Absent international fans at this year’s Tokyo Olympics mirror the absentee UK investors in the Japanese market, but like those supporters unable to attend the games, it is the investors that ignore Japan that will miss out, according to fund commentators.

The data is stark. According to research from the Investment Association, the trade body, investors hold £25.4bn in Japanese equity funds, equivalent to just 2.8 per cent of total assets under management.

Jason Hollands, managing director of Bestinvest, said that Japan could “certainly do with achieving greater visibility amongst UK investors.”

“This shows Japanese investments are heavily unrepresented in the average UK investor,” he said, despite it being the third biggest global stock market- behind two American markets – the New York Stock Exchange and Nasdaq.

There are good reasons to consider investing in Japan now, Hollands said. One being valuations, which have been low for several years in comparison to other markets but with these now looking more and more expensive “the Japanese market looks reasonably valued in comparison.”

Second is strong monetary and fiscal support, while the potential for income growth, particularly as companies recover from the blow of the pandemic, could also be key, Hollands said.

Japanese companies have stereotypically held large amounts of cash and reluctant to reward shareholders, but this has changed recently, with Japanese businesses increasing dividend pay-outs and share buybacks.

“The Japanese market is certainly not the highest yielding market at 2.2 per cent, but this does put it above global equities overall which currently yield 2.0 per cent and the direction of travel is encouraging,” he said.

Below Hollands and other market commentators give their Japan picks to play this opportunity.

JPMorgan Japanese IT

First, Hollands’ picked JPMorgan Japanese, which he described as “one for the trust fans”.

Investing across the market capitalisation spectrum the trust is focused on the ‘new Japan’ companies in high growth sectors such as robotics, e-commerce, fintech and computer gaming.

FE fundinfo Alpha Manager Miyako Urabe and co-manager Nicholas Weindling call this “Japan’s economic transformation” looking for the “new generation” of companies with the potential for long-term capital growth.

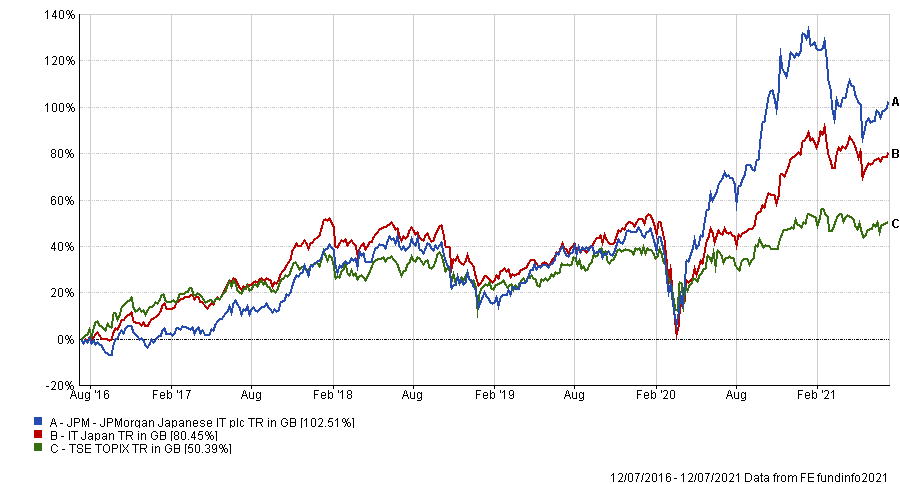

Launched in 1927, the £1.3bn trust has outperformed both the IT Japan sector and Topix index over five years, with a total return of 102.5 per cent.

Performance of fund versus sector and index over 5yrs

Source: FE Analytics

The trust is currently operating at 14 per cent gearing with ongoing charges of 0.66 per cent and holds an FE fundinfo Crown Rating of five.

Lindsell Train Japanese Equity

Next, Dzmitry Lipski, head of funds research at interactive investor, said his fund pick – the Lindsell Train Japanese Equity fund – is ideal for long-term growth investors able to handle some short-term volatility.

