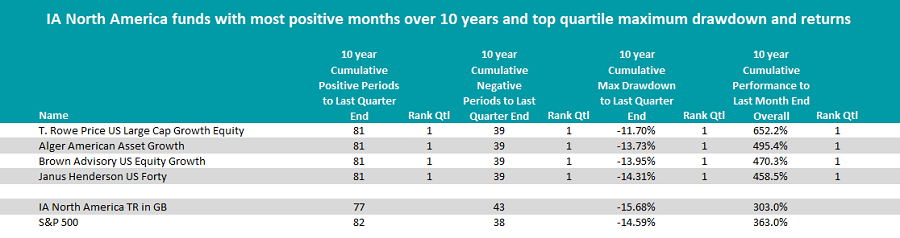

Out of 216 IA North American funds only four have successfully delivered consistently positive returns while minimising investor losses during the past 10 years.

Source: FE Analytics

The four funds featured all invest in growth with a focus on technology, the largest sector allocation for all the portfolios.

This reflects the environment and stocks that have dominated the US and global markets for the past 10 years. Even after the bad press in the 90s dotcom bubble, tech and internet stocks have emerged as the leaders of growth’s decade long bull run in the 2010s.

The style was bolstered by ongoing loose monetary policy and record-low interest rates, which combined with an increased social reliance on technology.

Names such as Microsoft, PayPal, Shopify or Facebook, as well as Amazon, Apple, Netflix and Google parent company Alphabet, the FAANGs acronym, are all examples of this trend and make regular appearances in the top 10 holdings of these four funds.

All of the funds featured in this study experienced 81 positive months out of a potential 120.

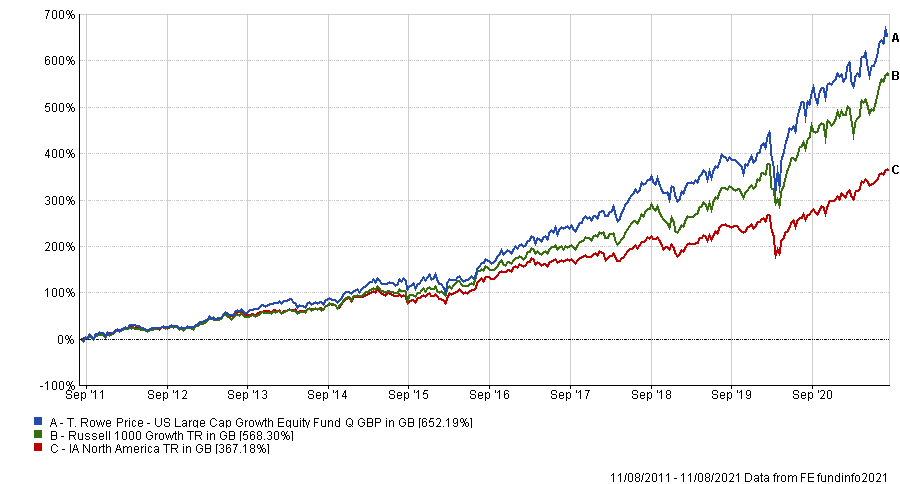

T. Rowe Price US Large Cap Growth Equity

The first fund is T. Rowe Price US Large Cap Growth Equity, which had the best maximum drawdown in the study, 11.7%. It also had the best total return over 10 years, making 652.2%. This was the fifth-best total return out of the entire IA North American sector for that time frame.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Manager Taymour Tamaddon – who has run the fund since 2017 – said although the fund has done well in the past, there are new issues to contend with.

The “strength and speed of the global economic recovery risks to growth persist” in the form of new variants and a slowing vaccine programme is one, while president Joe Biden’s potential corporate tax increase, which could be a major headwind to the popular tech stocks, is another.

However, Tammaddon said he was less fretted by the potential hike anticipating a “moderate to neutral” impact on US equity markets if it occurs.

The T. Rowe Price US Large Cap Growth Equity fund, with its large-cap mantra, has a “healthy exposure to FAANGS which have clearly been in the ascendancy in recent years,” said Laith Khalaf, head of investment analysis at AJ Bell.

The $3.1bn (£2.2bn) fund holds an FE fundinfo Crown rating of four and has an ongoing charges figure (OCF) of 0.75%.

Alger American Asset Growth

Next up is the Alger American Asset Growth fund, run by FE fundinfo Alpha Manager Dr Ankur Crawford, Patrick Kelly and Dan Chung.

The Alger fund house has been a long proponent of growth investing, favouring the style since its launch in 1964. It uses a bottom-up process, combined “with an appetite for positive change catalysts at investee companies,” Khalaf said. These are companies undergoing ‘Positive Dynamic Change’, meaning high growth or have undergone an innovation in management, product or business practice.

Commenting on the past few months in markets the managers said they continued to focus on and observe “broad themes”, specifically the rotation out of growth catalysed by the “grand reopening” of the economy combining with massive bouts of fiscal stimulus, and then the rotation back into growth stocks following the uncertainty about said recovery because of fears of Federal Reserve may raise interest rate.

This near-term see-sawing means growth stocks and funds fell after a decade of generally strong performance in 2021’s opening months but have rallied recently.

Alger American Asset Growth was no exception to this, experiencing a drop in its short-term, although the fund’s maximum drawdown of 13.7% was still the second best in this study. Over 10 years it made 495.4%, the thirteenth-highest out of 101 funds during that time.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Holding an FE fundinfo Crown rating of five it has an OCF of 2.08%.

Brown Advisory US Equity Growth

Penultimately is the $1.8bn Brown Advisory US Equity Growth fund. It has an “extremely concentrated portfolio” of just 33 names, Khalaf said, which are chosen on the basis of its long-term earnings power. The fund invests in mid and large-cap companies, though any stock must be at least $2bn in size at the time of purchase.

FE fundinfo Alpha Manager Kenneth M Stuzin has run the fund since 2009 and since 2011 the fund returned 470.3%, achieving this with a maximum drawdown of 13.9%. It has an OCF of 0.86%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Janus Henderson US Forty

Las up is Janus Henderson US Forty, a $1bn fund run by Douglas A Rao and Nick Schommer. The fund was launched in 1998 and the pair have run it since 2017.

The managers invest in a maximum of forty stocks, looking for large-caps which exhibit both innovation and have wide economic moats, Khalaf said.

Along with being very concentrated the fund has high conviction in its holdings. Just five names, Amazon, Microsoft, Facebook, Mastercard and Alphabet, make up 30% of the portfolio.

The aim of the fund is to outperform the Russell 1000 Growth index by at least 2.5% per annum – before deduction charges – over any five-year period. Over 10 years has underperformed its benchmark, but within the IA North America sector it made the tenth-highest returns during that time, up 458.5%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

It holds an FE fundinfo Crown rating of five and has an OCF of 2.13%.