The Lindsell Train Japanese Equity fund has gone through a tough year but investors thinking of selling should hold on, according to experts.

Run by veteran fund manager Michael Lindsell (pictured), the fund has lost investors 5.6% over the past 12 months, the worst performance of any Japan fund.

The poor returns have impacted its medium-term performance, with the fund among the bottom of the IA Japan sector rankings over three years and below the average peer over five years. It is also behind the Topix market index over one and three years, although is marginally ahead over five years.

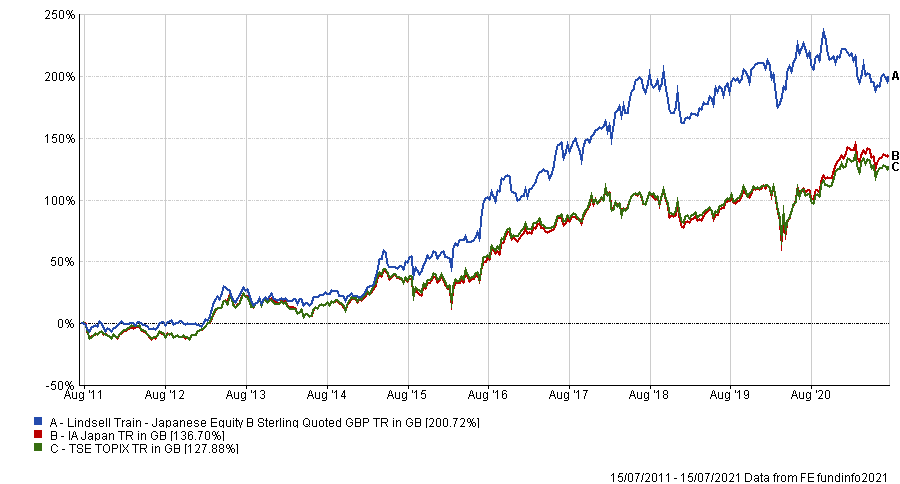

For investors that have held the £509m fund for a decade, however, it has been a top performer. The portfolio has made 201% in the past decade, while the average IA Japan fund has made 137% and the Topix index 128%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

Laith Khalaf, financial analyst at AJ Bell, said: “The Lindsell Train special sauce has come up short of late, as the value rally prompted by the arrival of vaccines and economic optimism has put the quality-growth stocks favoured by the fund in the shade – in the short term at least.”

However, he said investors should continue to hold Lindsell Train Japanese Equity as the concentrated portfolio is “highly differentiated” from the market, something that most investors should strive for when picking an active fund.

“That does mean you have to endure periods of underperformance like this, when the style is out of favour,” he added.

Looking forward, Khalaf said the manager’s style still looks like a good way to deliver strong long-term returns, but he noted investors may benefit from diversifying their portfolios to include other styles as well, both in Japan and globally.

Kate Marshall, acting head of investment analysis at Hargreaves Lansdown, agreed. After a strong run between 2015 and 2020, the past nine months have been torrid, yet she said there was no need to switch.

“It’s a very concentrated fund with just 22 holdings so when things are good they can be very good, but of course the reverse is also true, as we have seen recently. But the fund is run by a strong team so there’s no need to head for the exit,” she said.

Although no need to sell Lindsell Train, she would recommend the £231m FSSA Japan Focus fund for investors looking to add a new Japanese fund to their portfolio.

“This fund has a similar style and philosophy, but is less concentrated with 38 holdings and has fared better during the growth to value rotation,” she said.

Indeed, FSSA Japan Focus has gained 9.7% over the past year – still among the bottom of its peers but not the loss that the Lindsell Train fund has suffered – while it has been among the top three portfolios among its peers over three and five years.

Performance of fund vs sector and index over 5yrs

.png)

Source: FE Analytics

James Calder, research director at City Asset Management, said he did not recommend the Lindsell Train Japanese Equity fund to investors, but that this was not an indication that it was a poor investment.

“From an investors’ perspective, they need to decide whether you are a long-term investor? If yes, then the second question is ‘has something changed in Japan fundamentally or not?’,” he said.

Lindsell Train Japanese Equity, he said, should be viewed as a long-term fund and investors should take heart from the fact it has not changed its approach during this tough period.

“If you have held it for 10 years then happy days. If you are happy and it does what it says, then keep it, after all, good fund managers can have a bad year,” he said.

However, he understood that investors who have recently bought the fund within the past year may already be growing impatient. “If you bought it last year then your view may be very different,” he said.

Calder suggested the £3.4bn Comgest Growth Japan fund for investors that want buy fast-growing businesses, while the £910m Jupiter Japan Income fund was betted suited for those requiring a regular dividend.

“The Jupiter fund gives investors a steady approach in Japan. It is not that exciting as an asset class but there is value there and if you want an income fund, this is the way to go. If not go for Comgest, which has a social responsible investment policy at the heart of what it does and a solid approach to growth investing,” he said.

Both funds have performed well over the past five years. The Comgest fund has doubled the 48.8% returns of the Topix market, returning 99.3%, while the Jupiter fund has made 73.2%.