Lipski described manager Michael Lindsell as a “well-seasoned investor” having covered Japanese equities since 1985.

The fund is made up of 20-30 of FE fundinfo Alpha Manager Lindsell’s best ideas, Lipski noted, buying high-quality companies with durable, cash-generative business franchises.

Although the overall focus is on the long term, Lipski pointed out that due to the manager’s investment biases and process the fund will typically lag in rising markets. This is because it shuns the fast-growing stocks that have dominated the market returns in recent years, as well as the bottom of the barrel value stocks that have led the market rally over the past six months.

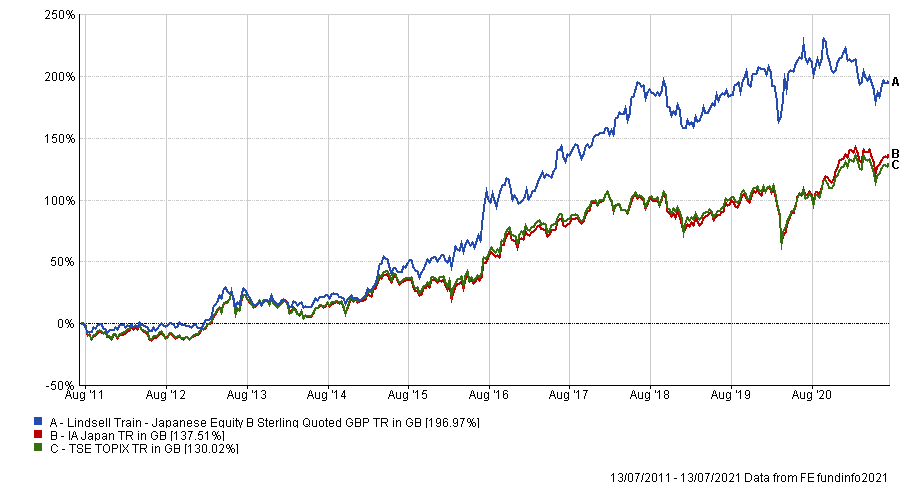

Indeed this shift in market style has hurt Lindsell Train Japanese Equity, which is now the worst performer in the IA Japan sector over one year and has underperformed the sector and benchmark, however over the longer term it remains a good pick, up 197pc.

Performance of fund versus sector and index over 5yrs

Source: FE Analytics

Holding an FE fundinfo Crown Rating of four it has an ongoing charges figure (OCF) of 0.72 per cent.

Baillie Gifford Japanese Income Growth

Next is Matthew Brett and Karen See’s Baillie Gifford Japanese Income Growth fund.

Applying the well-known Baillie Gifford growth investment style, this is combined with a focus on companies with high dividend growth.

Juliet Schooling Latter, FundCalibre research director, said: “The fund was launched specifically to tap into the exciting change in dividend attitudes in Japan: a new corporate governance code, coupled with a large cash pile on Japanese balance sheets was – and still is - a big opportunity for investors.”

While the headline yield figures may be low by Western standards, there is certainly plenty of room for growth, she added.

The Japanese market has benefitted from being highly liquid as well as its companies having strong balance sheets, which makes for a “robust financial position”, according to Schooling Latter.

“All in all, the future looks bright for this fund,” she said.

Launched five years ago the Baillie Gifford Japanese Income Growth fund has made a total return of 63.9 per cent since then, beating both the IA Japan sector and its benchmark.

The fund has a 1.86 per cent dividend yield and an OCF of 0.62 per cent.

Baillie Gifford Japanese

Fourth on the list is Matthew Brett’s other Japanese portfolio, the £3.7bn Baillie Gifford Japanese fund, AJ Bell analyst Laith Khalaf’s pick.

