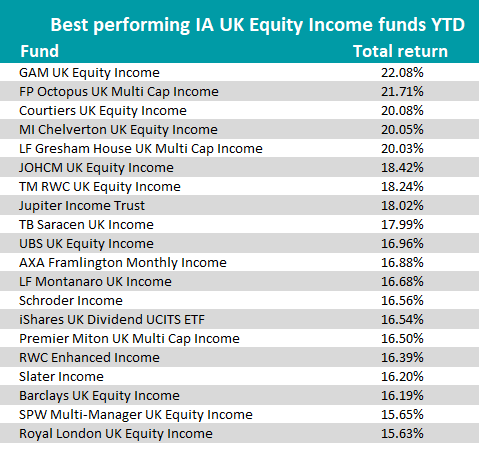

Adrian Gosden’s GAM UK Equity Income fund has been the best performer in the IA UK Equity Income sector year-to-date, but it was the decisions he made in late 2020 that has driven the surge to the top.

Towards the end of last year, the manager moved the fund into its highest allocation of small and mid-caps – 60 per cent – to get exposure to economically sensitive businesses.

This call paid off as the market rotated away from highly valued growth stocks that had been going on “for a really quite a long period of time” and into the more cyclical assets during the recovery.

Sectors such as industrials and chemicals and construction which Gosden shifted the GAM UK Equity Income fund into, thrived.

The changes were made gradually starting before October, “when things were not looking great for these companies,” Gosden said.

However, it is precisely these periods when fund managers earnt their crust, he added.

“When it's super comfortable and it's all really obvious there's not really much you can do for your clients. All the facts are out there and everyone knows them. When it's uncomfortable that's your chance to make a real difference for the client,” he said.

In periods where markets are severely rattled, be it Covid-19, the 2008 banking crisis or the tech bubble “those are when you’ve got to decide what you want to do for your clients,” Gosden said.

Essentially active managers need these unsettled periods in markets to flex their managerial muscles, particularly with the rise of index funds, which has forced them to justify their higher fees.

“For many years prior to Brexit the same sort of shares were doing well, week in week out, month in month out,” he added.

However, his GAM UK Equity Income has proven adept at changing to meet the new market conditions, up 22.1 per cent year-to-date, leading the UK equity income market during the first half of the year.

Source: FE Analytics

Markets are still in an uncomfortable state now, said Gosden, with the rising Delta variant cases causing anxiety about delayed ‘Freedom Day’ in the UK and future lockdowns, meaning he cannot rest on his laurels.

“There maybe some more things to do in the second half when we get some clarity,” he added.

Setting up the GAM UK Equity Income fund for the second half of the year the small and mid-cap exposure had been reduced from 60 to 50 per cent.

“I don’t want to make it into dramatic a point because that's just not how we do it. It's just to note that there's been a lot of activity down in that area,” Gosden explained.

Looking ahead, Gosden said he was “really positive” about the UK Equity Income space, despite the staggering hit it took during the initial Covid-19 sell-off with widespread dividend cuts and cancellations.

That was “pretty grim”, Gosden said, but the sector has been “rebased” as companies that had been overdistributed prior to Covid and needed to cut dividends, were given the ideal opportunity to do so.

This means the sector can now rebuild with more sustainable dividends overall. For example, this week the Financial Conduct Authority (FCA) gave the go ahead for banks to start repaying their dividends after they were ordered to halt them in an effort to preserve balance sheets. The restart means there will be “a nice pickup in the dividends for investors in 2021 compared to last year,” Gosden said.

The reopening of businesses as restrictions eased means there is a now a “dividend return story” in the UK “which will not just last one year,” Gosden said.

Other UK equity income managers agreed with Gosden’s positive outlook.

Emma Mogford, manager of Premier Miton Monthly Income fund, said the IA UK Equity Income sector has the potential to double in size in the next few years. She said: “In turn, this should boost returns for those invested in the sector.”

Gosden suggested that income managers should expect to deliver a decent 4 per cent and growing dividend yield.

He said: “I feel incredibly analogue in the digital world when I say that, because you speak to people who made 40 per cent on Nasdaq last year, and you meet people who are investing in Bitcoin, and stuff like this, but in my world that is quite good.”

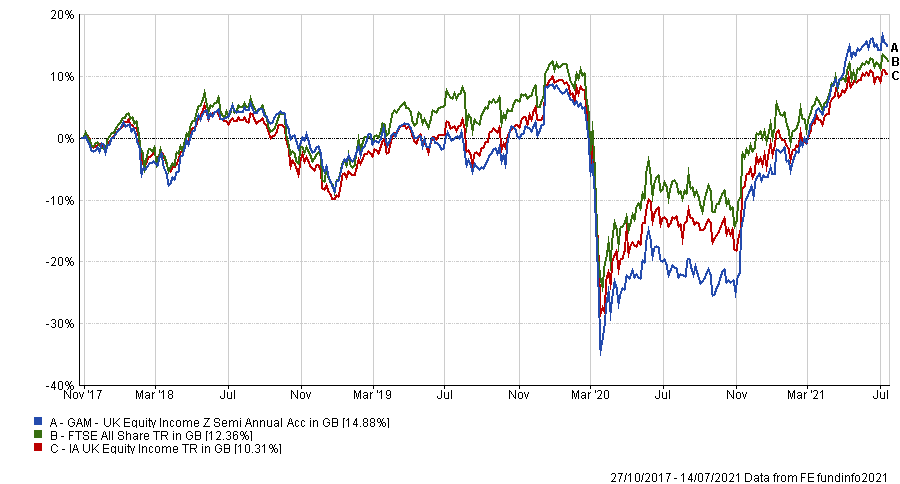

Gosden has managed the fund since launch in 2017 along with co-manager Chris Morrison.

The fund has outperformed the IA UK Equity Income sector and FTSE All Share benchmark since launch, with a total return of 14.9 per cent.

Performance of fund vs sector and benchmark since launch

Source: FE Analytics

It has ongoing charges figure (OCF) of 0.67 per cent and a yield of 3.14 per cent.