The Octopus UK Multi Cap Income fund has been one of the best performers in the IA UK Equity Income sector year-to-date, performance helped by a few, key stocks.

Year-to-date Octopus UK Multi Cap Income has been the third-best performer in the IA UK Equity Income sector, returning 18.5%. The average fund made 10.25% over the same time frame.

Its performance has been impressive, made even more so by the fact that it has made very few changes over the past year.

The fund adheres to Octopus’ company wide style of structuring funds around a core of established industry leaders. These high-quality businesses that make up around 70% of the portfolio with the remainder in satellite ‘emerging stars’ businesses with the potential for greater growth.

Manager Chris McVey said that the core element had remained largely “unchanged” from 2020 to 2021, explaining that they aimed to hold the same ‘core’ companies throughout the market cycle.

“It’s about finding those nuggets,” McVey said. “Our ultimate aim is to find that core for the portfolio that we really believe will double on a three to five year view.”

Below Trustnet looks at some of his best performers so far this year.

Pandemic winners

McVey said Future, a global multi-platform media company, not only contributed to the fund’s first-half outperformance against its peers, but its strong returns since launch in 2018.

The company has had a “great recovery” from the UK lockdown and “paid very well” throughout the pandemic last year, according to McVey. Year-to-date its share price is up 76.7%.

Due to the multi-cap structure McVey said the fund isn’t constrained to holding just the top 10 dividend payers other income funds are tied to, meaning they can search for more “progressive, faster growth entities.

“And that’s what gets us excited and underpins our performance,” McVey said.

Another winner was the Next Fifteen Communications Group, which is Octopus UK Multi Cap Income fund’s biggest holding at 2%.

A favourite of McVey and co-managers Dominic Weller and FE fundinfo Alpha Manager, Richard Power, despite its strong returns it has been “overlooked by the market”.

The firm is a media marketing businesses, providing a lot of exposure to large-tech names, yet McVey said it was not expensive for a company exposed to fast-growth markets.

Having had “fantastic performance,” – the company has seen significant growth in its share price so far this year, increasing by 58% – the manager said there should be more to come.

Reopening winners

Although not many changes had been made to the Octopus UK Multi Cap Income fund there had been a move towards more consumer facing stocks as a result of the pandemic.

Last year the fund took on reduced its exposure to consumer debt and this year, with the reopening of the economy, moved that into more consumer spending exposure.

One stock playing on this was MJ Gleeson a builder of low cost homes that specialises in areas of economic development and regeneration.

“It has fantastic social characteristics from an [environmental, social and governance] ESG perspective,” McVey said. It also is benefiting from long-term trends, such as new, low cost housing almost always being required. Year-to-date the share price has risen 11.1%.

Another consumer stock and “another good pandemic story” was Halfords. A major benefactor of the ‘cycling boom’ that has taken place during the past 18 months as people have avoided public transport, the manager said.

The company’s share price is up 35.6% so far this year.

The boring stock

The final stock pick was Strix a company McVey called “extremely boring” but also a “decent dividend paying, nicely growing business.”

The company makes safety switches for kettles, a “basic” product McVey said but one that is widely used. Out of every kettle in the world 60% use its safety feature, making this a world leader in what it does.

“It has great market presence, great cash generation and is able to use that cash to facilitate investment into some other markets,” McVey said, such as water filtration and purification. In 2021 the company’s share price rose 43.5%.

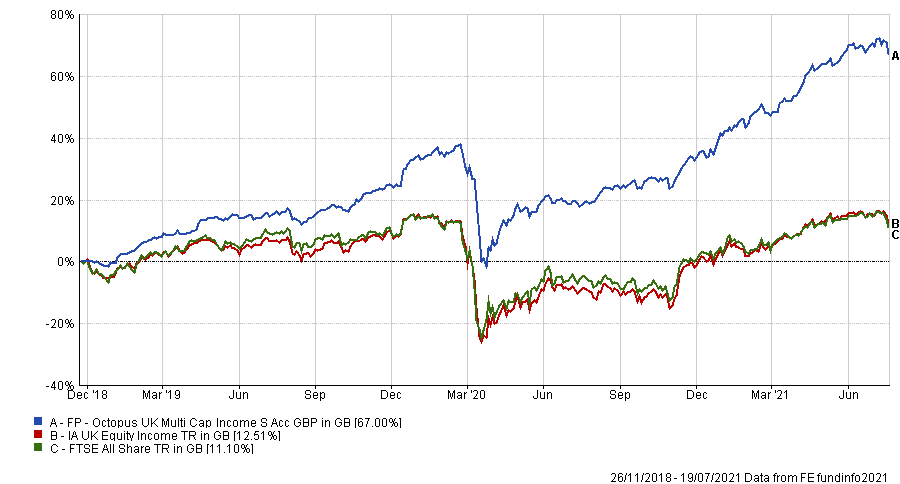

Since launch the Octopus UK Multi Cap Income fund has made a total return of 67%, outperforming the sector and FTSE All Share benchmark.

Performance of fund vs sector and index since launch

Source: FE Analytics

It has a yield of 3.6% and an ongoing charges figure (OCF) of 0.45%.