Brett took over from long-term fund manager Sarah Whitley in 2018 having been co-manager since 2008 and Khalaf said he has “stepped up to the plate,” since taking charge. The strong Baillie Gifford research team also alleviates any concerns over continuity, he added.

“This is a bottom-up fund which delivers a high conviction, concentrated portfolio of 35 to 55 stocks. That means the fund is a clearer expression of the managers’ best ideas, but it can lead to higher volatility, and deviation from the index, hopefully for the better, but inevitably over some shorter time periods, for the worse,” Khalaf said.

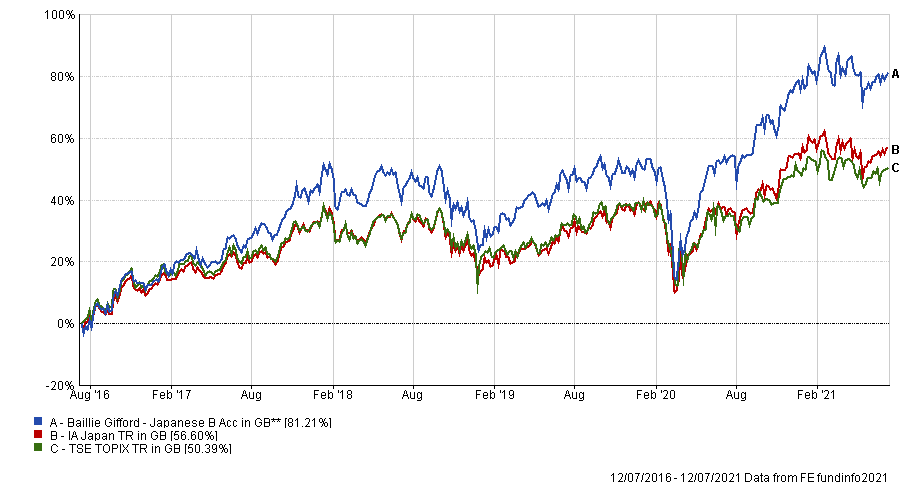

It has achieved very strong outperformance, coming through as the third-best fund in the entire IA Japan sector over five years. It made a total return of 81.2 per cent during that time.

Performance of fund versus sector and index over 5yrs

Source: FE Analytics

Commenting on the Japanese market in general, Brett said in the latest fund commentary that it suited Baillie Gifford’s growth style of investment.

“In contrast to other major markets, growth often commands little or no valuation premium in Japan, and we continue to identify global leading businesses which trade on a substantial discount to their peers. This provides an excellent backdrop for our investment style,” he said.

Baillie Gifford Japanese has an OCF of 0.61 per cent.

AVI Japan Opportunity

Bookending the portfolio picks with another investment trust is the AVI Japan Opportunity, chosen by Rob Morgan, pension and investment analyst at Charles Stanley Direct.

Taking a “natural value bias,” this fund would be an ideal complement to the more growth-oriented funds highlighted above.

“The value AVI is seeking to unlock could be in the form of an accumulated securities portfolio, legacy property or simply stockpiles of cash, but for whatever reason lies dormant and is not yet returned to shareholders or otherwise used as productively as possible,” he said.

The trust focus on small-caps that are undervalued and hold a significant proportion of their market capitalisation in cash. Morgan added that it’s looking to “harness the Japanese corporate governance revolution.”

“Things do not always pan out as planned of course,” Morgan said, noting that the fund can contain some volatile and more risky assets.

“But this could make a great diversifier for Japanese equity exposure as it is aiming to do something different to most other funds and has little overlap with them,” he added.

The relatively young trust, launched in October 2018, has underperformed the average IT Japanese Smaller Companies fund, making 13.7 per cent versus 25.3 per cent, but has had a strong year so far.

The trust’s total assets are £167.4m and is currently running at a 0.9 per cent premium. It has 4 per cent gearing and a 1.2 per cent dividend yield. Its ongoing charges are 1.54 per cent.