GAM UK Equity Income, RWC UK Equity Income and LF Gresham House UK Multi Cap Income are among the top performing IA UK Equity Income funds in the first half of 2021.

Data from the Investment Association (IA) shows UK Equity Income was the worst-selling sector in May 2021 with net outflows of £375m.

Yet it has been one of the best-performing sectors since the start of the year as the UK economy rebounded strongly amidst a successful vaccine roll-out.

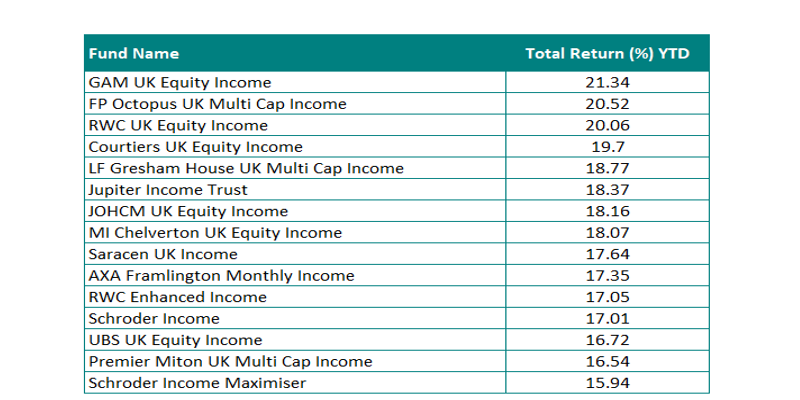

Top performing UK Equity Income funds YTD (as of 1 July)

Source: FE Analytics

The best performer in the sector this year is GAM UK Equity Income, run by Adrian Gosden and Chris Morrison.

The £184.2m fund aims to achieve income and capital appreciation through investing at least two-thirds of its assets in UK equities – with no restrictions on company, size or industry.

Gosden recently described the next 12 to 18 months as a “once in a generation opportunity” for UK equity investors, as the asset class is back in favour following the difficult post-EU referendum years.

However, now a deal has been signed with the EU, UK companies have resumed paying dividends, and coronavirus restrictions are set to end, the market should experience a major tailwind.

Gosden said: “Over recent months, we have been moving up the market-cap scale by recycling capital from selling certain mid- and small-cap stocks into new ideas in larger companies, as that is where the best valuations currently lie.

“As the heat cranks up in the UK market, investors have a chance to share the benefits as we enter the next phase of the nation's economic recovery.”

The fund has made a total return of 21.34 per cent in the year to 1 July. It has an ongoing charges figure (OCF) of 0.67 per cent.

In second place is FP Octopus UK Multi Cap Income, which has posted a return of 20.52 per cent this year.

The £63.1m fund has been managed by Chris McVey, Dominic Weller and FE fundinfo Alpha Manager Richard Power since its launch in November 2018.

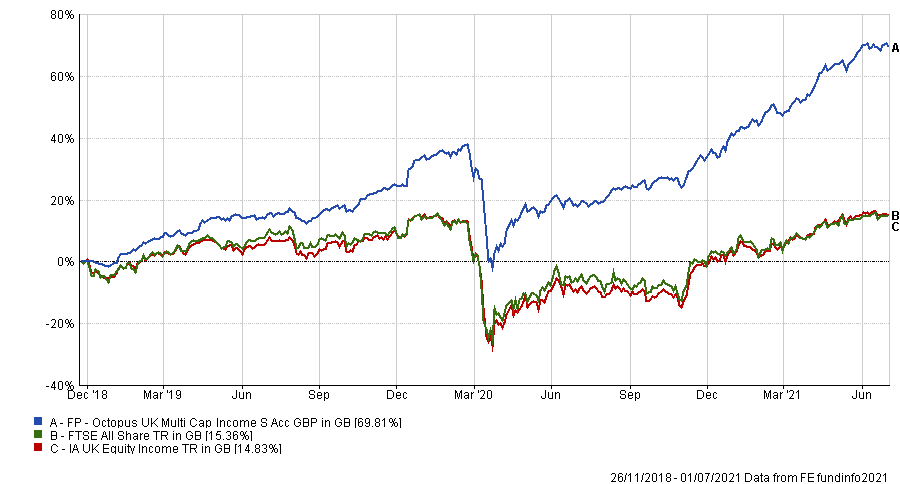

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

It has made 69.81 per cent since then, compared with 15.36 per cent from its FTSE All Share benchmark and 14.83 per cent from the average fund in the IA UK Equity Income sector.

According to McVey: “By taking a multi-cap approach, we can select opportunities from across the entire UK equity market, with a bias toward faster growth, progressive, small- and medium-sized companies.”

The fund has a yield of 3.6 per cent.

Narrowly in third is RWC UK Equity Income, managed by Ian Lance and Nick Purves, who run a disciplined value strategy.

The £387.9m fund has performed well since the announcement of three viable Covid vaccines, which acted as the starting pistol for the cyclical reflation trade. It is up 20.06 per cent this year.

Not far behind, with a total return of 18.77 per cent, is LF Gresham House UK Multi Cap Income.

The five FE fundinfo Crown-Rated fund is run by Ken Wotton and Brendan Gulston.

In a previous Trustnet article, Wooton said Brexit had both driven UK valuations to a historic 30-year discount and inadvertently prepared companies for Covid-19.

The manager said: “While Brexit has generated a lot of noise over the last five years, the segments of the market most acutely impacted by the vote have had ample time to adjust – and did so long ago.

“Well-run businesses have adapted smoothly, embracing technology and remote working long before these were required by the pandemic.”

The £93m fund has a yield of 2.96 per cent.

The fund with the highest yield among the top performers is the £2.2bn JOHCM UK Equity Income fund, run by James Lowen and Clive Beagles.

It has a value biased, contrarian investment approach and uses a strict yield discipline to drive purchases and sales.

Every holding must yield more than the FTSE All Share index on a prospective basis and this provides the framework in which to invest. Lowen and Beagles argue that whereas earnings can be manipulated, dividends have to be paid out of cash, and that dividend increases more accurately reflect their own view of future business prospects.

According to analysts at Rayner Spencer Mills Research: “It is important that in a range of funds delivering income, the source of income is well diversified. The team at JOHCM treat yield discipline as a significant part of the stock-selection process and this has the effect of making the fund one of the more contrarian in the range of funds.”

JOHCM UK Equity Income has a dividend yield of 5.39 per cent. It has made a total return of 18.16 per cent this year.

Finally, with a return of 18.07 per cent, is MI Chelverton UK Equity Income, which has been managed by David Horner and David Taylor since launch.

The £527.2m fund has a quality bias and seeks to provide a progressive income stream and long-term capital growth by investing primarily in a portfolio of mid- and small-cap UK equities.

The team at Rayner Spencer Mills Research said: “Given the small-cap, high yield, diversified nature of the fund, the management have specialist knowledge in a universe of approximately 150 stocks, giving them an investment edge over their peers.

“The long-term performance of the fund has demonstrated their excellent stockpicking ability in this space.”

Performance of fund vs sector since launch

Source: FE Analytics

Horner and Taylor launched the fund in 2006 and have presided over a 175.16 per cent return over that time, compared with 107.09 per cent for the average fund in the IA UK Equity Income sector.

The fund has an OCF of 0.89 per cent and a yield of 2.26 per cent.