the Dutch equipment supplier to the global semiconductor industry. It also holds a 5.5% position in Luxury giant LVMH – owner of brands such as Moet Hennessy and Louis Vuitton.

The largest strategy in the list was the £4.6bn Jupiter European fund, run by Mark Heslop and Mark Nichols. The fund’s biggest weightings are to RELX (7.1%), Dassault Systemes (6.1%) and Adidas (5.6%).

The £1.6bn Man GLG Continental European fund also made it to the list. It is managed by Rory Powe, who recently told Trustnet that not all companies will be as well equipped to the rising pressures of inflation eroding their margins.

The fund takes a concentrated approach, with just 30 holdings in the portfolio and the top 10 accounting for just over half of its assets. Its largest position is in Danish pharmaceutical firm Novo Nordisk (6.8%).

Turning to the Asian and emerging markets funds, not as many of them managed to deliver both top-ranked returns and top-ranked low volatility.

Out of 222 funds with a five-year track record across both the IA Asia Pacific Excluding Japan and IA Global Emerging Markets sectors, only four from each sector managed to achieve the feat. Out of 46 funds in the IA China/Greater China sector, only two funds achieved it.

The table below shows the 10 funds that delivered first-quartile returns and first-quartile volatility, ranked by their Sharpe ratio.

Source: FE Analytics

It is worth noting that these three sectors will have several overlaps, with China being a major influence on both the emerging markets and Asia Pacific sectors, because Chinese equities account for roughly a third of both the Asia Pacific ex Japan index and the emerging markets index.

The first notable fund in the list was the £350m Matthews Asia ex Japan Dividend fund, which delivered the highest risk-adjusted return of the funds that featured in the IA Asia Pacific Excluding Japan sector.

The FE fundinfo five-crown rated fund is managed by Yu Zhang, alongside Robert Horrocks, Sherwood Zhang and Joyce Li.

The fund aims for both capital appreciation and income but places a focus on dividends. Manager Li previously told Trustnet that Asian companies with consistent dividend pay out policies often exhibit the same characteristic a quality-growth manager would also look for – strong and sustainable cash flows.

The fund’s biggest holdings are in Taiwan Semiconductor Manufacturing Company (TSMC), Tencent and Link Real Estate Investment Trust, which make up 3.8%, 2.9% and 2.7% respectively.

Moving on to the IA China/Greater China sector, one notable fund that featured was the £3bn Schroder ISF Greater China fund.

Managed by Louisa Lo, this fund also has a top holding in TSMC – which makes up almost 10% of the portfolio. Alibaba and MediaTek were the next two biggest holdings, accounting for 6.8% and 4.4% respectively.

The growth-focused strategy was one of just two funds from the entire sector that made the list. The other was the £679m FSSA Greater China Growth fund, managed by Martin Lau and Helen Chen.

Looking over to the IA Global Emerging Markets sector, the £336m Capital Group Emerging Markets Growth Fund exhibited the highest return amongst the funds that featured from its peer group.

The FE fundinfo four-crown rated fund is managed by Victor Kohn, Ric Torres, Chapman Taylor and Eu-Gene Cheah.

Capital Group places a particular emphasis on giving its growth investors as smooth a ride as possible, with systems in place that enable dozens of analysts and several named managers to contribute ideas to portfolios.

Its largest position is in Samsung Electronics, with a 4.2% position. However, like the other funds that featured, it also has top 10 positions in TSMC (2.8%) and Tencent (2%).

Out of the 80 funds in the IA Japan sector with a five-year performance track record, there were no funds that managed to deliver low volatility alongside their top-ranked returns.

High volatility was much more common amongst the top-ranked performers, where half of the funds with top-quartile returns in the sector ranked bottom quartile for their high volatility.